Quantum Computing & Quantum Technology Initiatives in Canada

Table of Contents

Historical Context

Canada’s engagement with quantum science dates back to the field’s earliest breakthroughs. In 1984, Canadian cryptographer Gilles Brassard (University of Montreal), together with IBM’s Charles Bennett, developed the first quantum key distribution (QKD) protocol (known as BB84), a foundational advance in secure quantum communications. By the late 1990s and early 2000s, Canada began making strategic investments to build a national quantum research ecosystem. BlackBerry founder Mike Lazaridis, for example, donated over $100 million in 2002 to establish the Institute for Quantum Computing (IQC) at the University of Waterloo, after having founded the Perimeter Institute for Theoretical Physics in 1999 with a $170 million endowment. These institutions, alongside federal programs like the Canadian Institute for Advanced Research (CIFAR) Quantum Information Science program (launched 2002), helped position Canada as a early leader in quantum science. Around the same time, Canada also became home to the world’s first commercial quantum computing company: D-Wave Systems was founded in 1999 in British Columbia, pioneering quantum annealing machines and unveiling a 128-qubit system as the first commercially available quantum computer in 2011. These milestones set the stage for Canada’s robust quantum research community and the emergence of a “Quantum Valley” innovation cluster in the Waterloo region.

Quantum Computing in Canada: Current State of Advancements

Government Initiatives and National Strategy

The Canadian government has developed major initiatives to support quantum technology, with a strong emphasis on quantum computing. In January 2023, Canada officially launched its National Quantum Strategy (NQS), backed by a federal investment of $360 million over seven years. The NQS defines three priority missions – Quantum Computing, Quantum Communications, and Quantum Sensors – and allocates funding across pillars of research, talent development, and commercialization. Specifically, the strategy earmarks $141 million for basic and applied research, $45 million for training and retaining quantum talent, and $169 million to translate research into commercial products. Two eminent Canadian physicists, Dr. Raymond Laflamme (a pioneer in quantum error correction) and Dr. Stephanie Simmons (a leading expert in silicon photonic qubits), were appointed co-chairs of a Quantum Advisory Council to guide NQS implementation. The National Quantum Strategy builds on earlier federal efforts; in total, the Government of Canada has invested over $1 billion in quantum research and innovation since 2012. This long-term support has made Canada one of the world’s leading nations in quantum R&D, and Canada was ranked fifth globally in annual quantum science expenditures by the mid-2010s. In addition to the NQS, various government-funded programs underpin quantum computing development. For instance, the Quantum Algorithms Institute in British Columbia received federal support to accelerate quantum software innovation, and the Strategic Innovation Fund awarded $40 million to Toronto-based startup Xanadu to build and commercialize a photonic quantum computer. Provinces are also active: the province of Ontario’s support for the Waterloo quantum cluster and Quebec’s investment in a Quantum Innovation Zone (DistriQ) in Sherbrooke are examples of regional government engagement. This multi-level backing reflects a national recognition that quantum computing is a strategic technology for Canada’s future economy and security.

Academic Research Hubs and Quantum “Valleys”

Canada’s quantum computing prowess is anchored by several leading research institutions and regional hubs often dubbed “quantum valleys.” Foremost among these is the Waterloo region in Ontario, which hosts a dense cluster of quantum research centers. Within a few kilometers in Waterloo are the Perimeter Institute for theoretical physics and the University of Waterloo’s Institute for Quantum Computing, two world-class facilities founded with Lazaridis’ philanthropy and government support. Together they form the core of Waterloo’s “Quantum Valley,” home to over 250 researchers specializing in quantum information science. The University of Waterloo (including IQC) has become renowned for quantum computing experiments, quantum cryptography research, and spinoff companies, benefiting from close integration of theory and engineering.

Out west, the Vancouver area in British Columbia has developed its own quantum hub. The Stewart Blusson Quantum Matter Institute at the University of British Columbia focuses on quantum materials and devices, and nearby Simon Fraser University hosts quantum technology programs (including efforts in silicon-based qubits led by researchers like Stephanie Simmons). In 2020, British Columbia established the Quantum Algorithms Institute (QAI) to foster collaboration between academia and industry on quantum software, signaling a push to make the province a center for quantum computing development.

In Quebec, the city of Sherbrooke has emerged as a growing quantum innovation zone. The Université de Sherbrooke’s Institut Quantique conducts research in quantum computing and quantum materials, and in 2022 the province formally launched “DistriQ – Quantum Innovation Zone” to unite research, incubation, and industry in the region. This initiative, backed by over $5 million in federal funding for lab infrastructure, is the main driver of Quebec’s quantum ecosystem. Sherbrooke’s ecosystem has already yielded startups (like quantum processor company Nord Quantique) and attracts talent by offering shared facilities and an “extraordinary pool of knowledge,” as local entrepreneurs attest.

Other universities across Canada also contribute: the University of Toronto and affiliated institutes work on quantum algorithms and photonics; the University of Calgary is known for quantum communications experiments; and institutions like McGill, Université de Montréal, and Dalhousie have groups studying quantum information science. Through these hubs, Canada has built a pan-national network of quantum excellence, with Waterloo often cited as a model of how co-locating theoretical and experimental expertise can drive innovation.

Private Sector Developments: D-Wave, Xanadu and a Budding Quantum Industry

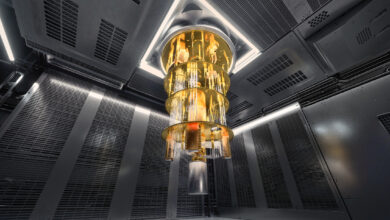

Canada’s private sector has played a pioneering role in quantum computing, and today a number of startups and companies are advancing the technology’s commercial frontier. D-Wave Systems, based in Burnaby, BC, was the earliest trailblazer – founded in 1999, D-Wave became the first company in the world to sell a quantum computing system. D-Wave’s machines use quantum annealing (adiabatic quantum optimization) and the company shipped its first 128-qubit “D-Wave One” system in 2011. Over the past decade, D-Wave has steadily increased the scale of its annealers (its latest Advantage system boasts over 5000 qubits) and developed a suite of software for applications in optimization, machine learning, and material science. It has attracted global customers (Lockheed Martin, Google, and NASA were early adopters) and continues to innovate, recently working on gate-model quantum processors to expand beyond annealing.

In Toronto, Xanadu has risen as another star of Canadian quantum tech. Founded in 2016, Xanadu focuses on photonic quantum computing – using light (photons) and optical circuits to perform computations. In 2022, Xanadu’s researchers unveiled Borealis, a photonic quantum computer with 216 squeezed-state qubits that was shown to outperform classical supercomputers on a specialized boson-sampling problem. This achievement, published as a quantum advantage milestone, made Borealis the first publicly accessible photonic quantum device to demonstrate a proven computational advantage. With support from both government (through the Strategic Innovation Fund) and venture capital, Xanadu is now striving to build a fault-tolerant, general-purpose photonic quantum computer.

Beyond these two flagships, a range of Canadian startups are tackling different layers of the quantum computing stack. 1QBit (1QBit Information Technologies, founded in Vancouver) develops quantum-inspired software and algorithms and has partnered with industry players to apply quantum methods in finance and health care. Anyon Systems, based in Quebec, is building superconducting quantum computing hardware and delivered a small-scale quantum processor to Canada’s defense department for research. In the quantum software realm, Quantum Benchmark (Waterloo) provided error characterization tools before being acquired by Keysight Technologies. Meanwhile, Canada also hosts companies specializing in quantum-safe cybersecurity, such as ISARA Corp. (Waterloo), which creates quantum-resistant encryption solutions for the era of quantum computers. The startup ecosystem is supported by dedicated investment funds like Quantum Valley Investments (the $100 million fund set up by Lazaridis in 2013), and incubators that nurture quantum entrepreneurs. Notably, many Canadian quantum startups maintain close ties to academia – for example, Vancouver’s Quantum Algorithms Institute and Toronto’s Creative Destruction Lab (CDL) program have been training grounds for quantum innovators. This tight-knit industry-academia linkage ensures a pipeline turning Canada’s research strengths into commercial products. While Canada’s quantum industry is still relatively small in terms of revenue, it punches above its weight in certain niches (such as D-Wave’s dominance in annealing-based computing and Xanadu’s lead in photonics). The continued support for commercialization under the National Quantum Strategy – including $169 million earmarked to help startups scale up – suggests that the private quantum sector in Canada will grow significantly in coming years.

Quantum Communications and Cryptography Initiatives

Beyond computing, Canada is actively advancing quantum communication technologies and quantum-safe cryptography, building on a legacy of cryptographic innovation. Given that one of the National Quantum Strategy’s core missions is to “equip Canada with a national secure quantum communications network and post-quantum cryptography capabilities,” significant effort is underway in this domain. A hallmark initiative is Canada’s work on Quantum Key Distribution (QKD), the art of sending encryption keys encoded in quantum states of particles. Canadian researchers were instrumental in the birth of QKD (via the BB84 protocol in the 1980s), and today Canada remains at the forefront of its deployment.

For instance, the Canadian Space Agency is developing the Quantum Encryption and Science Satellite (QEYSSat), a Low-Earth-Orbit mission slated for launch in 2026 that will demonstrate QKD from space. QEYSSat aims to exchange quantum keys between a satellite and ground stations, an approach to enable ultra-secure communications links over intercontinental distances beyond the limit of fiber optic QKD.

On the ground, Canada is also building out quantum communication testbeds. In late 2023, a multi-node quantum network testbed was launched in Quebec: the non-profit Numana, with federal and provincial funding, is deploying a fiber-based QKD network linking Sherbrooke, Montreal, and Quebec City. This open testbed uses equipment from industry partners (ID Quantique’s QKD systems and encryption gear from Ciena) and infrastructure provided by telcos Bell and Telus. It is designed to allow researchers and companies to experiment with quantum-secure communication technologies in a real-world setting. Such efforts align with Canada’s goal of eventually creating a nationwide quantum-secured network, potentially one of the first of its kind in the West.

Canadian universities and labs are likewise pushing the envelope in quantum communications research – for example, the University of Calgary demonstrated entanglement-based QKD over a record distance of 6 kilometers of optical fiber in Calgary’s city network a few years ago, and researchers at Toronto and Waterloo are working on quantum repeaters to extend QKD ranges.

In parallel, Canada is investing in post-quantum cryptography (PQC) to safeguard classical communications against future quantum code-breaking. The government’s Communications Security Establishment (CSE) and Cyber Centre have been urging institutions to begin the transition to quantum-resistant cryptographic algorithms, given the prospect that quantum computers could decrypt current public-key encryption by the 2030s. Canadian mathematicians and cryptographers are contributing to international PQC standards – for instance, algorithms submitted to the NIST PQC competition had Canadian co-authors, and companies like ISARA are developing toolkits for a “crypto-agile” migration to new encryption schemes. The National Quantum Strategy explicitly highlights developing “post-quantum cryptography capabilities” as part of the communications mission, and federal funding is being applied to both R&D and the creation of guidelines for government and industry to adopt quantum-safe practices. Canada is also collaborating internationally on quantum communication; it has partnerships with European and U.S. researchers (for example, participating in the UK-led Quantum Communications Hub projects and exploring transatlantic QKD experiments). These combined efforts in QKD networks, space-based quantum links, and next-generation cryptography indicate that Canada is moving steadily toward a future of secure communication infrastructure that can withstand the power of quantum computing. While full-scale quantum internet deployment is still on the horizon, Canada’s consistent progress – from pioneering theory decades ago to building physical networks and satellites now – underscores its prominence in quantum communications.

Quantum Sensing and Metrology Developments

Quantum sensing is an area where Canada exhibits particular strength, often with a focus on practical applications in defense, environmental monitoring, and healthcare. Quantum sensors leverage quantum phenomena (such as superposition and entanglement) to achieve measurement precision far beyond classical instruments, and Canada’s strategies have identified sensing as a priority for both innovation and national security. In fact, even before the 2023 NQS, Canada’s Department of National Defence (DND) highlighted quantum sensing in its own Quantum Science and Technology Strategy (2020) as a solution for challenges like Arctic surveillance and detecting stealth aircraft.

One high-profile example is the development of quantum radar. Researchers at the University of Waterloo’s IQC, with $2.7 million in DND funding, are prototyping a radar system that uses quantum illumination (entangled microwave photons) to detect objects with greater sensitivity and cut through background noise. The motivation is to spot stealth bombers or missiles that traditional radar might miss – especially in high-noise environments like the Canadian Arctic, where auroras and geomagnetic storms interfere with sensors. A quantum radar could theoretically reveal even radar-evading aircraft, and do so without alerting them, offering a compelling advantage for airspace defense.

More broadly, the Canadian Armed Forces’ Quantum 2030 roadmap places enhanced sensing (like quantum LIDAR and gravimetry) as top missions to pursue. Quantum LIDAR (light detection and ranging) can use entangled photons to improve detection of objects and terrain, which could aid navigation and mapping in low-visibility conditions. Another area of focus is quantum magnetometry – ultra-sensitive magnetic field sensors. Canadian startup SB Quantum, for instance, is developing quantum magnetometers (based on nitrogen-vacancy diamond or other quantum effects) that can detect mineral deposits underground or provide navigation in GPS-denied environments by sensing Earth’s magnetic anomalies. SB Quantum, part of the Sherbrooke quantum ecosystem, has received support to advance its magnetometer for both industry (resource exploration) and defense (submarine detection) applications. In the environmental and geophysical realm, quantum gravimeters and quantum LiDAR are eyed for tasks like charting Arctic ice or finding hidden tunnels, as noted by Canadian defence analysts.

Canada is also translating quantum sensing research into healthcare and metrology. Quantum sensors can dramatically improve medical diagnostics – for example, ultra-precise magnetometers (such as optically pumped magnetometers or quantum SQUIDs) can measure faint biomagnetic signals from the heart or brain, enabling new medical imaging techniques. Canadian researchers are exploring quantum diamond sensors to detect neurological signals and diagnose diseases at early stages, aligning with global trends that see quantum biosensing as transformative for medicine. In terms of fundamental metrology, the National Research Council (NRC) in Canada has dedicated programs for quantum measurement standards. The NRC’s Quantum Sensors Challenge Program is pushing the development of “revolutionary sensors” for use in environmental monitoring, resource exploration, healthcare, and defense. This includes photonic chip-based sensors and new materials engineered to exploit quantum effects for imaging and detection. Canada’s metrology labs are collaborating internationally to define standards for emerging quantum tech, ensuring that as quantum sensors become commercially available, there are benchmarks for their performance and interoperability.

Several quantum sensing projects are moving from labs toward real-world testing. For instance, quantum gravity gradiometers (which could help in oil and mineral prospecting or civil engineering by detecting density anomalies underground) are under development at Canadian institutions. The dual-use nature of many quantum sensors – applicable to both civilian and military domains – has led DND to support R&D through programs like IDEaS (Innovation for Defence Excellence and Security) challenges on quantum sensing. Overall, Canada’s approach to quantum sensing is characterized by identifying niche areas where quantum technology offers tangible improvements (be it navigating without GPS, scanning the Arctic, or high-resolution medical scans) and funding those areas for rapid development. Analysts note that while quantum computing often steals the spotlight, quantum sensing is perhaps the most mature quantum technology and could bring some of the earliest breakthroughs into daily life. Canada’s emphasis on quantum sensing – treating it as equally important as computing and communication – reflects an intent to lead in this high-impact, nearer-term quantum revolution. We can expect Canadian-developed quantum sensors to begin rolling out in specialized markets (like defense systems or medical devices) within the next few years, showcasing the country’s innovation in precision measurement.

Canada’s Global Position in the Quantum Technology Race

Canada is widely regarded as a global leader in quantum science, though it faces intense competition from larger players like the United States, China, and the European Union in the race to commercialize quantum technologies. In terms of foundational research and talent, Canada’s strengths are clear: it consistently ranks among the top five countries worldwide for output in quantum research, and even leads G7 nations in per-capita investment in quantum R&D. Over the past decade, Canada has invested over a billion dollars to cultivate a quantum ecosystem, a significant sum for a country of its size. This has yielded a strong base of expertise – Canadian universities and institutes have produced influential discoveries and trained a generation of quantum scientists, some of whom now lead efforts at major tech companies and labs around the world. Canadian initiatives like CIFAR’s quantum program helped lay the groundwork for international collaborations, giving Canada a voice in shaping the global quantum agenda.

However, when comparing absolute scale and urgency, Canada’s approach appears more measured than that of its superpower counterparts. The U.S. launched its National Quantum Initiative Act in 2018 with an initial $1.2 billion over five years for quantum research centers and industry partnerships, and U.S. federal quantum investments have since grown to roughly $5 billion (cumulatively reported through 2023). The European Union’s Quantum Flagship, started in 2018, commits €1 billion (~$1.4 billion) over ten years to propel European quantum R&D. Individual European nations are also investing heavily (e.g. Germany earmarked €2 billion and the UK £2.5 billion for quantum programs in the 2020s). By contrast, Canada’s National Quantum Strategy, with $360 million new funding, is comparatively modest – though Canada also relies on provincial contributions and prior investments to bolster the total support. Perhaps the most dramatic spender is China: reports suggest China has poured on the order of $10–15 billion of public funds into quantum technology, outspending the rest of the world’s governments combined. China’s state-led effort has produced world-leading achievements, particularly in quantum communication (for example, the Micius quantum satellite and a 2,000 km quantum-encrypted fiber network), and rapid progress in superconducting and photonic quantum computing. Against this backdrop, Canada’s strength lies not in outspending the giants, but in leveraging its niche leadership and collaborations. Canadian researchers are tightly integrated into global networks, and the country’s quantum companies often partner with foreign firms (for instance, D-Wave has U.S. and Japanese corporate clients, Xanadu collaborates with Amazon for cloud access, etc.). Additionally, Canada benefits from strong ties with the quantum efforts of its allies – it works closely with the US on standards for post-quantum cryptography, with Europe on quantum communication tests, and through the Five Eyes intelligence alliance on quantum-resistant security strategies.

In terms of competitive strengths, Canada’s primary asset is its talent and research output. Publications and patents from Canadian quantum scientists are highly cited, and Canada has been home to multiple “firsts” (first quantum computer sale, first public photonic quantum advantage, first QKD protocol, etc.). The presence of anchor institutions like IQC and Perimeter Institute attract international talent and students, contributing to a virtuous cycle of innovation. Canada also has a couple of flagship companies (D-Wave, Xanadu) that give it a footing in the commercial arena; few countries outside the U.S. and China have comparably mature quantum computing firms. Moreover, Canada’s balanced focus on computing, communications, and sensing (as formalized in the NQS missions) gives it a broad base to derive synergies between sub-fields. For example, advances in superconducting qubits at Canadian labs might feed into better magnetometers or vice versa.

On the side of challenges, one is scale and funding continuity: Canadian projects sometimes struggle to scale up due to funding gaps or a limited domestic market. Large-scale quantum computing efforts require sustained investment, and Canadian startups often seek foreign capital or customers to grow (indeed, D-Wave listed on the NYSE to raise funds, and some startups might be acquisition targets for U.S. tech giants). Brain drain is a related concern – with tech behemoths like Google, IBM, and Microsoft investing heavily in quantum, Canadian experts can be lured abroad by bigger budgets. Retaining talent will require Canada to present attractive opportunities at home, whether through government grants, industry jobs, or entrepreneurship support. Another challenge is that Canada’s big industry has been slow to engage in quantum relative to peers. In the U.S. and Europe, large enterprises in sectors from finance to automotive are already running quantum pilot projects or forming consortia (for example, JPMorgan and Volkswagen each have notable quantum teams). In Canada, until recently, adoption was limited to niche collaborations. Only in 2025 did a major Canadian bank – BMO – become the first in the country to join the IBM Quantum Network to explore practical quantum use cases like portfolio optimization. This indicates that Canadian industry is beginning to take notice, but widespread “quantum readiness” is not yet common among large Canadian firms. An expert panel convened by the Council of Canadian Academies in 2023 indeed found that, while Canada leads in research, it “faces challenges in the adoption of these technologies as they approach market readiness.” The panel emphasized that government support to date has focused on R&D, with “significantly less attention to stimulating technology diffusion and adoption” in the broader economy. This implies Canada will need to encourage more end-users (in energy, telecom, finance, etc.) to experiment with quantum solutions, perhaps via incentives or procurement, to avoid lagging in commercialization. Finally, Canada’s mid-sized economy means it must choose its battles wisely in the quantum domain. It likely cannot compete head-on in every subfield, so it may concentrate on areas where it has a lead (for instance, quantum annealing, photonic computing, QKD networks) and partner with allies to share advances in others. Encouragingly, Canada’s strategy explicitly mentions international collaboration and leveraging alliances as part of maintaining its global standing.

At the global level, Canada is often viewed as a key contributor and a respected player in quantum technology, if not a superpower. Its role is somewhat analogous to what it has been historically in fields like AI: an innovator and talent source that larger countries and companies pay close attention to. As quantum technologies evolve, Canada’s influence will hinge on its ability to translate its scientific leadership into deployable technology. The next few years, as quantum hardware approaches technical milestones and governments ramp up investments, will be crucial for Canada to solidify its position. Many expect Canada to continue punching above its weight – for example, by leading niche areas (like quantum safe communications for government networks) and co-developing breakthroughs with international partners – but also to face pressure as the U.S., EU, and China sprint ahead with massive funding.

The Canadian Quantum Ecosystem: Strengths and Observations

Canada’s quantum ecosystem presents an interesting contrast: on one hand, it boasts world-class research centers, skilled startups, and a history of quantum innovation; on the other hand, its government and industry approach has been described as steady and deliberate rather than aggressively expansive. Having worked in Canada for many years, I have observed the above-mentioned challenges and dynamics first-hand. In my opinion, Canada’s government appears “measured” in its quantum strategy, especially when compared to the more urgent, large-scale national programs elsewhere that I was able to experience. The rollout of the National Quantum Strategy itself exemplified this – it came a few years after other nations’ strategies, and its funding, while significant, is spread over several years and targeted in specific areas. This careful approach has advantages: it allows time to consult experts (hence the Quantum Advisory Council), set realistic goals, and integrate ethical, legal, and social considerations (which the CCA expert panel report “Quantum Potential” emphasized for responsible tech adoption ). It avoids the hype-driven spending that some critics warn about in the quantum field. However, the conservative pace also carries risks – technology moves quickly, and lack of a sense of urgency could see Canada miss opportunities or lose talent to faster-moving ecosystems.

From an enterprise readiness standpoint, Canada’s private sector (outside of the dedicated quantum startups) has only recently begun to prepare for quantum disruption. There are encouraging signs: partnerships are emerging between quantum firms and Canadian end-users – for example, Toronto’s Xanadu working with Volkswagen on battery chemistry simulations, Vancouver’s 1QBit collaborating with major Canadian banks on quantum risk analysis, and as mentioned, BMO stepping forward as a leader in banking by accessing IBM quantum processors. Telecom companies Bell Canada and Telus have engaged in the quantum communication testbed in Quebec, which shows interest from network operators in quantum-safe communication infrastructure. Yet, many large Canadian enterprises (in sectors like energy, mining, transportation, manufacturing) appear to be in a wait-and-see mode regarding quantum technology. This contrasts with, say, the United States where companies like ExxonMobil and Boeing have internal quantum teams, or Europe where Siemens and Total participate in quantum programs. The relative lack of “big player” involvement in Canada could be due to limited awareness or the smaller presence of R&D-heavy corporations domestically. Canada’s tech landscape does not include a Google or IBM of its own, so it relies on SMEs and startups to drive innovation. The challenge, therefore, is diffusion: ensuring the cutting-edge quantum solutions developed by researchers or startups are taken up by industry. The federal government may need to catalyze this by acting as an early customer (for example, using quantum sensors in defense or quantum cryptography in government communications) and by funding pilot projects with industry. In this regard, it is notable that the 2025 federal budget (through regional development agencies like CED) provided funds to help SMEs adopt quantum technologies in Sherbrooke – a sign that policymakers recognize the adoption gap and are starting to address it.

Another observation is the collaborative nature of Canada’s quantum ecosystem. There is a high degree of academia-industry-government collaboration, often coordinated through hubs or networks. For example, Quantum Valley in Waterloo is not just a cluster of buildings but an ecosystem where ideas flow between the university (IQC), theoretical institute (Perimeter), startups, and large companies like Blackberry (which has shown interest in quantum-safe encryption as a cybersecurity provider). Similarly, in Sherbrooke, the Institut Quantique works hand-in-hand with startups like Nord Quantique, sharing laboratory space and expertise, which greatly lowered the barrier for those startups to innovate. Federal agencies like the NRC facilitate collaboration through challenge programs (e.g. a forthcoming Quantum Internetworking Challenge program to link quantum devices in networks by 2026 ). This ecosystem approach is a strength for Canada – it helps maximize the impact of limited resources by avoiding silos. It also creates a welcoming environment for international partners; Canada often invites global companies or researchers to join its projects (for instance, the Quebec testbed is open to collaborators worldwide ). The presence of many expat researchers (some top Canadian quantum scientists are actually from abroad, drawn to Canada’s institutes) attests to its attractive research climate.

Nonetheless, experts counsel that Canada must not become complacent. A 2023 policy paper by the Canadian Global Affairs Institute argued that “more urgency needs to be injected” to transition quantum technology out of the lab and into practical use. It warned of a techno-security race where falling behind has strategic consequences. This is particularly relevant in areas like quantum computing where “first-mover advantage” is huge – the first to build a powerful quantum computer could potentially decrypt others’ secrets or commercialize new drugs faster. While Canada alone may not win such a race against superpowers, it can ensure it remains a key player and not just a spectator. The good news is that Canada has many of the necessary ingredients: talented scientists, entrepreneurial startups, and a government aware of both the promise and risks of quantum technology. The areas for improvement center on scaling up efforts: scaling the funding (perhaps via public-private partnerships or attracting more foreign R&D investment into Canada’s quantum sector), scaling the infrastructure (e.g. building national facilities like quantum fabrication foundries or secure quantum networks that companies can use), and scaling the talent pipeline (training more quantum engineers and technicians alongside theorists).

In summary, the Canadian quantum ecosystem is robust and research-rich, but to fully capitalize on its potential, it is navigating how to become more execution-focused. The coming years will test how well Canada can convert its quantum “knowledge power” into economic and strategic “quantum power.”

Conclusion and Future Outlook

Canada has established itself as a major hub of quantum technology research, and its recent initiatives aim to translate that strength into societal and economic benefits. The country’s National Quantum Strategy, with its coordinated missions in computing, communications, and sensing, provides a roadmap for the next stage of quantum innovation in Canada. In the immediate future, we can expect to see a ramp-up of activity on several fronts. Quantum computing hardware developed by Canadian companies will continue to advance: D-Wave is slated to deliver new generations of annealers and is working toward a gate-model quantum processor, while Xanadu is on track to refine its photonic qubit technology with the long-term goal of a fault-tolerant quantum computer. These efforts, supported by government investment and private capital, could yield prototype quantum processors of increasing size and reliability within a few years. On the software side, Canadian researchers and startups will likely contribute significantly to quantum algorithms and error-correction techniques, leveraging Canada’s strength in theoretical quantum computing. Concurrently, the quantum communications landscape in Canada will see concrete milestones – notably the launch of QEYSSat around 2026, which, if successful, will place Canada among the very few nations (besides China) to demonstrate space-based QKD. That achievement would be a leap toward a global quantum-secure communications network. On the ground, the expansion of QKD testbeds (like the Montreal–Quebec network) and the integration of quantum-safe encryption into critical infrastructure are likely to continue. We may see pilot projects where government agencies, banks, or power utilities implement quantum-resistant cryptographic systems as proofs of concept, laying groundwork for broader adoption once PQC standards are finalized.

In the realm of quantum sensing, Canada’s focus on practical outcomes suggests that within the next 3–5 years, some quantum sensor technologies will transition from labs to field deployment. For example, the quantum radar prototype from Waterloo could move to outdoor testing at DND sites in the Arctic, evaluating its ability to detect real aircraft. Quantum magnetometers developed in Sherbrooke might be trialed by mining companies or geophysical survey teams to locate mineral deposits with greater sensitivity than classical tools. The NRC’s quantum metrology efforts could yield new standards – perhaps a made-in-Canada quantum voltage standard or a portable atomic clock that can be used for high-precision timing in telecommunications. These developments will reinforce Canada’s reputation in precision measurement and could spin off new commercial products (for instance, a startup marketing a quantum navigation device for the aerospace sector).

Another key aspect of the future will be talent and workforce development. The investment in scholarships, training programs, and attracting global experts (part of the NQS talent pillar) will start to pay off as more graduates with quantum engineering skills enter the job market. We should see new specialized programs at Canadian universities (indeed, some have launched professional Master’s in quantum engineering) and growth in interdisciplinary teams – e.g. pairing quantum scientists with software engineers, or business students with quantum hardware PhDs to drive startup formation. By fostering a quantum-ready workforce, Canada is preparing for the time when quantum technologies become mainstream in industry.

In terms of Canada’s strategic posture, the next few years will involve careful policy follow-through. The Quantum Advisory Council and expert panels will likely monitor progress and adjust the strategy’s implementation. If certain areas lag or global developments accelerate (for example, a sudden breakthrough by another nation), Canada may adapt its plan, potentially increasing funding or forging new alliances. There is also an increasing recognition of the need for ethical and secure deployment of quantum tech. Canada, known for promoting responsible innovation, might spearhead efforts to develop norms or frameworks for quantum technology usage – such as guidelines for quantum computing in encryption to prevent “harvest-now, decrypt-later” abuses, or principles for ensuring quantum algorithms are used ethically in AI. This “responsible innovation” theme was highlighted in the CCA’s Quantum Potential report, urging Canada to consider societal implications alongside technical progress.

Looking further out, Canada’s vision is to have a thriving quantum industry that significantly contributes to its economy and security. According to government projections, quantum technologies could become a $139 billion industry in Canada and create over 200,000 jobs in the next couple of decades. Achieving this would mean moving from today’s predominantly research-driven environment to a more mature ecosystem with large-scale quantum computing services, quantum-secure communication networks in daily use, and quantum sensors embedded in various industries. By around 2030, if the current momentum continues, Canada could feasibly host one of the world’s first universal quantum computers accessible via cloud (perhaps through a company like Xanadu or a collaborative project), and could have a domestic quantum internet testbed linking multiple cities with quantum repeaters. In the defense sphere, DND’s Quantum 2030 roadmap envisions prototype quantum navigational aids and secure communication links operational by that time. Canadian tech firms might by then be delivering quantum solutions to global markets – for example, exporting QKD equipment or specialized quantum software.

Of course, forecasting in such a rapidly evolving field is challenging. There will undoubtedly be technical hurdles and new discoveries that shift timelines. Yet, the overall trajectory for Canada is one of steady progress guided by strategic investment. As Innovation Minister François-Philippe Champagne remarked at the NQS launch, strengthening quantum research, businesses, and talent will “give Canada a competitive advantage for decades to come.” The coming years will be about realizing that vision.