Quantum Patents and IP Strategy: Safeguarding Innovation in a Crowded Field

Table of Contents

Quantum technology is in the midst of an intellectual property gold rush. Innovators in quantum computing, sensing, communications, and cryptography are staking claims in a crowded patent landscape at an unprecedented pace. In the United States alone, the USPTO granted over 5,000 quantum-related patents in the past decade. Globally, more than 20,000 quantum technology patents were filed from 2001 to 2021, with half of those coming just in the last five years. This explosion in filings reflects the high stakes and high hopes in quantum R&D – but it also raises challenges for researchers and Technology Transfer Offices (TTOs) seeking to safeguard innovation. How do you protect your breakthrough in a field where patent activity is surging? And how can a small university spin-off navigate a thicket of existing patents held by tech giants and governments?

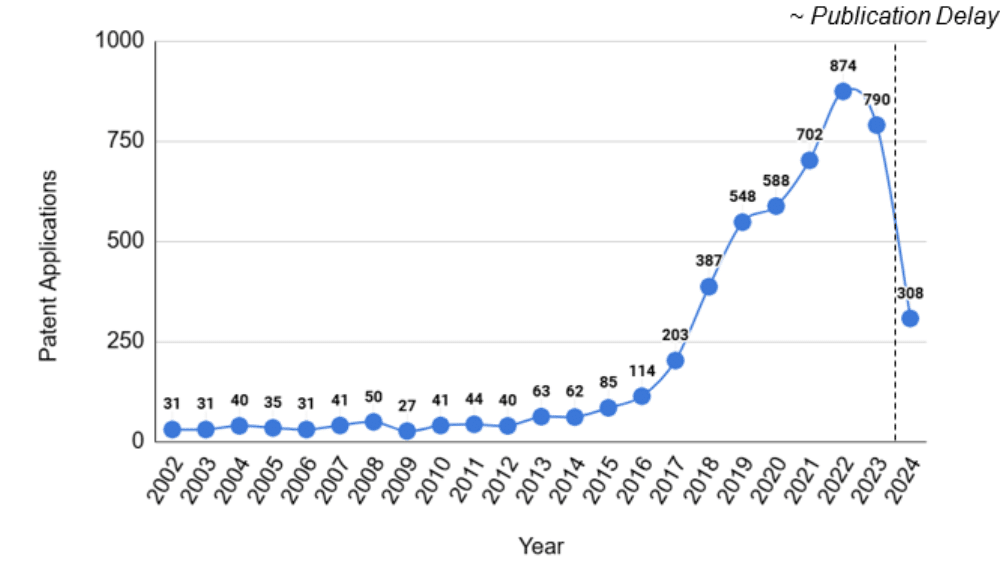

The Quantum Patent Boom: By the Numbers

Quantum computing patent applications have skyrocketed since the mid-2010s. This U.S. patent filing trend shows a sharp jump from just dozens per year a decade ago to hundreds annually by 2022. Publication delays mean recent years are undercounted, but the trajectory is clear: a quantum patent boom is underway.

The growth in quantum patents has been nothing short of dramatic. The number of inventions in quantum computing “multiplied over the last decade,” far outpacing patent growth in most other fields. In fact, from 2019 to 2023 the annual number of issued quantum computing patents worldwide grew by an average of 49%, including a 61% jump from 2022 to 2023 alone. This reflects massive global R&D investments and a race to secure foundational IP. Familiar tech giants and research institutes consistently dominate the top patent owner lists, confirming that the leaders in quantum research are also racing to file patents on their innovations.

Worldwide, patent filings in quantum are coming from all corners but not equally. A recent industry analysis highlighted that in 2023, Chinese entities filed more quantum computing patents than the U.S. and Europe combined. China’s aggressive push – bolstered by major state funding – has translated into a torrent of patent applications across quantum hardware, networking, and encryption technologies. The U.S., while second in quantity, still leads in “high-impact” patents: over 60% of U.S. quantum patents are cited in other research, indicating they cover core breakthroughs shaping the field. Europe is also a significant player; the European Patent Office (EPO) has granted over 2,000 quantum computing patents, with especially active filings from Germany, the UK, and France. Notably, Europe’s patents often emerge from collaborative research efforts (consortia of universities and companies) and focus on fundamental enabling technologies, aligning with Europe’s preference for open science and partnerships.

The surge is not limited to computing. Quantum communication and sensing patents are rising too. China leads in quantum communication patents (like QKD) thanks to centralized national projects. Meanwhile, the global patent race in quantum sensing and metrology is also heating up, though many such innovations ride on the coattails of advances in material science and optics. An academic study mapping quantum tech patents found that the majority of quantum-related patents over the past 20 years actually pertain to nanostructures and solid-state devices (e.g. advanced sensors, quantum dots, etc.). In other words, a lot of “quantum” IP builds on the evolution of classical semiconductor technology – which makes sense, as qubit devices often involve cutting-edge nanoengineering.

With so much activity, the overall patent landscape is both crowded and diverse. More than 40 countries have contributed quantum patents, yet just a handful account for the lion’s share. The United States and China alone each represent roughly a quarter or more of global quantum patent families. Corporate heavyweights like IBM, Google, Microsoft, Intel, Toshiba, and Alibaba are prolific filers, joined by defense contractors (e.g. Northrop Grumman) and a growing number of start-ups. IBM in particular stands out – analyses consistently rank IBM as the top patent holder in quantum tech, with one EPO report crediting IBM with over 400 distinct quantum computing patent families, significantly more than any other single entity. IBM’s quantum patent portfolio has been growing about 20% year-over-year for the past five years, covering not just hardware (superconducting qubits, etc.) but also software algorithms, error-correction techniques, and cloud platforms. This breadth is a strategic move: IBM is effectively patenting the ecosystem around quantum computing to maintain a dominant position no matter which specific approach wins out.

A Crowded Field and Patent “Thickets”

For university innovators, this crowded patent field is a double-edged sword. On one hand, the rush to patent indicates commercial interest and potential value in quantum breakthroughs – a strong patent can be a real asset if your tech gains traction. On the other hand, navigating existing IP is increasingly tricky. When dozens of groups around the world are working on similar qubit designs, control electronics, or quantum algorithms, the risk of overlapping claims or “patent thickets” rises. Patent thicket refers to a dense web of overlapping IP rights that can stifle innovation by making it hard to commercialize new tech without infringing someone’s patents. Some observers worry quantum tech could be headed in this direction, given the sheer volume of filings in certain subdomains. For example, superconducting qubit technology shows a sustained upward trajectory in patenting, with far more filings than other modalities. A startup building a superconducting processor might have to contend with patents from IBM, Google, Intel, and multiple universities – a daunting landscape to navigate without infringing. This is especially concerning for broad concepts like quantum error-correction codes or qubit control techniques, where many players are likely to arrive at similar methods.

Yet, paradoxically, the flurry of patents might also be contributing to a robust “information commons” in quantum technology. By filing patents (which are published publicly), organizations disclose technical details that enter the public domain after the patent expires or if the application is abandoned. A recent study noted that about 50% of quantum patent disclosures from the last 20 years are already in the public domain – either because patents were granted but have since expired, or because applications went un-granted. Thousands of published quantum patent applications never resulted in enforceable rights, but they did reveal information that others can learn from and build upon (albeit not patent themselves due to prior art). Every patent filed raises the bar for the next, because any invention must be novel over all prior disclosures. In that sense, the patent race is rapidly establishing prior art that could prevent over-broad new patents and force truly novel innovation to occur. This accelerating cycle of disclosure may help avoid a situation where basic quantum techniques are locked up by a few gatekeepers. Instead, many foundational ideas are becoming public knowledge (after a period of exclusivity or even immediately if the patent fails).

For TTOs, an implication is that publishing or patenting early is crucial – otherwise someone else might patent a similar idea first, or your own publication could even block your later patents. The patent strategy timeline needs to align tightly with the research timeline in quantum tech. We’ve seen cases where companies file “provisional” patents as early as possible to stake a claim (even if the tech is immature) because waiting even a year could mean the difference between being the first inventor or facing prior art from a competitor. Remember, patent rights generally go to the first to file in most jurisdictions now. In such a fast-moving field, a well-planned IP strategy and prior art search are not optional – they’re essential safeguards.

Global Approaches: China, U.S., Europe, and Beyond

Differences in national strategy also shape the patent landscape. China’s approach has been a top-down patent surge: generous government incentives for quantum R&D and patenting have led to a 120% increase in Chinese quantum patent filings over five years. Chinese universities and companies are encouraged to patent everything they can in quantum, as part of a bid to become the global leader. This has yielded quantity – China is clearly ahead in sheer number of quantum patents filed annually. These filings cover “everything from quantum processors to quantum networking”, indicating a comprehensive effort. The strategy appears to be: file broadly, file often, and secure a wide perimeter of IP. One must note, however, that a patent filed in China is not automatically enforceable elsewhere unless the filer pursues international protection. Many Chinese quantum patents may remain domestically focused (which still poses issues for anyone aiming to operate in the Chinese market). For a Western startup, one lesson is to monitor Chinese patents for two reasons: (1) to avoid inadvertent infringement if you plan to enter China or collaborate with Chinese partners (you’ll need to know if a Chinese patent overlaps your tech and maybe negotiate a license); and (2) to glean technical insights – Chinese researchers are publishing lots of ideas via patents that might not appear in journals. In other words, Chinese patents are part of the global knowledge base now, even if their legal effect is local.

The U.S. approach mixes strong private sector patenting with targeted government support. U.S. companies tend to focus on high-impact patents – ones that truly move the needle, as reflected by citation rates. While the U.S. doesn’t lead in raw count, it leads in influential inventions (e.g. foundational quantum computing architectures). The U.S. government, via the National Quantum Initiative, is investing $1.8 billion in quantum research, but those funds often flow into open science (national labs, academia) as well as support for startups (e.g. SBIR grants). Patents arising from federally funded research are usually owned by the institutions (thanks to Bayh-Dole Act), which enables universities to license them to spin-offs. TTOs in the U.S. thus have a mandate to patent promising quantum tech and use IP as a bridge to commercialization – either via startups or industry licensing. We see many top U.S. universities on the patent assignee lists (MIT, Harvard, Yale each have dozens of quantum patents). The lesson for TTOs is to actively engage in patent scouting: identify quantum innovations in your labs early and secure IP before publication. It’s worth noting that despite the U.S.’s market-driven ethos, it hasn’t shied away from the patent race – IBM’s strategy shows an almost institutional commitment to patent leadership. Startups are advised to follow suit in their niches: secure patents not only for defense but also as assets to attract investors (VCs often view a strong patent portfolio as validation in deep-tech fields).

Europe’s approach has emphasized collaboration and open innovation, but that hasn’t meant avoiding patents. The EU Quantum Flagship (a €1 billion program over 10 years) funds many collaborative projects among companies and universities. Often the results are jointly owned patents or publications. European companies and universities do patent – for instance, Toshiba Europe and Thales have filed on quantum cryptography and sensing. However, European patent strategy appears to focus on quality over quantity, given that Europe’s share of quantum patents is smaller. One analysis pointed out that European firms prioritize fundamental technologies (quantum hardware, algorithms) and work closely with academia. This often leads to patents on foundational aspects rather than a slew of small incremental patents. Also, some European groups choose open-source routes for software (e.g. certain quantum software frameworks are open to encourage adoption). From a TTO perspective, Europe offers a model of leveraging consortia: multiple entities co-inventing and co-patenting. An EPO report found a minority of quantum computing patent families have multiple applicants (indicating joint inventions), but those cases are significant signs of cross-border and cross-sector collaboration. If you’re a TTO in a smaller country or university, partnering on research can pool talent and also share the burden/benefit of IP – one partner might have the resources to prosecute a patent internationally, for example, which then benefits all co-owners. The downside is complexity in IP management (negotiating ownership splits, future licensing rights, etc., must be clear upfront).

Other regions have their nuances as well. Japan has a strong corporate patent presence (Toshiba and Fujitsu alone have filed 600+ quantum patents collectively, many in quantum communication and encryption). Japan’s focus on secure communications and sensing shows in its patents, aligning with national priorities on data security. Canada, despite a smaller population, punches above its weight thanks to early quantum institutes – Canadian startups like D-Wave and Xanadu accumulated patents in quantum annealing and photonics respectively, supported by a mix of private and government funding. Australia has notable patents around silicon-based quantum computing (e.g. UNSW’s research led to silicon qubit patents, held by a university/company consortium). Russia and India have fewer quantum patents so far, but both have initiated national quantum programs in recent years and we can expect a rise in filings from those countries too.

Patenting Challenges in Quantum

Filing a quantum patent is one thing – getting it granted is another. The high-tech nature of quantum innovations means patent examiners sometimes struggle with classification and evaluation. Common rejection reasons in the U.S. include obviousness (35 USC §103) – accounting for roughly 30% of rejections in quantum computing applications – and patentable subject matter (§101) issues, which make up about 15%. The latter is interesting: §101 rejections often relate to claims that are deemed abstract or not applied enough, a known hurdle for software and algorithm patents. Quantum algorithms can fall into a gray area. For instance, a method for error-correcting qubits might be seen as a purely mathematical concept, which is not patentable unless tied to a specific practical implementation. TTOs and patent attorneys need to craft claims carefully to pass the eligibility bar, perhaps by anchoring algorithms to physical quantum hardware or control systems so they are seen as technical solutions, not just math.

Another challenge is trade secrecy vs patenting. In some cases, companies might prefer to keep certain quantum advancements as trade secrets rather than patent them (thus avoiding disclosure). This is particularly true for things like manufacturing processes of quantum chips or proprietary techniques to reduce noise in qubits, where keeping it secret might be feasible and the tech might evolve faster than the 18-month publication timeline of a patent. However, for university spin-offs, trade secrets are tricky – academic environments value publication and staff/student turnover is high, so secrets can leak. Patents at least give a legal protection and don’t require confidentiality after filing. Weighing this is part of IP strategy. Notably, a study observed that many early quantum patents have short effective lives because companies keep filing continuations and building on prior filings (which can truncate the term). This suggests a rapid iteration – inventors file an initial patent, then a year or two later file an improvement and claim priority, which means the 20-year clock started at the first filing. In effect, by the time the final, improved version is out, the remaining patent term might be much less. This indicates that speed of innovation is outpacing patent term in some areas; a good reason to think hard about what to patent when, and to maintain a pipeline of innovation (and patents) rather than banking on one patent to give two decades of monopoly. The competitive landscape may shift so fast that a patent from 2015 might be obsolete by 2025 – but it still served to stake territory and prevent others from claiming it.

Finally, there is the looming issue of standards and patent pools. Quantum computing and networking may in the future have industry standards (for interfaces, protocols, etc.). If patented technology ends up in a standard, those patents might need to be licensed under fair terms (FRAND commitments). We already see this conversation in post-quantum cryptography (PQC) – the new encryption algorithms chosen to resist quantum attacks are intended to be used globally, so any patent claims on them would need to be made available. NIST required that submissions to the PQC competition be freely usable or licensed royalty-free. Many of the leading PQC algorithms are not patented (or the patents are released for free use), to encourage adoption. TTOs working on quantum-resistant encryption or communication protocols should consider whether keeping a technology proprietary might limit its adoption. Sometimes, embracing an open model can set a de facto standard that brings other benefits (like widespread use or services revenue). In contrast, fundamental patents on quantum hardware (e.g. a unique qubit design) are easier to justify keeping exclusive, since customers don’t directly need to interoperate at that level – they just buy your device.

Strategies for Safeguarding Innovation

In this complex environment, what proactive steps can innovators and TTOs take? Here are a few key strategies:

- File Early, File Smart: Given the rapid pace of discovery, it’s critical to file patent applications as early as possible on truly novel ideas – ideally before any public disclosure. Even a pre-print or conference talk can count as prior art against you if not carefully timed. Use provisional applications to secure a priority date and then follow up with full applications. As one patent law firm advised quantum startups: establish priority and protect core innovations early. This stakes your claim and deters others from patenting similar developments.

- Conduct Thorough Prior Art Searches: Before investing in a patent, do due diligence. The crowded field means many concepts (quantum gates, calibration methods, etc.) might already be disclosed in someone’s patent. Freedom-to-operate searches are crucial if you plan to commercialize. It’s worth reviewing not just granted patents but also pending applications worldwide (many are published at 18 months). Pay special attention to Chinese-language filings (use translation tools) and to broad international patent families. By identifying prior art, you can tailor your patent claims to truly novel aspects and avoid wasting time on claims that will be rejected as obvious or already patented.

- Leverage Government Programs for IP: Many countries offer support that can indirectly help your patent strategy. For instance, the U.S. SBIR/STTR programs provide funding to small businesses (often spin-offs) for R&D – some grants even cover patent application costs. Governments also often have fast-track examination for “critical technologies” like quantum; for example, the USPTO’s Patents 4 Partnership program or other accelerators for emerging tech. In the U.K., patents related to national priority areas might get expedited. These programs can help startups secure IP faster and cheaper, so TTOs should keep abreast of them. Moreover, collaboration programs (like EU Horizon grants) often include funding for patent and IP management in the project budget.

- Collaborate and Cross-License: Recognize that no one will own the entire quantum stack. Smart companies focus on building strong portfolios in their niche and then cross-licensing with others for complementary needs. For example, a quantum hardware startup might license a critical algorithm patent from a university, while allowing that university to use the hardware IP for research – a win-win. We’re already seeing nascent patent pooling discussions, where groups agree to license certain quantum patents under fair terms to avoid choking the market. TTOs can facilitate introductions and deals that clear freedom-to-operate roadblocks for their startups. Rather than viewing IP purely as a sword, use it as bargaining chips for partnerships. As PatentPC analysts put it, companies should “explore licensing deals with major patent holders to avoid legal disputes”. An early license or cooperation agreement can save a startup from costly litigation down the road.

- Keep Trade Secrets Where Sensible: Not everything must be patented. If you have a proprietary manufacturing process (say for a stable qubit material) that isn’t apparent from the final product, you might choose to keep that know-how secret. Patents eventually publish and expire; trade secrets can theoretically last indefinitely (consider Coca-Cola’s recipe). Several quantum tech companies likely keep certain calibration techniques, software optimizations, or customer-specific solutions as trade secrets. However, be cautious: if the secret could be independently discovered or reverse-engineered, a patent might offer better protection. University TTOs typically favor patents (since publication is part of the academic mission), but in some cases, advising a spin-off to maintain a competitive advantage as a trade secret – at least until the product is ready and the patent can be broad – could be wise.

- Monitor and Adapt: The quantum IP landscape will evolve. Today’s gold rush may lead to tomorrow’s patent wars or, alternatively, to a trove of expired patents as many filings never make it to commercial success. TTOs should continually monitor new patent publications in key quantum areas. Set up alerts for competitor filings. Watch for consolidation – if big players are acquiring startups, they’re also acquiring their IP, potentially creating stronger opponents or allies. Stay flexible; an IP strategy is not static. For instance, if the U.S. or EU introduces new export controls on quantum tech (as is being debated), that might affect what you patent (or where you patent – you might avoid filing in certain jurisdictions). Also keep an eye on standardization efforts, which could turn certain patented technologies into essential facilities.

In conclusion, while the quantum patent landscape is indeed crowded, a thoughtful strategy can safeguard a newcomer’s innovation and even turn the chaos to advantage. Patents, when aligned with business goals, can attract investment, deter infringement, and provide leverage for collaboration. TTOs and innovators should view IP not just as legal protection but as a core part of innovation strategy – especially in a field where today’s lab discovery might be tomorrow’s billion-dollar application. A mix of agility (to file and pivot quickly), diligence (to avoid pitfalls), and cooperation (to align with the broader ecosystem) will serve best. The quantum revolution is a marathon, not a sprint, and IP rights are the mile markers along the way, ensuring that those who push the frontiers are recognized – and rewarded – for their contributions to this transformative field.

Quantum Upside & Quantum Risk - Handled

My company - Applied Quantum - helps governments, enterprises, and investors prepare for both the upside and the risk of quantum technologies. We deliver concise board and investor briefings; demystify quantum computing, sensing, and communications; craft national and corporate strategies to capture advantage; and turn plans into delivery. We help you mitigate the quantum risk by executing crypto‑inventory, crypto‑agility implementation, PQC migration, and broader defenses against the quantum threat. We run vendor due diligence, proof‑of‑value pilots, standards and policy alignment, workforce training, and procurement support, then oversee implementation across your organization. Contact me if you want help.