Investment Screening and M&A: When Capital Becomes a Quantum Sovereignty Vector

Table of Contents

Introduction

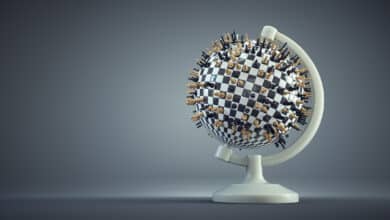

Foreign investment screening, acquisition scrutiny, and “strategic capital” policies increasingly shape which quantum technology companies survive – and where their intellectual property (IP) and talent ultimately reside. National security and technological sovereignty narratives are no longer abstract concerns; they influence the day-to-day decisions of quantum startups.

The Sovereignty Stakes in Quantum Investment

Quantum technologies are widely seen as strategic, dual-use innovations at the nexus of economic competitiveness and national security. As a result, who finances and controls quantum startups has become a sovereignty concern. Governments fear that if adversarial nations gain stakes in or outright acquire domestic quantum firms, they could siphon critical know-how or capabilities abroad. Conversely, lacking domestic capital might force startups to relocate or sell to foreign buyers, again leading to an “innovation exodus” of talent and IP. The narrative of “quantum sovereignty” – ensuring a nation isn’t dependent on others for quantum tech – now permeates policy. It is reflected in export controls and investment screenings designed to guard the “crown jewels” of quantum innovation.

At the same time, no country has a monopoly on the quantum ecosystem. The field is inherently international – for instance, U.S. firms might rely on European cryogenic hardware, and Chinese labs have needed Western components. This interdependence complicates sovereignty claims. Complete self-reliance in quantum is extraordinarily difficult (only a couple of global powers might attempt it). Nonetheless, major powers are racing to secure control over quantum technology. Over $40 billion in public funding has been committed globally to quantum R&D, often justified by “strategic autonomy” goals. In this climate, capital itself is weaponized: friendly capital is courted as “trusted” funding, while adversarial capital is viewed with suspicion or outright banned. The flow of money into or out of quantum ventures has become a battleground of geopolitical influence and national policy.

A Global Trend: Tightening Investment Screening

Foreign investment review regimes have proliferated worldwide, targeting high-tech sectors like quantum computing, encryption, and advanced sensors. In the United States, the Committee on Foreign Investment in the US (CFIUS) has been empowered by recent reforms to scrutinize even minority investments in “critical technology” companies such as quantum startups. Under updated rules, any foreign investment that provides access to non-public technical information or board rights in a quantum firm can trigger a mandatory national security review. This means a foreign venture capital fund taking a small stake with a board observer seat in a U.S. quantum computing startup might need to file for approval – a stark change from a decade ago when only large takeovers drew government attention. CFIUS’s broadened reach reflects concern that adversaries could obtain sensitive quantum IP via even passive investments. Notably, U.S. regulators explicitly tie these reviews to export control status: if the technology would require an export license to share with the investor’s home country, the investment likely requires approval.

China’s involvement is a primary focus of these measures. A White House stated that People’s Republic of China has long used direct investments and partnerships to elicit technology transfer from U.S. companies. Indeed, between 2022 and 2024, investments involving Chinese government or affiliated entities accounted for the most CFIUS investigations. U.S. authorities grew wary as Chinese venture funds and state-backed firms sought stakes in Western quantum and semiconductor startups. In response, policies now often treat all unvetted foreign capital with suspicion, leading to lengthy reviews that deter even allied investors. By 2024, 55% of transactions referred to CFIUS were subjected to full investigation (though only one deal was ultimately blocked outright). This heavy scrutiny, and the uncertainty it brings, has had a chilling effect: quantum startups can ill afford months of fundraising delays or open-ended compliance demands while CFIUS deliberates. Some deals have been abandoned due to the bureaucratic drag alone.

U.S. policymakers are seeking balance. There is recognition that a blanket approach may handicap domestic companies by cutting them off from friendly capital. Proposals have emerged to fast-track investors from trusted countries (Five Eyes allies, EU, Japan, etc.) with expedited 30-day reviews, while categorically barring investment tied to hostile states like China. The aim is to separate “friend” from “foe” capital – encouraging money from allies to keep flowing, but slamming the door on adversarial funding. This differentiated approach was explicitly outlined in the America First Investment Policy of 2025, which directs Treasury to streamline approvals for allied investors and impose bright-line restrictions on Chinese-affiliated funds in quantum deals. In practice, this could mean a venture round led by, say, a Japanese or European fund sails through in a month, whereas a minority investment from a Chinese state-backed entity is flatly prohibited. The intended result is to shield U.S. innovation from espionage or unwanted tech transfer, without starving it of growth capital from partners.

Europe has likewise tightened its defenses. The European Union implemented an FDI screening regulation in 2020 and, as of late 2025, is moving to require all member states to screen foreign investments in sensitive sectors like defense, chips, AI – areas that would encompass quantum technology. Major economies in Europe (France, Germany, Italy, etc.) already expanded their review regimes to cover emerging tech and critical infrastructure. The UK, after Brexit, established one of the most assertive systems: the National Security and Investment Act (NSIA) of 2021, which mandates notification of foreign investments in 17 sensitive sectors including quantum technology. The UK government has not shied away from using this power. In 2022–2023 it intervened in deals involving semiconductors and artificial intelligence; by 2025, quantum computing was squarely on the radar for national security reviews.

A landmark case was IonQ’s acquisition of Oxford Ionics in 2025, a U.S.–UK deal in the quantum computing arena. Despite IonQ being from a “friendly” country (the US), the UK subjected the $1 billion takeover to rigorous scrutiny and approved it only with strict conditions to safeguard UK sovereignty. Under the final order, all of Oxford Ionics’ trapped-ion quantum hardware had to remain on British soil for government oversight, and the company’s core R&D operations, staff, IP, and manufacturing capabilities were required to stay in Britain. These mitigation measures ensured the UK “retains access to key quantum computing capabilities” even after foreign acquisition. In essence, the UK used its investment screening to secure a promise that the technology and talent won’t be relocated overseas. This case demonstrated that even allied investments are not exempt from sovereignty concerns – foreign capital is welcome only on the condition that national strategic assets remain anchored at home. By imposing safeguards rather than blocking the deal outright, the UK signaled a nuanced stance: it wants to stay open to foreign investment in quantum, but not at the cost of losing control over a critical technology.

Other U.S. allies are similarly vigilant. Canada, Australia, and Japan have all expanded their FDI laws to cover quantum and other advanced tech, often increasing oversight of investments from China or other rivals. Even smaller nations are coming under the screening umbrella, sometimes due to EU pressure or security alliances. By 2026, it is broadly understood that any cross-border venture funding or M&A deal involving a quantum tech company will likely face some government review. The era of laissez-faire globalization in deep tech funding is over – replaced by a climate of techno-nationalism where capital flows are monitored as potential vectors of foreign influence or IP leakage.

The Other Side of the Coin: Outbound Investment and Strategic Capital

Investment screening is not only about inbound foreign capital; it’s increasingly about controlling outbound flows and mobilizing domestic “friendly” money. In an unprecedented move, the United States finalized regulations in late 2024 to restrict U.S. investors from funding Chinese quantum tech companies. This “reverse CFIUS” policy bars U.S. venture capital or private equity from certain transactions involving Chinese entities engaged in quantum computing, quantum communications, and specific military-related quantum sensing. Effective January 2025, U.S. persons are forbidden to invest in Chinese companies developing quantum computers or their critical components (like advanced cryogenic systems), or quantum sensing and networking technologies destined for military or surveillance use. The rule even covers joint ventures and greenfield investments – a broad net aimed at preventing U.S. capital and expertise from bolstering a strategic rival’s quantum capabilities. While American investments in Chinese quantum startups were relatively limited already, this outbound screening is symbolically significant: it underscores that in great-power tech rivalry, not only do countries want to guard their own startups, they also want to deny adversaries the fuel (capital) to grow competing tech ecosystems. However, the long-term effect could be mutual decoupling, where Chinese venture funds and banks likewise avoid Western quantum ventures, and each bloc funds its own – fragmenting the global innovation landscape.

In parallel, nations are ramping up “strategic capital” initiatives to support their domestic quantum sector. Facing the reality that private capital often flows to the biggest markets or safer bets, governments are increasingly acting as investors of last resort for quantum startups – or creating incentives for allied capital to fill the gap. In the UK, for example, calls have grown for a “Quantum Sovereign Wealth Fund” to scale homegrown companies. The CEO of KETS Quantum Security (a British startup) warned in late 2025 that without a government-backed investment vehicle, the UK will lose its quantum companies, talent, and IP to foreign markets. Her warning came after several UK quantum firms relocated or sold abroad in search of greater funding: PsiQuantum (originally UK-based) moved operations to the US, Universal Quantum shifted to Germany, and Oxford Ionics – as noted – was acquired by an American firm. These moves underscore a blunt truth: if domestic capital isn’t available at scale, startups will go where the money is, sovereignty concerns notwithstanding. To counter this, the KETS CEO advocated that the UK’s 2025 budget establish a sovereign quantum fund to “prevent a mass exodus of British innovation” and avoid “ceding control of critical quantum technologies”. Such a fund would directly invest public money into promising quantum ventures, ensuring they can grow without needing an overseas buyout or relocation for funding.

The UK is not alone. Many countries have created public or quasi-public funds for quantum tech investment. China’s approach has been heavy state investment from the start – Chinese quantum companies are largely backed by government grants or state-guided funds, with relatively little foreign or purely private VC involved. In fact, since quantum is deemed a “strategic emerging industry,” China has tight restrictions on foreign shareholding in key quantum enterprises, and most Chinese quantum firms (like Origin Quantum and QuantumCTek) count state entities as major shareholders. Several U.S. allies have followed suit with targeted funds: Germany, France, Denmark, Japan, South Korea, Singapore, and the EU itself all have venture programs deploying public money into quantum tech. The European Union’s €1 billion Quantum Flagship and upcoming “European Quantum Act” are supplemented by national funds (e.g. Germany’s Future Fund, France’s Plan Quantique) that often take equity stakes or provide scale-up capital to domestic startups. Europe frames this as building a “resilient, sovereign quantum ecosystem” so that Europe is “not a mere consumer of others’ quantum tech”. Notably, despite being home to one-third of the world’s quantum startups, Europe attracted only 5% of global quantum private capital in 2024 (versus ~50% to U.S. startups). This funding gap drives Europe’s push for more coordinated public investment to keep its companies from being lured abroad or bought out.

Even the United States, traditionally more hands-off, has shown interest in direct government investment in quantum firms. In 2025, reports emerged that the U.S. administration was considering taking equity stakes in domestic quantum computing companies to ensure their success. While controversial, such a move would echo how the U.S. Department of Energy or Defense sometimes fund companies for strategic technologies (and how In-Q-Tel, the CIA’s venture arm, invests in quantum encryption and computing startups). All these “strategic capital” efforts share a common goal: to provide a friendly or internal source of funding so that quantum innovators don’t have to turn to rival nations’ capital. By strengthening domestic and allied capital networks, countries aim to make hostile takeovers or IP leakage less likely. In essence, if adversarial money is a vector of influence, then sovereign or allied money is seen as the antidote – keeping critical technology in-house or in-community.

From Board Seats to Cloud Servers: The Mechanics of Control

High-level policies ultimately play out through specific conditions and corporate governance mechanisms. A sovereignty-minded government doesn’t just think in terms of “allow vs. block” an investment – it drills down into how a deal is structured and what access or control it entails. Several key vectors determine whether capital translates into undue influence or loss of critical control:

Board Representation and Veto Rights

Who gets a seat at the table? Foreign investors often seek board seats or observer rights in startups they fund. However, a board seat can give access to sensitive technical information and strategic decisions. CFIUS explicitly flags minority investments that grant board or observer positions as potential national security risks in critical-tech companies.

For example, if a quantum encryption startup takes funding from an overseas entity and offers that investor a board observer role, U.S. regulators may deem it a “covered transaction” because the investor could glean non-public cryptographic details. Startups are learning to navigate this by sometimes denying board seats or special rights to foreign investors to stay below review thresholds. In some cases, mitigation agreements require that a foreign board member be excluded from certain discussions or that the company set up a security committee for oversight.

The ability to influence corporate decisions (mergers, IP sales, export of technology, etc.) through veto rights is another concern. Governments may demand these rights be limited or removed as a condition of approval. Case in point: when China’s Tencent invested in a U.S. quantum communication firm, the deal was quietly restructured so that Tencent had no voting rights or access to core IP, aiming to satisfy U.S. reviewers (hypothetical example based on common practice).

In essence, a share of equity is one thing, but a seat in the boardroom amplifies that equity into potential control, so it’s carefully watched.

Licensing and IP Agreements

Not all tech transfer happens via ownership. Licensing deals, joint ventures, and research partnerships can also transfer critical know-how across borders – sometimes exploiting loopholes in investment oversight. Chinese entities have proven adept at this: when outright acquisitions became difficult, they turned to minority stakes “below the radar,” and to licensing arrangements that give access to technology without taking equity control.

For example, rather than buying a quantum software startup, a foreign firm might sign an exclusive license to that software for certain regions – obtaining the tech’s benefits without triggering an M&A review. In 2020, a U.S. congressional report noted instances of Chinese companies using joint R&D agreements to gain early looks at quantum sensor designs, effectively side-stepping CFIUS. Now, regulators are responding. The U.S. has broadened CFIUS to cover not just stock purchases but any transaction that could result in technology transfer, including certain intellectual property licensing or asset sales that convey controlled know-how.

Similarly, the EU’s screening regulation allows scrutiny of arrangements that might “circumvent ownership change” but still outsource critical technology. This means a startup can’t simply avoid scrutiny by selling a patent portfolio or entering a “strategic cooperation” – those could raise flags too. From the startup’s perspective, this requires caution: lucrative licensing deals with foreign partners might be blocked or require permits if the tech is sensitive. In practice, we see companies splitting their IP or using license restrictions to stay compliant (e.g. licensing non-sensitive portions or only to companies in allied countries).

The bottom line: who gets to use or reproduce a quantum breakthrough is as important as who legally owns the company.

Data Hosting and Cloud Infrastructure

In the cloud era, even if a company remains domestically owned, it might run on foreign infrastructure. Quantum startups often leverage cloud-based quantum computing platforms or remote labs, raising the question of data sovereignty. Governments worry that if, say, a European quantum encryption service is hosted on U.S. or Chinese cloud servers, foreign authorities could access or disrupt it. There’s also the issue of export control: is giving a foreign user access to a cloud quantum computer equivalent to exporting that computing capability? Recent U.S. export rules have grappled with this, requiring clarity on “the treatment of cloud-based systems” in quantum computing controls. This ambiguity led some companies to err on the side of caution and restrict cloud access for foreign collaborators.

To address concerns, some countries are localizing critical infrastructure. Germany’s Fraunhofer Institute partnered with IBM to host an IBM quantum computer in Germany – the hardware sits on German soil, governed by German law, but provides access to IBM’s cutting-edge tech for local researchers. This “sovereign cloud” approach allowed Germany to build know-how on a foreign platform in a controlled way.

Likewise, the EU’s planned EuroQCI seeks to ensure quantum communication networks are largely EU-operated. For startups, these pressures mean choices like preferring a domestic cloud provider (if available), or negotiating contracts that guarantee certain data residency and access rules. Cloud service agreements might require government approval if they involve sensitive data going offshore. In sum, the physical and legal location of quantum computing resources (data centers, labs) has become a strategic consideration. Don’t be surprised if a term sheet now asks, “Where will your quantum emulator be hosted, and under whose jurisdiction?”

Export-Controlled Customers and Markets

Quantum technologies blur the civilian-military line. A high-precision quantum sensor can be used for oil exploration or submarine detection; a quantum random number generator can secure bank transactions or military comms. Thus, many quantum products fall under export control regimes. Companies must mind not only who invests in them, but to whom they sell or demo their technology.

For instance, the U.S. Commerce Department in 2024 added certain quantum computing items to its export control list, requiring licenses to export quantum computers above specific qubit counts or to send related tech to countries like China. If a U.S. quantum hardware startup has interested customers in, say, Russia or China, those sales might be illegal without approval. This directly affects startups’ growth – some have had to pivot from lucrative overseas markets due to export bans.

Moreover, if a foreign company tries to acquire a startup that has export-controlled contracts (like a defense contract or customers in sanctioned countries), regulators will step in. An acquisition can be seen as an export: when a Chinese company attempted to hire away or acquire a small U.S. quantum encryption firm, it was effectively trying to obtain technology that the U.S. had deemed off-limits for export. Such deals are essentially dead on arrival.

In the UK’s Oxford Ionics case, part of the rationale for intervention was that quantum computing capability has potential defense applications, so foreign takeover required guarantees that the tech wouldn’t be repurposed for non-ally military uses. Startups now must ensure strict compliance with export laws – often needing lawyers to vet whether sharing certain algorithm specs with a foreign prospective investor is allowed. Some governments are also expanding export controls to cover outbound research collaborations – for example, prohibiting national labs from working on certain quantum projects with foreign nationals from adversary states without clearance.

All this adds up to daily due diligence for startups: checking if a seemingly innocuous pilot project or cloud API access might trigger export rules. The customer base and partnership list of a quantum company can thus raise red flags in investment screening: if a target company engages with blacklisted foreign labs or militaries, an M&A review will likely impose conditions or disallow those contracts.

Key-Person Dependencies and Talent Mobility

In cutting-edge quantum ventures, much of the “secret sauce” resides in human capital – a few brilliant physicists or engineers whose expertise is irreplaceable. This creates a subtle sovereignty issue: if those individuals were to be hired away by a foreign rival or relocated in an acquisition, the country loses a crucial asset.

Investment screening processes now often evaluate “people risks.” In some deals, authorities have required assurances that key personnel will stay in the country for a number of years or that new security protocols be put in place to retain critical staff. The Oxford Ionics case again is illustrative: the UK’s conditions effectively aimed to keep the company’s talent and know-how local (staff could not just be moved to IonQ’s U.S. labs en masse).

Governments also worry about foreign nationals in sensitive roles: for example, the U.S. now mandates reporting if foreign nationals from adversary countries have access to controlled quantum tech. This was meant to monitor insider risks, though it applied only to new hires, creating loopholes. In extreme cases, countries directly control talent mobility – China, for instance, reportedly withholds passports of certain “strategic” quantum scientists to prevent them from traveling to or potentially defecting to other countries. One renowned Chinese quantum physicist, Pan Jianwei, who studied in Europe, is now said to be unable to leave China as his work is deemed vital to national interests.

Such measures starkly illustrate the view of top researchers as national security assets. For startups, this means key hires might come under government vetting or retention schemes (e.g. special visas, citizenship offers to keep talent, or binding them with security clearance requirements). It also means in planning an exit or partnership, founders must consider: will transferring this team or know-how abroad trigger political pushback? Many have learned to engage with defense/security agencies early to reassure that they have mitigation plans for personnel (like training backups, NDAs and claw-back clauses if someone leaves to a foreign competitor). Human capital is part of the “supply chain” too. Thus, sovereignty-minded policy isn’t only about where hardware sits, but also where brainpower lives and thrives.

Impact on Quantum Startups: Bridging Geopolitics and Day-to-Day

The convergence of geopolitics and quantum tech means that even the smallest startup must now navigate considerations that once only burdened big defense contractors. Quantum entrepreneurs are learning to live in a world of gated capital. For instance, a startup developing quantum sensors might find that one of its eager prospective investors – perhaps a Chinese venture fund known for backing deep-tech – is essentially off-limits if they want any chance of later winning government contracts or avoiding a CFIUS blockage. Founders now vet not just term sheets, but the investor’s nationality and affiliations, sometimes pre-emptively turning down money from “problematic” sources to avoid future headaches. Venture capital firms, for their part, are creating parallel funds or structures to accommodate (or exclude) certain LPs so that their portfolio companies won’t get caught in screening due to an indirect foreign limited partner. This is a sea change from the free-flowing global VC scene of years past.

Fundraising timelines have extended for many quantum startups as a result. Deals that once could be closed in weeks might stretch months if a national security filing is needed. Startups must factor in legal costs for FDI counsel and potential covenants in investment agreements that allocate risk if a deal is blocked. It is not unheard of now for term sheets to include a clause like “Investor will cooperate in good faith to obtain CFIUS approval and may divest as required”, which is essentially planning for the sovereignty issue up front. In worst cases, startups have had to scuttle promising funding rounds because the review uncertainty scared off other co-investors – nobody likes a deal where the government might say no after six months of effort. This is pushing companies to seek “friendly capital” first. Many Western quantum startups now prioritize outreach to domestic funds or those from allies (e.g. U.S. startups courting EU, Japanese, or Canadian investors) and treat money from China, Russia, etc. as radioactive. This friend-shoring of capital mirrors the geopolitical climate.

M&A strategies are also evolving. In the past, a likely exit for a frontier tech startup might be acquisition by a larger tech company, regardless of nationality (whoever pays best). Now, founders and their boards must weigh not just the price, but will the government approve this sale? A high offer from an unexpected buyer can be a poisoned chalice if it will be blocked. We’ve seen deals quietly shop for domestic “white knight” buyers when a foreign suitor is interested, to create an alternative that regulators would bless. Sometimes governments themselves facilitate this: there are cases in other sectors where, say, a U.S. defense contractor was nudged to acquire a critical tech firm to keep it out of foreign hands. In the quantum sector, similar patterns are emerging. If a Chinese company showed interest in a quantum RNG (random number generator) startup, one might expect a swift counter-offer from an allied entity – or even a government-supported bid – to ensure the IP stays home. It’s a new kind of great game in tech M&A. The result for startups: they may have fewer exit options and less leverage in negotiations, since certain bidders are effectively barred. This can depress valuations – e.g., a startup might not get a bidding war for its patented quantum algorithm if half of the potential buyers are off the table due to nationality. On the flip side, some startups benefit by being treated as strategic assets; governments might broker support or partnerships for them. For example, a national lab or state-owned bank might become a customer or investor to boost a local champion, sweetening its prospects compared to if it were to be sold abroad.

All these geopolitical pressures are prompting startups to adopt a “compliance mindset” much earlier than usual. Instead of “move fast and break things,” a quantum hardware startup might be “move carefully and document things.” They engage security consultants to implement insider threat programs (monitoring sensitive research, background-checking employees from certain countries), and they ensure their IT is segregated (so if a foreign partner is working on one project, they can’t access others). Many are effectively doing what large defense firms do, but at startup scale – because the government expects it if they want to work on, say, a cryptography contract or receive a large grant. In the U.S., joining initiatives like the Quantum Economic Development Consortium (QEDC) helps startups stay in the loop on the latest export control guidance. In Europe, startups interface with new government “quantum coordinators” who are tasked with monitoring the ecosystem for foreign influence. In China, companies align closely with government programs to ensure support (and indeed have little choice but to accept state involvement).

Crucially, this intersection of geopolitics with the startup ecosystem is now explicit and expected. Coverage of quantum tech has shifted from pure science to emphasizing national strategies and global competition, shaping public perception and policy agendas. In other words, even the narrative around quantum startups is often framed in terms of which country is ahead, who’s investing, and what the security implications are. This can be a double-edged sword: it helps attract government funding and talent patriotism, but it can also hype fears and make international collaboration harder. Startups that once freely collaborated with universities worldwide on research now think twice if that might jeopardize a future export license or raise a security review flag.

Conclusion

In the quest for quantum advantage, capital has indeed become a sovereignty vector – a channel through which nations assert control or influence over the future of technology. We’ve seen how governments are wielding investment screening tools to keep adversaries out of their critical tech sector, while using funding and policy levers to keep homegrown firms thriving (and firmly on home turf). These high-level policies translate into very tangible impacts on how a quantum startup raises money, who it can partner with, where it hosts its systems, and even how it manages its personnel. The once separate worlds of geopolitical strategy and day-to-day startup operations are now deeply entwined.

For countries, the challenge is finding the right balance. Over-securitize, and you stifle innovation – companies starved of capital or cut off from global talent networks could wither. But under-regulate, and you might wake up to find your most promising quantum breakthrough now owned by (or accessible to) a strategic rival, undermining both economic and national security. Policies are still evolving to strike this balance. The UK’s approach of conditional approvals (rather than reflexive blocks) in the IonQ–Oxford Ionics deal is one example of a calibrated solution: allow beneficial investment but ring-fence what matters most. The U.S. idea of expedited ally reviews is another attempt to not throw the baby out with the bathwater. Allies are also coordinating more – we see efforts like the U.S.-EU Trade and Technology Council discussing aligned approaches to screen investments and share information on concerning investors, essentially trying to close loopholes where a adversary might invest in a European quantum startup to sidestep U.S. restrictions or vice versa.

For quantum startups and their investors, the imperative is to be geopolitically savvy. This means embracing compliance and transparency as part of the business model, and where possible, turning sovereignty concerns into a competitive advantage. A startup that can proudly say it is a trusted national champion, with government support and secure practices, may gain favor in securing contracts from wary customers (e.g. banks or defense agencies that care about security provenance). Conversely, being labeled a potential “trojan horse” for foreign interests is a death knell for business prospects. We are likely to see startups proactively branding themselves as aligned with certain ecosystems (“U.S. and allies only” or “EU-based, GDPR-compliant and sovereignty-focused”) to signal trust. In some cases, international collaboration will proceed but within like-minded blocs – for example, a Canadian and Dutch quantum firm teaming up, confident that neither government will object, whereas those same firms might avoid partnering with a Chinese entity due to political optics and legal hurdles.

Quantum Upside & Quantum Risk - Handled

My company - Applied Quantum - helps governments, enterprises, and investors prepare for both the upside and the risk of quantum technologies. We deliver concise board and investor briefings; demystify quantum computing, sensing, and communications; craft national and corporate strategies to capture advantage; and turn plans into delivery. We help you mitigate the quantum risk by executing crypto‑inventory, crypto‑agility implementation, PQC migration, and broader defenses against the quantum threat. We run vendor due diligence, proof‑of‑value pilots, standards and policy alignment, workforce training, and procurement support, then oversee implementation across your organization. Contact me if you want help.