Quantum Sensing and Navigation as Sovereignty

Table of Contents

Introduction

In capitals from Washington to Beijing, leaders increasingly view mastery of quantum technology as key to future national power – a strategic asset as critical as oil or nuclear arms in decades past. So far, quantum computing and encryption have dominated the spotlight in this geopolitical race. Yet an under-covered front is emerging where quantum science may yield tangible advantages even sooner: quantum sensing, especially in positioning, navigation, and timing (PNT). Imagine a battlefield where GPS satellites are blinded or jammed, yet one military’s drones and submarines still navigate with uncanny precision. Or consider a nation able to detect stealth aircraft and hidden submarines by their faint gravitational or magnetic disturbances. These scenarios hint at why quantum sensing and navigation technologies are becoming sovereignty drivers. They promise physical advantages – in timing, navigation, and detection – that could be decisive in contested environments, all without waiting for fully error-corrected quantum computers.

Quantum sensing leverages quantum phenomena (entanglement, superposition, etc.) to achieve measurement precision beyond classical limits. Importantly, many quantum sensors are nearing deployable maturity, unlike quantum computers that remain experimental. Atomic clocks, quantum optical gyroscopes, gravity sensors and the like are transitioning from labs to real-world pilots. This means a nation that leads in quantum PNT and sensing could secure strategic benefits sooner than one betting solely on future quantum computing breakthroughs.

Quantum PNT in Contested Environments: Strategic Value

Positioning, Navigation, and Timing (PNT) underpins both modern militaries and civilian infrastructure – from guiding missiles and troops to timestamping financial transactions. Today’s PNT is dominated by satellite constellations like GPS, which are vulnerable to jamming, spoofing, or outright destruction in a conflict. Quantum PNT aims to liberate users from that vulnerability. Quantum-enhanced inertial navigation systems (“quantum compasses”) use ultra-precise cold-atom accelerometers and gyroscopes to track position without any external signals. In effect, a vehicle or submarine can dead-reckon its location with such precision that it can navigate for long periods even if GPS is unavailable or adversaries jam the radio spectrum.

The payoff is navigation that cannot be jammed or spoofed – a critical advantage for submarines, aircraft, or even future smartphones operating in GPS-denied environments. Military applications are obvious: a submarine could cruise covertly for months knowing its position to within meters, purely by its on-board quantum sensors, even if satellites are knocked out.

This is not science fiction – prototypes are already emerging. In 2018, a UK team demonstrated a portable cold-atom “quantum compass” that measured motion so precisely it could maintain accurate navigation over time without GPS. The U.S. Air Force and Navy likewise have programs to deploy compact atomic clocks and quantum gyroscopes on aircraft and ships, enabling precision navigation even when GPS signals are denied or spoofed. In fact, defense and navigation applications are a key driver for U.S. quantum sensing efforts; high-precision quantum accelerometers and gyros are seen as a way to give warfighters reliable positioning data in submarines, underground facilities, or contested airspace where satellites can’t reach.

The United Kingdom’s 2023 National Quantum Strategy explicitly highlights sovereign Positioning, Navigation and Timing as a priority mission area alongside quantum computing, underlining how vital these GPS-independent navigation capabilities are considered. China, too, is reportedly racing to develop quantum navigation aids for its platforms, aiming to reduce reliance on U.S.-controlled GPS – a matter of military necessity and national pride.

Beyond navigation, quantum timing provides a strategic edge. The accuracy of an atomic clock can determine whose communications or sensors sync faster and more securely. Quantum clocks are so precise that next-generation versions aim for an error of less than a second over billions of years. A portable optical clock, paired with quantum inertial sensors, could allow an army to deploy its own local PNT network on the ground – effectively a backup GPS that cannot be jammed externally. Such clocks also bolster cybersecurity (by securing time-stamped records and encryption systems) and finance (where precise timing of trades is crucial). It’s telling that nations are investing heavily in timing: the UK’s quantum hub in sensors and timing and U.S. agencies like NIST are pushing the frontier of atomic clock development. Control of time and navigation has always been a form of power – from maritime empires that mastered celestial navigation and chronometers, to GPS today giving the U.S. a global strategic asset. Quantum PNT is the next leap, promising self-reliance in navigation and timekeeping. For nations preparing for “day one” scenarios where space infrastructure might be lost, this is a game-changer.

Concentrating Power: Military and Economic Advantages

The capabilities unlocked by quantum sensing concentrate power in two domains: military security and economic advantage.

Militarily, they act as force multipliers. A prime example is quantum radar for stealth detection. Stealth aircraft and encrypted communications may meet their match in quantum radars that use entangled photons to detect objects with much lower power and higher sensitivity than classical radar. By comparing an emitted photon with its entangled twin kept at the receiver, a quantum radar can pick out a faint reflection even amid heavy noise. This could nullify an adversary’s stealth coating or jamming techniques – essentially undermining decades of investment in stealth technology. A nation that perfects quantum radar gains the ability to see what was previously unseen, dramatically improving air defense and surveillance. It’s no surprise that both the U.S. and China have pursued early quantum radar prototypes.

While practical quantum radar is still in R&D, other sensing tools are closer at hand. Quantum magnetometers and quantum gravimeters can detect submarines or underground facilities by sensing minute anomalies in magnetic or gravitational fields. For example, a submarine disturbs Earth’s magnetic field and gravity ever so slightly; a network of sensitive quantum sensors could track those disturbances and reveal the sub’s location, even deep underwater or at great range. This capability would erode the stealth of nuclear subs, shifting the balance in naval deterrence. Indeed, in defense circles quantum sensors are seen as enhancing both the “sword and the shield” – more penetrating surveillance, and more secure detection of threats. Whoever masters these sensors could dominate the undersea domain and the skies, despite an opponent’s countermeasures.

On the economic front, quantum sensing promises a more subtle but far-reaching advantage. The same gravimeters that can spot hidden tunnels can also locate mineral deposits or oil reserves without drilling. Natural resources exploration could be revolutionized: a country with quantum gravity sensors could survey its territory (or even under the ocean floor) for valuable minerals, water, or energy reserves with unprecedented accuracy. This boosts energy security and economic development. Quantum LiDAR and imaging can improve climate and agricultural monitoring, giving nations better data on water resources or crop health. In industrial applications, quantum sensors enhance everything from manufacturing to infrastructure maintenance – for instance, quantum devices can detect microscopic cracks or stresses in bridges, airplanes, and power plants before they fail. All these civilian uses translate to economic strength and resilience.

Crucially, breakthroughs in military quantum sensing often translate into commercial spin-offs, and vice versa. A telling example is quantum magnetometry: the UK has developed quantum magnetic sensors not only to detect vehicles or submarines for defense, but also to enable wearable brain scanners that can measure neural activity for healthcare. The same technology – ultra-sensitive magnetometers – serves dual purposes, concentrating both military power and economic value (through a new medical device industry). Nations that invest in quantum sensing today could end up home to tomorrow’s leading companies in areas like quantum navigation systems, quantum imaging, or precision mapping. The UK explicitly notes that its world-leading quantum gravity sensor demos are expected to yield both strategic benefits (e.g. detecting underground threats) and economic benefits (new industries building quantum instruments).

In short, quantum sensing capabilities don’t just confer a one-time advantage; they seed a high-tech ecosystem that can keep a country ahead. Just as GPS spawned multibillion-dollar industries (think navigation devices, precision agriculture, telecommunications timing), a sovereign quantum PNT capability could spawn new services and firms – from quantum survey companies to navigation systems for autonomous vehicles. Early leaders may become exporters of quantum sensor technology, gaining influence as other nations seek to buy or license these critical tools.

Finally, there’s a geopolitical angle: if only a few countries can build quantum accelerometers, clocks, or radars at scale, those countries effectively control the supply of a strategic resource. They can decide export terms, build dependencies, or withhold technology as leverage. This dynamic is reminiscent of how control of semiconductor fabrication or satellite networks confers geopolitical clout. Thus, quantum sensing concentrates power by altering both the military balance and the economic/industrial hierarchy. It’s an arena where physical technological superiority – the kind that can’t be easily copied without advanced manufacturing – translates into lasting advantage.

Industrial Base and Policy: Building Quantum Sensors at Scale

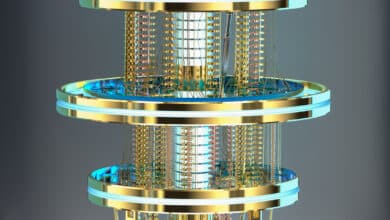

Realizing the promise of quantum navigation and sensing is not just a physics challenge; it is an industrial and engineering challenge. Quantum sensors often require cutting-edge hardware: stabilized lasers, vacuum chambers for cold atoms, cryogenic refrigerators for certain superconducting devices, ultra-pure materials (e.g. isotopically enriched atoms or special crystals), and precision nano-fabrication. Many of these devices remain fragile and bulky prototypes in labs. As my previous overview noted, quantum systems are famously delicate – many sensors need carefully controlled environments (vacuum, cryogenic temperatures, magnetic shielding) to operate. Moving them from laboratory benchtops to the field means grappling with size, weight, and power constraints, as well as robustness in real-world conditions. This dependency on specialized, high-precision components means that a nation’s manufacturing prowess and supply chain become part of the equation.

In other words, quantum sensing pulls on industrial policy levers: governments must foster the domestic industries that can build and maintain these complex instruments.

Take the example of a quantum inertial navigation unit. It might involve cooled atoms or ions interrogated by multiple lasers on a microchip, with precise control electronics. Producing such a device at scale demands advanced photonics manufacturing (for lasers and optical chips), semiconductor-grade cleanrooms, and expertise in integrating electronics with atomic physics hardware. Not every country has these capabilities readily available. Some critical parts – say, high-end photodetectors or vacuum pumps – might only be made in a handful of nations. This raises supply chain sovereignty concerns. Analysts point out that exotic materials and components (like isotopically pure diamond sensors or certain superconducting alloys) face supply limitations and high costs. Ensuring a steady supply of these requires either strong international partnerships or domestic production. We have seen how export controls on advanced tech (for instance, on semiconductor equipment) can throttle a nation’s progress. A similar scenario could play out if key quantum sensor components become subject to tech restrictions. Policymakers are thus keen to support local supply chains for quantum tech where possible – or at least diversify sources so no single foreign supplier can hold them hostage.

Another aspect is calibration and standardization. A sensor is only as useful as it is trusted; users will demand that quantum instruments give accurate readings traceable to known standards. Classical sensors have decades of established calibration procedures, but quantum sensors are so new that in many cases, new methods and standards are needed. How do you certify that your quantum gravimeter is measuring “true” gravity and not drifting? This might require national metrology institutes to develop reference instruments or procedures (for example, cross-comparing a quantum gravimeter with a classical one, or performing drop tests to verify its accuracy). Major countries are indeed investing in metrology for quantum tech – for instance, Britain’s National Physical Laboratory (NPL) is deeply involved in quantum timing and sensing standards. The behind-the-scenes work of establishing calibration services, testing facilities, and performance benchmarks is a crucial enabler for broad deployment. It’s one thing to have a lab demo; it’s another to produce a device that frontline soldiers or field engineers can rely on under harsh conditions. Governments need to ensure not only that the devices are built, but also that they maintain accuracy and can be serviced, repaired, and calibrated in-country over their lifetime.

Because of high initial costs and complexity, early markets for quantum sensors are often niche – defense and national labs, primarily – where cost is less of a barrier and the value of performance is high. These early adopters effectively subsidize the technology until economies of scale bring prices down for wider use. We see this dynamic in action: military R&D contracts fund the first bulky quantum navigators or radars, which then over time become compact and cheap enough for civilian uses (much as GPS was first a military program).

Governments are actively trying to speed this commercialization pipeline. In the U.S., the 2024 GAO (Government Accountability Office) report highlighted that quantum sensors are relatively mature scientifically but need help crossing the “valley of death” from lab to field, citing challenges like technology transfer, a limited specialized workforce, and component supply bottlenecks. To tackle this, policymakers are promoting collaboration between researchers, defense programs, and industry. For example, the U.S. Quantum Economic Development Consortium (QED-C), set up by NIST, brings together companies and labs to identify technology gaps and develop standards in areas including sensing.

In the UK, a “quantum industrial strategy” approach ties academic hubs to companies from day one: the Gravity Pioneer project that demonstrated an outdoor quantum gravimeter was a partnership between the University of Birmingham, an engineering firm (RSK), and the Ministry of Defence funding – explicitly to ensure real-world relevance. This kind of public-private co-development is essentially an industrial policy bridge: defense gets a say in what the prototype should do (e.g. detect tunnels of a certain size), and industry learns how to build something deployable and eventually finds civil uses for it (surveying infrastructure, etc.).

Moreover, tight integration with classical systems is a recurring theme. A quantum sensor rarely operates alone; it feeds data into a larger system. A quantum navigation unit, for instance, will sit alongside traditional accelerometers, GPS receivers, and software that fuses all inputs. Ensuring interoperability and seamless integration is part of the challenge. If a nation’s tanks or airplanes get quantum navigation upgrades, those must interface with existing guidance computers and user displays. This requires engineering effort and likely new standards or protocols for quantum-classical sensor fusion. Countries investing in quantum sensing must thus also invest in the surrounding ecosystem: digital infrastructure to handle the richer data streams, training for personnel to use and maintain the hybrid systems, and logistics to support any unique needs (like resupplying laser coolant or replacing spent vacuum cells). All of this becomes part of sovereign capability – it’s not just having the sensor widget, but the know-how and infrastructure to deploy it effectively.

Dual-Use Innovation: Bridging Defense and Commercial Applications

The history of advanced technology shows that dual-use innovation – where military and civilian programs inform and reinforce each other – is often the fastest route to progress. Quantum sensing is no exception. Governments are positioning quantum navigation and sensing as dual-use fields, funding them in defense programs while also seeding commercial R&D, with an eye toward cross-pollination. The rationale is straightforward: defense projects provide focus, urgency, and funding to get technologies off the ground, while commercial spin-offs ensure a broader industrial base, cost reduction, and talent pipeline that defense can later draw upon.

We can already see this bridge being built. In the UK, the Quantum Technology Hub for Sensors and Timing (led by Birmingham) and the national quantum program explicitly straddle both worlds: they develop military-applicable devices like submarine quantum navigators and gravity sensors for tunnel detection, but they do so in collaboration with companies targeting civil markets (construction, oil exploration, autonomous vehicles, etc.). The result is that the same prototype can satisfy a Ministry of Defence scenario and attract a commercial partner who sees a peacetime use. Similarly, the United States’ approach via DARPA and other defense grants often requires participants to outline commercialization plans for the tech they develop, encouraging them to team with startups or larger firms that can eventually mass-produce the sensors. DARPA’s past investments in inertial quantum sensors, for instance, have involved contractors who simultaneously look at aviation or consumer applications for the technology once it matures.

On the flip side, when a private company or university lab makes a breakthrough in, say, quantum magnetometry, defense agencies are quick to fund follow-on projects to adapt it for security purposes (e.g. detecting shielded nuclear materials or hidden electronics).

One major benefit of the dual-use approach is resilience through diversification. If a technology has only a military use, it might languish in classification and suffer from single-customer stagnation. But if it also serves a civilian need, more stakeholders will invest to improve it. For example, quantum timing devices developed to sync battlefield communications might also become the heart of next-gen telecom networks and financial exchanges that need ultra-precise time synchronization. This broader market will drive costs down and spur incremental improvements that defense can later reap. Another example is quantum LiDAR: initially researched for its ability to see through fog or camouflage (military reconnaissance), it can be commercialized for self-driving cars or drones to have superior sensing, thus drawing corporate R&D money into what began as a defense problem.

Dual-use innovation programs act as a policy bridge by providing funding and incentives that connect defense priorities to commercial ecosystems. Many national quantum programs explicitly mention this. The EU’s Quantum Flagship, for instance, while not military-focused, emphasizes industry involvement and practical demonstrators in fields like sensing to ensure results translate into products. The U.S. NSF’s Quantum Leap Challenges have included sensing topics with both scientific and commercial deliverables, while its defense labs coordinate with agencies like the Department of Energy to avoid duplication and push technologies out to industry consortia (again, QED-C is a case in point).

From a sovereignty perspective, dual-use development has another advantage: it builds a domestic talent and supplier base that can meet defense needs without always relying on foreign imports. If your country’s private sector is manufacturing quantum gravimeters for oil companies and research labs, those same factories and engineers can be tapped in a crisis to produce devices for the military or critical infrastructure. This ties into “technology sovereignty” in the sense of optionality – having at least one local source or a friendly source for key tech. A vibrant commercial quantum sensor sector means you don’t depend on potentially unreliable external suppliers when it comes to critical gear. For example, India’s investments in quantum sensing are partially driven by civilian aims like resource exploration, but the know-how gained means its defense can later procure home-grown quantum magnetometers or gravimeters rather than buying abroad. Even where full self-sufficiency isn’t realistic, countries can aim to cultivate pockets of excellence domestically (be it in manufacturing certain components or in integration skills) so that they remain indispensable in the global supply network.

In summary, dual-use initiatives ensure that quantum navigation and sensing capabilities are not confined to secret labs but become part of a broader innovation ecosystem. They align military and economic incentives: defense gets better and cheaper sensors, while industry gets new markets and government support. Policymakers act as matchmakers in this space – connecting defense program managers with startup entrepreneurs, funding prototype deployments in both military exercises and civilian pilot projects. Over time, this approach not only accelerates technology readiness, it also cements these capabilities as a national asset embedded in the economy. Quantum sensing, when approached this way, becomes less of a boutique science project and more of an integrated sector – much like the space industry moved from purely government rockets to a mix of military, commercial, and civil players. For countries that successfully bridge these worlds, the reward is a sustainable sovereign capability: one that is supported by both defense imperatives and market forces.

Sovereign Capability

What does it mean to have sovereign capability in quantum sensing and navigation? In the classical defense arena, sovereign capability might conjure images of building every piece of a system domestically. But in the quantum era – where the supply chain is globally distributed and expertise is scarce – a more practical definition is emerging. Sovereign capability is less about autarky and more about autonomy: the ability for a nation to trust, validate, and sustain its critical quantum systems without undue reliance on outsiders.

In other words, you don’t need to manufacture every component of a quantum sensor on home soil, but you do need the ability to independently verify its performance, integrate it securely into your own platforms, harden it against interference, and maintain it throughout its life cycle with minimal foreign assistance.

A key aspect is verification and validation. Nations should invest in local expertise and facilities to rigorously test any quantum sensor or PNT device they deploy. This means establishing independent testing labs and certification bodies that can evaluate a quantum accelerometer or clock and certify that it meets claimed specs under various conditions. For example, if a military procures a quantum navigation unit from an overseas vendor, sovereign capability means having domestic scientists and engineers who can put that device through its paces – confirm its accuracy, inspect it for “backdoors” or hidden functionalities, and ensure it’s robust against spoofing or jamming attempts. In the quantum sensing context, spoofing/jamming might take new forms (attempting to feed false signals into a sensor environment, introducing decoy magnetic fields, etc.), so part of sovereignty is developing techniques to certify resilience. A country could run specialized war-game simulations: for instance, see if their quantum radar can be confused by exotic electronic warfare tactics, or test whether an atomic clock-based nav system stays on track under intentional magnetic interference. The goal is to preempt adversaries by understanding your system’s failure modes better than they do.

Closely related is sustainment and maintenance. Advanced sensors are not much use if you must ship them back to the manufacturer (perhaps overseas) every time they need recalibration or repair. Sovereign operation demands training domestic personnel to maintain and calibrate the equipment in-country. This might involve requiring vendors to include training and detailed technical manuals with any purchase, or even negotiating access to design IP so that local engineers can perform deeper repairs if needed. Many countries already apply this principle for conventional defense gear – for example, requiring that a certain percentage of maintenance be done by local technicians, or that an imported system come with technology transfer for self-reliance. The same approach should apply to quantum tech. If you buy a quantum gravimeter truck or a batch of quantum navigation units, you’d want your national metrology institute or military engineering corps capable of recalibrating the sensors, swapping out a faulty laser, or updating the software without having to fly in an overseas contractor. By developing an in-house “quantum systems integrator” talent pool, you ensure the technology doesn’t become a mysterious black box that leaves you at the mercy of the supplier for every tweak.

Another pillar of sovereign capability is security and integrity. Quantum sensors will likely be part of critical infrastructure (think quantum timing for power grids or navigation for naval fleets). Thus, one must be able to trust that they are free from deliberate vulnerabilities. The only way to achieve that trust is through independent evaluation – having your own experts tear down hardware and scrutinize software for any signs of tampering. For example, a quantum random number generator or timing device could, if subverted, introduce subtle errors that compromise security or accuracy. Sovereign control means not taking that risk on faith. Just as nations require source code escrow or on-site inspections for sensitive conventional systems, they should do so for quantum systems. Ownership of the ability to validate is almost more important than ownership of the hardware itself.

One might ask: given the complexity of quantum devices, is it realistic for every country to have such sovereign capability? Smaller states may not develop full in-house expertise on, say, the physics of cold atoms. Here, the concept of “sovereign optionality” comes into play. Rather than full independence, it’s about ensuring you have options and avoiding single points of dependency. This could mean partnering with allied countries to share testing facilities or exchange experts. It could mean adopting open standards so that if one vendor fails you, another’s component can be slotted in with minimal disruption. It definitely means having a Plan B: if supplier X can no longer provide replacement parts, do you have a second source or can you produce a basic substitute domestically? For instance, you might not make the best laser chips nationally, but you maintain a modest capability to manufacture or repurpose lasers in a pinch, just to keep systems running. Sovereignty in this sense is measured by how agile and self-sufficient you can be when geopolitics or war cuts off normal supply lines.

Finally, sovereign capability in quantum sensing implies a national framework for certification and standards tailored to contested environments. It’s not enough for a device to work in the lab; a sovereign military needs to know it will work in the Arctic cold, in the desert heat, after being shipped over rough terrain, and under enemy attempts to disrupt it. Establishing those environmental and adversarial testing standards – and validating devices against them – should be part of the procurement cycle. For example, certifying a “quantum GPS” for an aircraft might involve testing it in RF-jammed chambers and magnetic anomaly simulators, ensuring it truly cannot be spoofed or jammed as advertised. This capability to certify ruggedness and resilience is something that cannot be outsourced if one wants true confidence. The nations that get this right will have fielded systems that they trust even under duress, which is the ultimate aim of sovereignty: you control your tech, and by extension, your destiny in crisis.

Procurement and Assurance Checklist for Quantum Sensing/Nav Tech

To operationalize the above principles, governments and organizations can apply a checklist when developing or acquiring quantum sensing and navigation systems. This ensures that sovereignty and resilience considerations are built in from day one:

- Calibration and Standards: Can the quantum sensor be calibrated against known references domestically? Ensure you have access to calibration procedures and, if needed, reference devices (e.g. a conventional gravimeter or atomic clock) to verify the sensor’s readings. A sovereign user should not rely solely on the manufacturer’s word – independent calibration capability is a must for trust in performance.

- Anti-Jamming and Spoofing Resilience: Has the system been tested in GPS-denied or electronically contested environments? For navigation units, confirm they truly operate without external signals and are immune to RF jamming. For sensing devices like radar or magnetometers, evaluate them against likely countermeasures (jamming signals, decoy targets) and certify their performance. Design procurement trials that include adversarial scenarios to validate robustness.

- Environmental and Field Hardening: Verify the Size, Weight, and Power (SWaP) requirements and environmental limits of the system. Can it run on battery or onboard power? Does it require cryogenics or vacuum maintenance, and if so, how will that be handled in the field? Ensure the device has been ruggedized for shock, vibration, temperature extremes, and other battlefield or harsh field conditions. Sovereign deployment means the tech is reliable outside pristine lab settings.

- Supply Chain and Spares: Map out the critical components (lasers, vacuum pumps, specialty chips, etc.) and their origins. Wherever possible, secure multiple suppliers or domestic stockpiles for these parts. Procurement contracts should require a plan for long-term support: availability of spare parts, or technology transfer agreements to produce spares domestically if needed. Don’t let a single foreign supplier of a tiny component become your Achilles’ heel.

- Local Maintenance and Training: Include a training package and technical documentation with any acquisition. Ensure that a cadre of local engineers or technicians is trained to operate, service, and repair the system without foreign assistance. This might involve sending teams to the vendor for hands-on training or hiring domestic quantum experts. The goal is that routine upkeep and troubleshooting can be done in-country, and that you retain the “intellectual ownership” of the equipment.

- Integration and Interoperability: Confirm that the quantum sensor can integrate with your existing systems and networks. This means standard data interfaces, compatibility with your software platforms, and no dependency on proprietary foreign cloud services or continuous remote calibration updates. For navigation, ensure the quantum unit can feed into your inertial navigation or vehicle control systems seamlessly. Require open or well-documented interfaces so that you can modify or upgrade parts of the system down the line without needing the original vendor.

- Independent Verification and Red-Teaming: Before full deployment, have an independent test lab or “red team” evaluate the system. This team should attempt to hack, trick, or stress the sensor in ways an adversary might – for example, attempting to introduce subtle magnetic noise to foil a magnetometer, or analyzing the output data for any anomalous patterns. They should also inspect the hardware for supply chain tampering (extra modules or unexplained components on the circuit boards) and the software/firmware for hidden backdoors. Only after passing independent checks should the device be certified for mission use.

- Flexibility and Exit Strategy: Finally, build clauses into procurement contracts that support sovereign optionality. This includes requiring escrow of critical source code or technical drawings, so that if the vendor relationship breaks down you can sustain the system. It also means avoiding lock-in: favor designs that use modular components which could be swapped out for equivalents from another supplier in a pinch. By planning an exit strategy (e.g. having a secondary supplier or a domestic development program as backup), you ensure that your quantum sensing capability cannot be taken away by external decision or supply disruption.

By following this checklist, nations and organizations can approach quantum sensing and navigation technologies with eyes open to the sovereignty implications. The promise of quantum PNT and sensing is immense – from giving militaries an edge in denied environments to fueling new high-tech industries – but realizing that promise sustainably requires careful attention to trust, verification, and self-reliance. In the quantum era, physical advantage and sovereignty will belong to those who not only harness new physics, but also master the ecosystem needed to deploy and maintain it on their own terms.

Quantum Upside & Quantum Risk - Handled

My company - Applied Quantum - helps governments, enterprises, and investors prepare for both the upside and the risk of quantum technologies. We deliver concise board and investor briefings; demystify quantum computing, sensing, and communications; craft national and corporate strategies to capture advantage; and turn plans into delivery. We help you mitigate the quantum risk by executing crypto‑inventory, crypto‑agility implementation, PQC migration, and broader defenses against the quantum threat. We run vendor due diligence, proof‑of‑value pilots, standards and policy alignment, workforce training, and procurement support, then oversee implementation across your organization. Contact me if you want help.