Quantum Technology Initiatives in Singapore and ASEAN

Table of Contents

Historical Context of Quantum Research in ASEAN

ASEAN’s journey in quantum technology is relatively recent but steadily gaining momentum. Singapore took the lead in the early 2000s – the National Research Foundation began funding quantum research as early as 2002, and by 2007 the government helped establish the Centre for Quantum Technologies (CQT) at the National University of Singapore. CQT was a milestone for the region, bringing together physicists, computer scientists, and engineers to explore quantum physics and build prototype quantum devices. Over the subsequent decade, CQT’s researchers published around 2,000 scientific papers and trained more than 60 PhD students, seeding a generation of quantum scientists in Southeast Asia. This early start positioned Singapore as the region’s quantum research hub. Other ASEAN members followed in the 2010s: research groups and academic programs in Malaysia, Thailand, and Indonesia began exploring quantum information science, albeit on a smaller scale. For example, Malaysian researchers formed the Malaysia Quantum Information Initiative (MyQI) community to raise awareness and collaborate nationally, while in Thailand a Quantum Technology Roadmap 2020–2029 was drawn up to guide R&D in quantum computing, communications, and sensing. By the early 2020s, these foundational efforts coalesced into national initiatives, signaling ASEAN’s intent to catch the “second quantum revolution.” In 2022, Indonesia’s government created a dedicated Research Center for Quantum Physics under its National Research and Innovation Agency (BRIN), aiming to build local expertise in fundamental quantum science and future technologies. And in 2024, Malaysia launched its first quantum computing facility through an international partnership, marking a significant step toward developing a homegrown quantum ecosystem. While ASEAN’s quantum efforts began later than those in the US, EU, or China, this historical progression – from Singapore’s early investments to the recent region-wide initiatives – has laid the groundwork for the current state of quantum technology development in Southeast Asia.

Quantum Computing Advancements in ASEAN

Government Strategies and National Initiatives

Several ASEAN governments have now outlined strategies to advance quantum computing and allied technologies. Singapore leads with a comprehensive national effort. In 2021–2023, it announced a National Quantum Strategy (NQS) backed by nearly S$300 million (~US$219 million) in new funding. This investment builds on an initial S$400 million that Singapore’s National Research Foundation had already poured into quantum R&D since 2002. The National Quantum Strategy focuses on four pillars: scientific excellence, engineering capabilities, talent development, and innovation & industry partnerships. Concretely, it elevates CQT into a flagship national R&D center and establishes “nodes” at A*STAR, NUS, NTU and other universities to coordinate research across the country. Singapore is also expanding its Quantum Engineering Programme (QEP) – a multi-institution effort launched in 2018 – into a third phase (QEP 3.0) to drive engineering of quantum devices. Under QEP 3.0, new national programs are being created, such as a National Quantum Sensor Programme focusing on positioning, navigation, timing and other sensing applications, and a National Quantum Processor Initiative to spur local development of quantum processors using different qubit technologies (trapped ions, neutral atoms, photonics, etc.) These augment existing platforms like the National Quantum Computing Hub (NQCH), National Quantum Fabless Foundry (NQFF), and National Quantum Safe Network (NQSN), which continue to be funded and expanded in partnership with industry. In short, Singapore’s government strategy is highly structured – it seeks to solidify the city-state as a “premier hub” for quantum technology by investing in R&D infrastructure and human capital over the next five years.

Malaysia, recognizing the strategic importance of quantum tech, has also taken initial steps toward a national program. In late 2024, Malaysia’s Ministry of Science, Technology and Innovation (MOSTI) supported the launch of the country’s first Quantum Computing Centre through a partnership between the national applied R&D agency MIMOS and South Korea’s quantum company SDT Inc. This government-led center is intended as a nucleus for quantum computing R&D, with a focus on priority areas like cybersecurity, AI, and biotechnology. The collaboration brings together key Malaysian stakeholders – including the National Cyber Security Agency (NACSA), MyQI (the Malaysian Quantum Initiative community), MOSTI itself, and the Ministry of Defence – signaling a coordinated effort to integrate quantum tech into critical sectors. While Malaysia does not yet have a fully funded “national quantum strategy” akin to Singapore’s, thought leaders in the country are calling for one. As of 2022, Malaysia was notably absent from the map of 46 countries with systematic quantum tech programs. This is changing gradually: government officials and experts have urged the formulation of a National Quantum Technology roadmap to ensure Malaysia isn’t left behind. The MyQuantum or MyQI initiative – a grassroots coalition of Malaysian academics – has been raising awareness and advising government agencies to kickstart quantum R&D. According to MyQI members, Malaysia still faces a significant talent and infrastructure gap (“10 to 20 years behind” leading nations in quantum capability), but recent moves like the MIMOS-SDT center and increased funding for quantum projects indicate the country is beginning to close that gap.

Thailand has been proactive in defining a national direction for quantum technologies. The Thai government, through its Ministry of Higher Education, Science, Research and Innovation (MHESI), published a Quantum Technology Roadmap 2020–2029 to guide development in three focus areas: quantum computing & simulation, quantum communication, and quantum metrology & sensing. Dedicated government funding has been allocated to quantum R&D, and Thailand has assembled a network of universities and research institutes to execute this roadmap. A major program known as the “Establishment of Integrated Ecosystem for Quantum Technology Research in Thailand” (funded by the PMU-B grant agency) was launched, bringing together five teams across the country to build core capabilities. Notably, Suranaree University of Technology leads work on quantum sensing, Prince of Songkla University leads quantum communication research, Chulalongkorn University focuses on theoretical quantum computing, and Chiang Mai University on experimental quantum simulation. Meanwhile, the National Institute of Metrology Thailand (NIMT) spearheads quantum metrology efforts (e.g. developing an optical atomic clock) as part of this multi-team program. These coordinated projects, supported by Thai government funding and global partnerships, aim to bootstrap an indigenous quantum tech ecosystem. Thai officials see an opportunity to “catch up” in this emerging field by leveraging the country’s pool of young scientists trained abroad and by fostering international collaborations. The strategic intent is for Thailand to become a regional leader in certain quantum domains – for instance, by building national quantum communication networks and advanced sensing capabilities by the end of the decade.

Indonesia has similarly recognized quantum technology in its national science agenda, especially in the context of the fourth industrial revolution. In 2022, Indonesia established the BRIN Research Center for Quantum Physics, a dedicated unit under the National Research and Innovation Agency (BRIN). This center’s mission is to explore fundamental quantum science and build capacity for future technologies, aligning with Indonesia’s vision of reaching a “golden era” by 2045. BRIN’s quantum center has already formed seven research groups, covering theoretical and experimental high-energy physics as well as quantum information, computation, simulation, and devices. As of August 2024 it employs 35 full-time researchers (plus postdocs and research assistants), indicating a significant and growing talent base. Indonesia is currently focusing on foundational research and education: for example, Institut Teknologi Sepuluh Nopember (ITS) in Surabaya launched the country’s first academic Quantum Computing and Information Group in 2022 to train students and collaborate on quantum algorithms. On the policy side, Indonesian authorities are increasingly aware of quantum computing’s security implications. Government advisors have noted that quantum computers could “threaten to breach [Indonesia’s] most sensitive data” much sooner than anticipated, urging the nation to prepare by adopting quantum-resistant encryption and developing local expertise. While Indonesia’s quantum initiative is still in early stages, these steps – establishing BRIN’s research center, university programs, and discussions on quantum security – reflect a commitment to participate in the quantum era.

Beyond these four countries, other ASEAN members are in nascent stages of quantum tech engagement. Vietnam has signaled interest through international partnerships (for instance, exploring collaboration with Russia’s Rosatom on quantum R&D ) and includes quantum computing in its digital transformation and education strategies. Singapore’s early start and continued leadership have in many ways catalyzed the broader region – Singapore’s success has provided a model that neighboring countries now aspire to adapt. In summary, ASEAN governments are moving from initial curiosity to concrete action in quantum computing. Singapore’s well-funded national strategy stands at the forefront, with Thailand, Malaysia, and Indonesia ramping up their own initiatives in the form of roadmaps, centers, and international collaborations. These efforts underscore a growing understanding in ASEAN that quantum computing and allied technologies will be strategically important for economic competitiveness and security in the years ahead.

Leading Research Institutions and Programs

ASEAN’s quantum advancements are driven by a network of leading research institutions, many of which have become hubs of expertise in their respective countries. In Singapore, the flagship is the Centre for Quantum Technologies (CQT) at NUS. Founded in 2007 as one of Singapore’s Research Centres of Excellence, CQT has been the engine of quantum research in ASEAN. It conducts cutting-edge work in quantum computing, quantum communication, and quantum theory, and has produced significant outputs (thousands of publications and dozens of PhD graduates) over the past 15+ years. CQT’s success and accumulated expertise underpin much of Singapore’s current initiatives – for example, CQT researchers are heavily involved in the National Quantum Computing Hub and the National Quantum Safe Network projects. Additionally, CQT has incubated startup companies (spin-offs) in quantum technology, demonstrating tech transfer from lab to industry (more on this in the next section). Aside from CQT, Singapore’s Nanyang Technological University (NTU) also hosts notable quantum research. NTU collaborates with NUS under the Quantum Engineering Programme and has strengths in quantum materials and hardware. In 2024, NTU and NUS researchers jointly spun off a new deep-tech startup, AQSolotl, to commercialise a homegrown quantum control system (the “Chronos-Q” quantum controller). This controller, developed over three years by teams at NTU and CQT, serves as an interface to operate quantum processors, and is being piloted as part of Singapore’s National Quantum Computing Hub hardware setup. Such developments highlight the synergy between Singapore’s research institutions – CQT, NTU’s quantum labs, and others at A*STAR – and their role in building a quantum ecosystem.

In Malaysia, quantum research is more decentralized but growing through collaborative networks. Several universities have active research groups in quantum information and photonics. For instance, Universiti Malaya, Universiti Teknologi Malaysia (UTM), and Universiti Putra Malaysia have faculty working on quantum algorithms, cryptography, and photonic qubits. The Malaysia Quantum Information Initiative (MyQI) serves as an umbrella community for these researchers MyQI is a volunteer coalition spanning multiple universities, aimed at consolidating efforts and acting as a reference point for government and industry on quantum matters. They organize talks, workshops, and outreach to raise awareness nationally. Importantly, MyQI has also been liaising with regional partners – it is working with counterparts in Singapore, Thailand, etc., to form an ASEAN Quantum Network for knowledge exchange. Within Malaysia’s government research apparatus, MIMOS (the Malaysian Institute of Microelectronic Systems) has taken on a leading role. MIMOS, known for electronics R&D, now hosts a nascent quantum research team and, in collaboration with universities, will operate the new Quantum Computing Centre. The Centre for Artificial Intelligence and Technology (CAIT) at UTM and other university labs also contribute, often through theoretical research or simulations given Malaysia does not yet possess advanced quantum hardware. While Malaysia’s institutional capacity is still developing, the combination of academic initiative (MyQI) and agency-driven projects (MIMOS’s center) is moving the country towards a more cohesive quantum research environment.

Thailand’s quantum research is characterized by strong roles for both academic institutions and national labs. As noted, the Thai government’s integrated quantum research program involves multiple universities:

- Suranaree University of Technology (SUT) – hosts the Quantum Technology Research Initiative (QTRic) and leads projects in quantum sensing. SUT has established collaborations among faculty to pursue quantum device research and education.

- Chulalongkorn University – one of Thailand’s top universities, focusing on quantum computing theory under the national program. Chula’s physics department has research groups in quantum information theory and quantum optics.

- Chiang Mai University – leading experimental quantum simulation research (e.g., cold atom simulation experiments).

- Prince of Songkla University (PSU) – taking charge of quantum communication research, which likely includes quantum key distribution protocol experiments.

Meanwhile, NIMT (National Institute of Metrology Thailand) is driving quantum metrology. NIMT’s effort to construct an optical lattice atomic clock is a flagship project to develop ultra-precise time standards domestically. By controlling individual Ytterbium atoms, NIMT researchers have built key components of this clock – a notable achievement that reflects six years of sustained research and inter-agency collaboration. The “integrated ecosystem” project has effectively created a distributed national quantum lab across these institutions, each building core expertise. This is complemented by events like Siam Quantum – Thailand’s first international quantum science conference in 2024 – which help connect Thai researchers with global peers. The breadth of involvement (from Bangkok to regional universities) and the coordination via a national roadmap illustrate how Thailand’s institutions are collectively advancing the quantum agenda.

Indonesia’s primary quantum research organ is the BRIN Research Center for Quantum Physics in Puspiptek (the national science complex). This center has organized its teams into focused groups such as a Quantum Information and Computation Research Group and a Quantum Simulation Research Group, which concentrate on algorithm development and quantum simulation of materials respectively. On the academic side, Indonesian universities are building capacity: ITS (Surabaya) launched a dedicated quantum computing group in 2022, and Institut Teknologi Bandung (ITB) and Universitas Indonesia have faculty researching quantum optics and cryptography. Indonesia’s approach is strongly oriented towards training – BRIN’s center works closely with the National Talent Management program to recruit and train young scientists. International cooperation is also a part of the institutional strategy. For example, BRIN has partnered with the ICTP (International Centre for Theoretical Physics) to strengthen scientific capacity in quantum fields. These institutional efforts aim to ensure Indonesia has a home-grown knowledge base to tap into the second quantum revolution by 2045.

Across ASEAN, it’s clear that Singapore’s CQT remains the flagship research institution, but a constellation of other centers and universities are emerging as regional leaders in various subfields. Collaborative networks – both formal (like Thailand’s multi-university program) and informal (like the ASEAN Quantum Network community) – knit these institutions together. This is critical for smaller countries: by sharing expertise and resources, ASEAN research groups can tackle ambitious projects that single institutions might struggle with alone. As quantum technology development requires interdisciplinary talent and often expensive infrastructure, these institutional collaborations (e.g. Singapore partnering with universities abroad, Thai universities pooling resources, Malaysian researchers teaming up with foreign companies) are helping ASEAN punch above its weight in global quantum research.

Private-Sector Developments and Industry Partnerships

While much of ASEAN’s quantum push originates in academia and government, the private sector is increasingly playing a role – through startups, industry research collaborations, and international partnerships. In Singapore, a small but vibrant cluster of quantum technology startups has formed in recent years, often founded by alumni of CQT and local universities. Examples include:

Horizon Quantum Computing – a Singapore-based startup developing software tools to simplify quantum algorithm design and optimize code for quantum hardware. Horizon raised significant venture funding and exemplifies the entrepreneurial spin-offs from Singapore’s research ecosystem.

Entropica Labs – a quantum software startup (recently acquired by an international firm) that originated in Singapore, focusing on quantum algorithms for optimization and life sciences. Entropica’s team worked closely with IBM Q and other platforms, and their success attracted venture investments to the region’s quantum sector.

SpeQtral – a notable Singaporean startup specializing in quantum communication. SpeQtral is a spin-off from CQT, aiming to build secure quantum networks via satellites. It has already demonstrated technology in space: in 2019, a team from CQT launched the SpooQy-1 CubeSat, which successfully generated and detected entangled photon pairs in orbit. This made Singapore one of the first in the world to achieve quantum entanglement in a nanosatellite, showcasing local innovation in quantum communications.

Atomionics – a Singapore startup working on quantum sensors (e.g. atom-interferometry based devices) for navigation and resource exploration. Atomionics represents the foray of private players into quantum sensing, developing commercial instruments that leverage quantum effects for ultra-precise measurements.

Applied Quantum – is another Singapore-based startup that focuses on bridging academic quantum research with real-world applications, particularly for enterprise and government use-cases. Founded by me, it takes a practical approach to deploying quantum algorithms and architectures—whether for optimization, simulation, or secure communications. Under its specialized division, Secure Quantum, the company zeroes in on quantum-safe cryptography and secure networks, helping clients future-proof their infrastructure against the cryptographic challenges posed by large-scale quantum computers. This two-pronged structure—Applied Quantum for broad quantum solutions and Secure Quantum for security-specific deployments—aligns with Singapore’s emphasis on both innovation and trustworthy, robust implementations in the fast-evolving quantum landscape.

The Singapore government encourages such startups through incubators and grants. In fact, part of the National Quantum Strategy’s Innovation and Enterprise pillar is to strengthen the quantum startup ecosystem by funding prototype development and facilitating industry collaborations. One example of tech transfer is the earlier mentioned AQSolotl startup: founded by NTU and NUS researchers in 2024, it is selling a quantum control hardware (CHRONOS-Q) that was developed with public research funding. This startup’s leadership interestingly includes a Malaysian researcher and CQT affiliates, highlighting cross-border talent flow in ASEAN’s quantum industry.

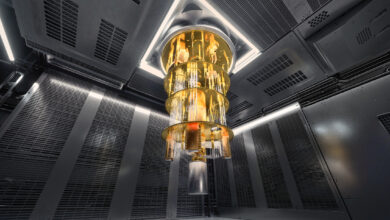

Beyond startups, government–industry collaborations are a key part of ASEAN’s strategy to build quantum capabilities. Singapore again leads: its agencies have signed agreements with major global quantum companies to access cutting-edge technology. In 2023, Singapore’s National Quantum Office, together with NUS, A*STAR, and the National Supercomputing Centre (NSCC), inked an MoU with Quantinuum (the U.S.-UK quantum computing firm) to provide Singaporean researchers access to Quantinuum’s advanced quantum computers. This gives scientists and students in Singapore hands-on experience with high-end quantum processors, accelerating use-case development in areas like chemistry and optimization. Likewise, as early as 2020, IBM partnered with the National University of Singapore under the Quantum Engineering Programme to offer cloud access to IBM Quantum systems. NUS became the first Southeast Asian institution in the IBM Quantum Network, which meant local researchers could experiment on IBM’s 50-qubit-class machines and collaborate with IBM experts. These partnerships are mutually beneficial: Singapore builds local expertise and tackles practical problems on real quantum hardware, while companies like IBM gain a presence in ASEAN’s tech hub. Another collaboration is between Singapore’s QEP and Thales (the French aerospace/defense firm) to develop quantum technologies for industry use, such as quantum sensors for aviation – reflecting a drive to co-create solutions with established industry players.

Other ASEAN nations are also pursuing industry engagement. In Malaysia, the strategic partnership with SDT Inc. of South Korea to establish the quantum computing center is a prime example of international industry collaboration. SDT, a “full-stack” quantum company, is bringing in its expertise in quantum computing and communication to jump-start Malaysia’s capabilities. This collaboration includes knowledge transfer in areas like ultra-precision electronics and quantum network security. It’s notable that Malaysia involved not just tech companies but also end-user stakeholders (like NACSA for cybersecurity and major banks for financial use-cases) in this initiative, indicating an intent to align R&D with real-world applications from the outset. In Thailand, a homegrown startup called Quantum Technology Foundation (Thailand) [QTFT] has emerged, focusing on quantum software services in Bangkok. QTFT is helping corporations explore quantum optimization solutions, effectively acting as a bridge between academic algorithms and business problems. The Thai government’s funding programs also encourage public-private projects; for instance, we may soon see Thai telecom companies or banks working with local universities on quantum cryptography trials, analogous to Singapore’s approach.

In Indonesia, the private quantum sector is still embryonic. However, big tech companies have begun outreach: for example, Microsoft has engaged with Indonesia’s “Making Indonesia 4.0” initiative, highlighting how quantum advancements (like Microsoft’s quantum hardware research) could benefit future Indonesian industries. We can expect similar moves where global quantum firms form partnerships or training programs in Indonesia and Vietnam as those countries’ interest grows.

International partnerships extend beyond corporate agreements – ASEAN institutions actively collaborate in global research projects. Singapore’s CQT has long-standing ties with US and European labs, and is part of the U.S. White House’s Quantum Network Expansion initiative to link quantum testbeds internationally. Malaysia’s researchers often collaborate with groups in Japan, Australia, and Europe on quantum theory. The Philippines and Vietnam, though quieter in this domain, send students and scientists to train abroad in quantum science, many of whom may return to kickstart local research. Additionally, Russia’s state-backed Rosatom has expressed interest in working with Vietnam on quantum R&D as part of broader tech cooperation, showing ASEAN’s appeal as a partner for larger powers aiming to extend their quantum ecosystem.

In summary, the private-sector landscape for quantum in ASEAN is small but growing, centered in Singapore and slowly radiating outwards. ASEAN startups are tackling niches from quantum software to sensing, often supported by government seed funding. Collaborations with tech giants (IBM, Quantinuum, etc.) and foreign partners bring in valuable technology and training. Government-industry consortia, like Singapore’s financial sector QKD trials or Malaysia’s SDT-MIMOS center, ensure that quantum research is tied to practical needs (finance, cybersecurity, etc.). This collaborative, partnership-driven model reflects ASEAN’s pragmatic approach: rather than attempt everything in isolation, the region is leveraging global expertise and market mechanisms to accelerate its quantum journey.

Quantum Communications and Cryptography in ASEAN

Quantum communication and cryptography are areas where ASEAN countries see both opportunities and security imperatives. The ability to transmit information with quantum-level security – immune to conventional eavesdropping and safe against future quantum code-breaking – is particularly attractive to finance and government sectors in this region. As a result, significant effort is being devoted to Quantum Key Distribution (QKD) testbeds and quantum-safe cryptography initiatives.

Singapore has been at the forefront of quantum communications in ASEAN. It has built a nationwide quantum communication test network under the National Quantum Safe Network (NQSN) program. Launched in 2022, NQSN connects government agencies, research labs, and commercial entities in Singapore via secure fiber-optic QKD links and also trial implementations of post-quantum cryptography. In August 2024, the Monetary Authority of Singapore (MAS – the central bank) took a major step by bringing together the financial industry to pilot QKD for banking networks. MAS, along with Singapore’s biggest banks (DBS, OCBC, UOB, and the local branches of HSBC) and telecom partners, signed an MoU to conduct quantum security trials using QKD in financial services. This initiative will test how QKD can protect inter-bank communications and key exchanges, addressing the looming threat that quantum computing poses to classical encryption. The trials, conducted with hardware from SpeQtral and network operator SPTel, aim to evaluate QKD’s performance in real operational environments and train bank IT teams in deploying quantum-safe solutions. It builds on MAS’s earlier advisory (Feb 2024) that urged financial institutions to start preparing for quantum risks and to experiment with quantum-safe technologies. In parallel, Singapore has pursued satellite-based quantum communication. The SpooQy-1 CubeSat experiment mentioned earlier was a pathfinder: it demonstrated that a compact (~2.6 kg) satellite can generate entangled photons in orbit. Data from SpooQy-1, which orbited at 400 km altitude, confirmed the creation of entangled quantum signals suitable for QKD. Building on this, the Singaporean startup SpeQtral, in collaboration with international partners, is developing a full-fledged quantum satellite mission to distribute secure keys over wide distances. Such projects indicate ASEAN’s ambition to be part of the global race for a quantum internet – a future network of quantum-linked nodes and satellites enabling ultra-secure communications.

In terms of quantum-resistant cryptography, ASEAN countries are also beginning to adapt their cybersecurity policies. Post-quantum cryptographic (PQC) algorithms – classical algorithms designed to resist decryption by quantum computers – are being studied and standardized worldwide. Singapore’s cybersecurity agencies and financial regulators are very cognizant of this; MAS’s quantum advisory explicitly recommended banks to start trialing both QKD and PQC solutions. The aim is a dual-pronged quantum-safe strategy: implement near-term measures like QKD for especially sensitive links, while transitioning general encryption infrastructure to PQC algorithms (which can run on today’s classical networks). Singapore’s Infocomm Media Development Authority (IMDA) and Cyber Security Agency (CSA) have funded research into PQC, and some trials of PQC-based VPNs are underway in government networks. In Malaysia, awareness of quantum-safe cryptography is growing as well. NACSA (the National Cyber Security Agency) has begun studying the impact of quantum computing on Malaysia’s critical information infrastructure. Security experts in Malaysia note that a “harvest now, decrypt later” threat exists – adversaries could record encrypted Malaysian data now and decrypt it in the future when quantum computers are available. Thus, there is an urgency to deploy PQC in government and finance. We are likely to see Malaysia’s central bank and other regulators follow Singapore’s lead in issuing guidelines for quantum-safe practices.

Quantum Key Distribution (QKD) research is active in several ASEAN nations. Aside from Singapore’s live testbeds, Thailand’s quantum communication team (at Prince of Songkla University) is working on QKD protocols and quantum repeaters in the lab. Under the Thai quantum program, this team’s goal is to develop a domestic QKD system and integrate it with existing fiber networks. Thailand’s long-term roadmap envisions a Thai quantum network linking government facilities – a vision similar to NQSN – by leveraging both fiber QKD and free-space optical links. Vietnam and Indonesia do not yet have operational QKD networks, but academic interest exists. In Vietnam, some university projects (with international partners) have studied free-space quantum communication across short distances, laying groundwork for future secure links. In Indonesia, BRIN’s Quantum Physics Center includes a Quantum Devices & Technology Group which is exploring photonic quantum communication hardware. Moreover, Indonesia’s cybersecurity experts, as noted in the Jakarta Post, are concerned about securing communications “in a quantum future” and thus likely to invest in technologies like QKD or PQC for national defense and finance.

On the diplomatic front, ASEAN is also engaging in government-backed quantum security projects through partnerships. Singapore and Japan, for example, have held joint demonstrations of QKD between servers to test interoperability of Japanese QKD equipment in Singapore’s network. Additionally, companies like Toshiba have been working with Singaporean entities to deploy their QKD systems in the local telecom infrastructure, aligning with the country’s aspiration to be a “quantum-safe” digital hub. Meanwhile, Malaysia’s inclusion of its defence ministry (MOD) in quantum initiatives hints at potential projects for secure military communications using quantum technology. Defense applications (like secure battlefield communication links that cannot be cracked) are a natural extension once QKD is proven reliable in civilian networks.

In summary, ASEAN’s efforts in quantum communications and cryptography are robust and multifaceted. Singapore is operating at a near-deployment level – running QKD trials in the financial sector, building quantum-safe networks, and even launching quantum communication satellites. Other countries are in earlier R&D phases but recognize quantum-secure communication as a national priority (to protect government and banking data, for instance). Across the region, there’s growing alignment with global moves to implement quantum-proof encryption. As quantum computing advances, ASEAN wants to ensure that its information remains secure – and so investments in QKD infrastructure and PQC adoption will likely accelerate. The collaborative trials (banks with tech startups, cross-country experiments) demonstrate ASEAN’s practical approach: test these quantum cryptographic solutions now, develop local expertise, and be ready well before large quantum computers come online that could threaten classical encryption.

Quantum Sensing and Metrology Developments in ASEAN

Quantum sensing and metrology – using quantum phenomena to measure physical parameters with unprecedented precision – form another crucial pillar of ASEAN’s quantum technology endeavors. Southeast Asian nations are exploring quantum sensors for applications in navigation, defense, geophysics, and fundamental science, recognizing that these technologies can yield near-term benefits (often sooner than general-purpose quantum computers).

Singapore has made quantum sensing a priority area under its National Quantum Strategy. As part of QEP 3.0, it established a National Quantum Sensor Programme (NQSP) dedicated to developing sensors for strategic domains. These include position, navigation and timing (PNT) sensors that could enable navigation without GPS, highly accurate atomic clocks, as well as quantum devices for biological sensing and imaging. For example, one goal is to build portable atomic interferometry devices that can serve as navigation units for ships or aircraft, maintaining precise position even if GPS signals are lost (which has defense and aerospace implications). Singapore’s research teams (at CQT, NUS, NTU) are also working on quantum magnetometers and optical magnetencephalography tools that could improve medical diagnostics. In fact, the QEP’s earlier phase funded projects on “quantum sensors for environment and navigation” – such as developing a cold-atom interferometer to detect minute changes in gravity (useful for underground prospecting) and an NV-diamond based magnetometer for detecting tiny magnetic fields. These projects, now bolstered by the NQSP, aim to translate to industry prototypes in collaboration with companies in the aerospace, electronics, and healthcare sectors. Singapore’s approach is very use-case driven: research teams work closely with agencies like DSO (the defense R&D organization) and DSTA (Defense Science & Tech Agency) for navigation and timing applications, and with biomedical institutes for imaging applications. By funding quantum sensing, Singapore hopes to leverage quantum technologies for industrial growth in areas such as precision navigation (critical for autonomous vehicles and defense), mineral exploration (through quantum gravimetry), and healthcare (through advanced imaging).

Thailand has achieved notable progress in quantum metrology, which underpins advanced sensing. The development of an optical atomic clock by NIMT is a standout project. Over years of research, Thai scientists managed to trap and cool individual Ytterbium atoms and control their quantum states – the core of a clock that can oscillate with extremely stable frequency. This optical clock, once fully realized, will serve as a new national time standard with far higher precision than existing cesium clocks, benefiting GPS timing and telecommunications synchronization. The atomic clock project is part of Thailand’s integrated quantum program and has yielded spin-off technologies and know-how in laser stabilization, vacuum systems, and quantum control. Those by-products are being repurposed for other metrological tools, strengthening Thailand’s measurement science capabilities for industry. Additionally, Thai research teams at SUT are working on quantum sensors for various applications – one focus is quantum optical sensors that can detect minute changes in environmental conditions or in biological samples. Another area is quantum-enhanced interferometry for detecting gravitational fluctuations or seismic vibrations (potentially useful in oil & gas exploration or earthquake monitoring). Thai scientists acknowledge that quantum sensing and metrology is an area where “quantum technology is already making an impact” and providing real-world utility. For instance, as Dr. Yap (a Malaysian researcher collaborating in Singapore and Malaysia) pointed out, atomic clocks (quantum devices) are integral to GPS – without them, the GPS system would not function. This underscores that quantum sensors are not just theoretical: they are operational in today’s critical systems, and ASEAN projects aim to build on these successes.

Malaysia and Indonesia are also interested in quantum sensing, though their efforts are at an earlier stage compared to Singapore and Thailand. Malaysia’s nascent quantum programs have identified sensing as one possible niche. Under MyQI’s advocacy, there have been discussions on developing quantum gravimeters that could help Malaysia’s oil and mineral industries by detecting density anomalies underground (a faster, possibly more cost-effective way to survey for resources). Some Malaysian universities have experimental quantum optics labs which could be adapted to sensing experiments – for example, Universiti Malaya has done work on laser-cooled atoms and could explore atomic magnetometers. Furthermore, the inclusion of “biological sensing and imaging” in Singapore’s NQSP is likely to benefit the wider region, as any breakthroughs (like a quantum-enhanced MRI technique or a single-photon microscope for medical diagnostics) could be shared with or implemented by ASEAN neighbors. Indonesia, via BRIN’s Quantum Devices group, is investigating quantum material sensors – such as using two-dimensional quantum materials to detect electromagnetic fields or chemical changes at very low concentrations. While these are still research topics, the practical drivers are clear: Southeast Asia’s economies could gain from quantum sensors in navigation (ensuring reliable navigation for ships in the Strait of Malacca or aircraft in remote areas), defense (submarine detection via quantum magnetometers, or secure inertial navigation for missiles and drones), environmental monitoring (ultra-sensitive detectors for climate and atmospheric gases), and precision manufacturing (quantum-level measurement standards to improve semiconductor fabrication, for instance).

Importantly, ASEAN nations view quantum metrology as enabling higher standards and competitiveness in emerging industries. For example, as Thailand integrates its optical clock, it will be able to contribute to international timekeeping and potentially support a regional GPS augmentation system – an asset for both civilian and military applications. Quantum sensors could also drive new high-tech sectors: a startup like Atomionics (in Singapore) developing quantum gyroscopes and accelerometers might create devices that Southeast Asian airlines or shipping companies adopt to improve safety and autonomy. On the scientific front, these sensors allow local researchers to do world-class science (e.g., measuring gravitational waves or tiny magnetic brain signals) without needing billion-dollar colliders or space telescopes – thus democratizing high-precision experimentation.

In summary, quantum sensing and metrology is a pillar where ASEAN can reap direct benefits. Singapore’s focused program on sensors for positioning, healthcare, and remote sensing is likely to yield prototypes in the next few years. Thailand’s work on national measurement standards via quantum devices is bringing state-of-the-art precision to the region. These developments have dual-use implications: they boost scientific research capabilities and can be turned into commercial or defense technologies. As these projects mature, ASEAN could see quantum sensors being deployed in real-world settings – from quantum clocks stabilizing telecommunications networks to quantum gravimeters surveying tropical forests for hidden tunnels or cavities. The overall approach is one of leveraging quantum tech for industrial and economic growth: by mastering quantum measurements, ASEAN countries aim to support advanced manufacturing, improve navigation and timing infrastructure, and ensure they are not just consumers but also contributors in the high-value supply chain of quantum-enabled devices.

ASEAN’s Global Position in Quantum Technology

The rise of quantum initiatives in ASEAN begs the question: where does the region stand globally in this strategic field? In terms of raw investment and technological output, ASEAN’s quantum efforts are modest compared to the heavyweights of the United States, China, and the European Union. Globally, quantum research has attracted over $44.5 billion in public and private investments as of 2025. The lion’s share of this comes from major powers – China alone has reportedly allocated at least $10–15 billion for quantum programs (including a $10B National Laboratory for Quantum Information Sciences), while the U.S. National Quantum Initiative and related defense projects are backed by billions of dollars through the Department of Energy, NSF, and DARPA. The EU has its €1 billion Quantum Flagship and additional country-level investments (Germany, France, UK each committing €2–€5 billion over the next few years). In contrast, ASEAN’s investments are on the order of hundreds of millions: for instance, Singapore’s NQS is S$300M (≈$220M) over five years, and cumulatively Singapore has invested around S$700M ($515M) in quantum research since the early 2000s. Other ASEAN countries are just beginning; their budgets are likely tens of millions at most for now (Thailand’s government funding for its quantum roadmap, Malaysia’s initial allocations via MOSTI, etc.) This disparity means ASEAN must strategically leverage its strengths to stay relevant in the face of competition.

One clear strength is focus and agility. ASEAN nations, especially Singapore, have been nimble in identifying niche areas to excel in, rather than trying to compete head-on in all aspects of quantum tech. Singapore carved out a reputation in quantum communication early on – it achieved South East Asia’s first quantum satellite experiments and established one of the first urban QKD testbeds in the world. This gives it a specialized leadership in that subfield, even as larger countries focus on building universal quantum computers. Moreover, Singapore’s relatively small but well-coordinated ecosystem allows for efficient use of resources: the NQS, by concentrating on core priorities (computing, communications, sensing, talent), ensures that funding isn’t spread too thin. The existence of unified centers like CQT also helps maintain critical mass in research. Talent is another strength. ASEAN benefits from a strong pool of internationally trained scientists, many of whom have returned home or collaborate closely with their home countries. Thai and Malaysian quantum physicists who earned PhDs in the US or Europe often maintain partnerships, effectively acting as bridges connecting ASEAN labs with global networks. This international connectivity means ASEAN researchers can participate in cutting-edge projects and tap into expertise from leading centers in Canada, Australia, Japan, etc., even if local facilities are still growing.

However, ASEAN faces notable challenges relative to the global frontrunners. The most obvious is limited scale of funding and infrastructure. Cutting-edge quantum hardware development (like building a 100+ qubit superconducting quantum computer or a pan-nation quantum internet) requires substantial capital, cleanroom facilities, and large teams – resources that places like China and the US have dedicated, but no single ASEAN nation can match at this point. Indeed, a fully indigenous national quantum computing industry exists only in a handful of countries (the US, China, Germany, France, Japan, South Korea, etc.), as Singapore’s government itself has noted. ASEAN countries will likely continue to depend on international partnerships for access to the most advanced quantum processors or specialized hardware components (e.g. photon detectors, ultra-low-temperature cryostats). Another challenge is brain drain and talent retention. As the global demand for quantum expertise heats up, ASEAN will have to compete with North America, Europe, and East Asia to attract and keep skilled quantum scientists and engineers. Singapore has been relatively successful here by offering competitive grants and roles (its Quantum Scholarships and hiring of international faculty), but smaller economies might struggle unless they provide clear career paths in quantum technology domestically.

In the global landscape, Singapore clearly stands out as ASEAN’s standard-bearer. It is often cited as one of the world’s leading emerging hubs for quantum tech deployment. Singapore’s inclusion in IBM’s Quantum Network and its ability to ink deals with top firms (Quantinuum, AWS, etc.) give it a seat at the table in global discussions. We can consider Singapore in the second tier of quantum powers – not at the level of the US/China/EU “quantum superpowers,” but comparable to advanced mid-sized players like Canada, Australia, or Israel which each have strong quantum programs and contribute significantly to the field. Malaysia, Thailand, and Indonesia are in a third tier: they are newcomers, similar to many other countries that launched quantum initiatives in the early 2020s (e.g. India, which announced a $1B quantum mission; or smaller EU states like Netherlands or Sweden focusing on niches). Malaysia and Thailand have the potential to become regional centers of excellence in certain aspects (Malaysia in quantum education and perhaps semiconductor-based quantum devices, given its electronics industry; Thailand in metrology and quantum applications for manufacturing), but they will need sustained investment and strategic planning to realize that potential. Indonesia, with its large economy and population, could leverage quantum tech as part of its digital transformation goals, but it currently lags in experience and will depend on capacity building through BRIN and university partnerships.

An important aspect of ASEAN’s global positioning is collaboration over competition. Unlike the US-China rivalry that often frames quantum tech as a race for supremacy, ASEAN’s narrative is more about cooperation and ecosystem-building. ASEAN countries frequently collaborate with multiple great powers simultaneously – for example, Singapore works with US companies and labs, participates in EU-led consortia (through academic collaborations), and also partners with China on certain projects (Chinese researchers have co-published with CQT on quantum optics research). This non-aligned, open collaboration stance can be an advantage, allowing ASEAN to serve as a bridge or neutral ground for international quantum efforts. It’s telling that Singapore’s officials emphasize that it’s “not a quantum race; it is a global ecosystem.” ASEAN’s inclusive approach means the region can host international conferences, standards discussions, and pilot projects that involve stakeholders from around the world, thereby staying plugged into global advancements.

Nevertheless, to maintain and improve its global position, ASEAN will need to address gaps. One area is quantum manufacturing and hardware fabrication. As quantum devices move from lab to fab, countries like Malaysia and Singapore – which have semiconductor fabrication infrastructure – could play a role in manufacturing components (e.g., silicon quantum chips, photonic circuits). Efforts like Singapore’s National Quantum Fabless Foundry (NQFF) hint at this, but scaling that up to compete with the likes of Intel or TSMC’s quantum efforts is a steep hill. Another area is standards and policy: ASEAN as a bloc could have more influence if it develops common stances on quantum technology governance (for instance, export controls on quantum technologies, data protection rules in a post-quantum era, etc.). Right now, these discussions are in infancy in the region, whereas the US and EU are already formulating strategies for “quantum-safe” regulatory environments.

In conclusion, ASEAN’s global position in quantum tech is that of an up-and-coming player with pockets of excellence. The region’s strengths lie in its collaborative ethos, strong talent pipeline (especially via Singapore and increasingly Thailand/Malaysia), and targeted initiatives. Challenges remain in sheer scale and resources when benchmarked against the global top players. However, by focusing on niche leadership (e.g., quantum communications security, specialized quantum sensors) and by leveraging international partnerships, ASEAN is carving out a respectable place in the global quantum ecosystem. The region is determined not to be left behind in what many consider the next revolution in technology – and if current trends continue, ASEAN will be an important contributor to, and beneficiary of, that revolution, even as the US, China, and EU drive the overall pace.

Singapore’s Role as ASEAN’s Quantum Hub and the Regional Ecosystem

Singapore’s role in ASEAN’s quantum landscape is analogous to a hub or nucleus – it is the most advanced, well-connected node from which expertise, partnerships, and even personnel radiate out to neighboring countries. Over the past two decades, Singapore methodically built a strong foundation in quantum science, and today it is reaping the benefits as the region’s leading quantum hub. A combination of factors contributes to this position: long-term investment, world-class institutions, strategic international linkages, and a measured approach to commercialization.

One of Singapore’s hallmarks is its consistent research investment. By investing early (since the 2000s) and continuously, Singapore accumulated intellectual capital that other ASEAN states are now trying to develop. For instance, the pool of quantum PhDs and seasoned researchers in Singapore (many of them drawn from around the world to CQT and NTU) is a unique asset in the region. Singapore’s government has also shown a willingness to adapt its strategy as the field evolves – moving from pure research funding in the 2000s, to engineering and applied programs in the late 2010s (with QEP), and now to an integrated National Quantum Office overseeing multi-agency efforts and industry collaboration. This measured government approach means Singapore did not rush blindly into mega-projects, but rather scaled up in stages: first ensuring strong scientific output and talent (through CQT, academic grants), then building prototype systems and testbeds (QEP’s sensors, networks, etc.), and only now beginning to push towards larger-scale prototypes like quantum processors and national networks. Observers note that while Singapore is very ambitious to be a “Global Quantum Hub,” it is also pragmatic – focusing on areas with clear comparative advantages and economic relevance. For example, instead of attempting to build a superconducting supercomputer with hundreds of qubits (which would pit it directly against Google or IBM), Singapore is exploring niche hardware like trapped ions and photonics through its NQPI, where its researchers have specific expertise and can partner with firms like Infineon or Orbis. This careful calibration reduces the risk of wasted funds and increases the chances that Singapore’s quantum ventures will produce tangible, if incremental, progress.

Another aspect of Singapore’s leadership is its role as a regional talent magnet and collaboration hub. Singapore’s universities and institutions host many researchers from Malaysia, Vietnam, Thailand, and beyond. We saw in the NTU spin-off example that a Malaysian lecturer (Dr. Yap) co-founded a Singapore-based quantum startup. This kind of cross-pollination is common – talented individuals from ASEAN are drawn to Singapore’s well-funded labs and then often collaborate with or mentor teams in their home countries. Singapore also facilitates training: through workshops, the Centre for Quantum Technologies regularly invites students from ASEAN (pre-pandemic, there were summer schools and exchange programs). By concentrating advanced facilities in one place, Singapore allows the whole region to benefit (scientists can come use equipment or work on joint experiments that would be hard to do elsewhere in Southeast Asia). In diplomacy, Singapore often represents ASEAN in global quantum forums and then shares insights back with its neighbors. For instance, Singapore’s experience in setting up a quantum safe network can inform Malaysia and Thailand as they consider similar networks in the future.

Commercially, Singapore is the base for almost all significant ASEAN quantum startups and corporate testbeds at present. This has a spillover effect: companies setting up quantum innovation offices in Singapore (like Keysight’s Quantum Lab or Google’s AI Quantum team collaboration via the Centre for Quantum Computing at Google ASEAN) can serve the wider region. The presence of these companies also means if a Thai or Indonesian institution wants to work with, say, IBM Q or AWS Braket, they often channel through Singapore connections. Singapore’s venture capital scene is beginning to support quantum ventures, which could eventually fund startups in other ASEAN nations as well (for example, a VC in Singapore might invest in a Thai quantum encryption startup if one arises, thereby integrating the ecosystems).

In short, Singapore acts as a central node linking ASEAN to the global quantum network. It has the research depth, the skilled manpower, and the policy support to lead, but it is also consciously sharing its knowledge with neighbors. That said, Singapore is aware that being the hub also means bearing a lot of the development cost upfront. The government’s measured approach to commercialization – not over-hyping near-term economic returns, and carefully evaluating where to deploy funds – reflects an understanding that quantum tech is a long game. Singapore’s leaders have publicly noted that while they are investing hundreds of millions now, the true payoff of quantum computing could be a decade or more away. This realistic yet forward-looking stance sets the tone for ASEAN’s approach: ambitious but patient.

The Emerging Quantum Ecosystem Across Southeast Asia

Beyond Singapore, the broader Southeast Asian quantum ecosystem is in a formative stage, characterized by enthusiasm, early achievements, and a spirit of collaboration. Each of the major ASEAN countries brings something to the table:

Malaysia contributes a growing community of researchers (via MyQI) and a strategic focus on quantum training. Malaysian universities are incorporating quantum computing topics into curricula (e.g., UTM and UKM offering introductory quantum information courses), aiming to produce a quantum-aware workforce. The country’s first quantum computing center at MIMOS will be a focal point for hands-on experimentation. Malaysia is also leveraging international partnerships as a cornerstone of its approach – whether it’s tapping Korean expertise for hardware, or sending students to Singapore and Japan for advanced studies. The Malaysian government’s emphasis on digital economy and sovereignty resonates in its quantum narrative: leaders like Dr. Rais Hussin have called quantum technology critical for “national security, the digital economy, and sovereignty,” indicating that once capacity builds, we may see Malaysia integrate quantum tech into its National Digital Strategy.

Thailand offers a well-structured research collaboration model. Its multi-university, multi-project program (backed by a clear 10-year roadmap) is somewhat unique – it ensures that various aspects of quantum tech progress in parallel under a national vision. Thailand’s success in advancing an optical clock and establishing quantum research teams across different regions (Bangkok, Korat, Chiang Mai, Songkla) shows how distributed development can work. The Siam Quantum conference series and the creation of organizations like QTRIC and QTFT indicate a maturing ecosystem that includes academia and startups. We can anticipate Thailand focusing on quantum applications that align with its economic strengths: for instance, precision agriculture or food security (using quantum sensors to monitor crops or food supply chains), given Thailand’s agricultural sector; or quantum-enhanced manufacturing techniques to boost its sizable electronics and automotive industries. The quantum roadmap explicitly ties into Thailand’s aim to be a regional innovation leader.

Indonesia brings scale and a future market. While its quantum program is still ramping up, Indonesia’s large economy means it could become a significant consumer of quantum technologies – for example, Indonesian banks adopting quantum-safe encryption, or its telecom sector rolling out quantum key distribution over the vast archipelago to secure communications. BRIN’s initiative ensures Indonesia won’t solely be a consumer; it is building local R&D capabilities so that by the 2030s it can contribute to innovations. Indonesia also has a vibrant tech startup scene (especially in Jakarta) and we might see quantum tech awareness spread there, with startups beginning to explore niche quantum software services or PQC tools for cybersecurity companies. Additionally, Indonesia’s strategic position between East and West could allow it to mediate collaborations (for example, hosting joint workshops involving ASEAN, China, and the US, as it often does for broader science initiatives).

Vietnam, Philippines, and others are still mostly spectators in quantum, but even they are starting to join the conversation. Vietnam’s government in 2024 mentioned quantum computing in the same breath as AI, blockchain, and IoT as frontier technologies to develop. We may see Vietnam establishing a small quantum research lab under one of its academies of science, likely with Russian or Japanese support. The Philippines has strong IT and engineering talent, and if awareness grows, their universities may launch quantum computing education programs to keep Filipino talent up-to-date (some Filipino students have already attended quantum computing summer schools abroad). Both countries could become adopters of quantum-safe communications in the future, especially if ASEAN standards or frameworks for quantum security emerge.

Crucially, the ASEAN quantum ecosystem is held together by regional cooperation mechanisms. The emerging ASEAN Quantum Community Network, as mentioned by MyQI, is an example: it’s an informal alliance of scientists in ASEAN exchanging knowledge, organizing events, and presenting a united front to attract international support. One could imagine in a few years an “ASEAN Quantum Summit” or joint projects (similar to how CERN brought European nations together for particle physics) – perhaps a regional quantum encryption network linking Singapore-Kuala Lumpur-Bangkok, or a jointly developed Southeast Asian quantum sensor for climate monitoring. Such ideas are nascent, but the foundation is being laid by these community efforts.

Another observation is that ASEAN’s quantum efforts are often complementary rather than duplicative. Singapore focuses on core tech and infrastructure; Thailand on broad-based research and specific tech like clocks; Malaysia on ecosystem building and niche applications (with emphasis on talent and outreach); Indonesia on long-term capacity and security considerations. This complementarity, if nurtured, means ASEAN as a bloc could cover the spectrum of quantum technologies together. In time, one can envision a scenario where, for example, a quantum secure communication between a Singapore bank and a Malaysian bank is enabled by a satellite partly developed in Singapore, using protocols standardized by a Thai-led working group, with hardware components manufactured in Malaysia. This kind of integrated ecosystem would amplify ASEAN’s collective strength and reduce reliance on external providers.

The broader quantum ecosystem in Southeast Asia is therefore a patchwork that is increasingly knitting together. It spans from fundamental science (quantum physics research groups in universities) to applied engineering (national programs and testbeds) to early industrial involvement (startups and trials in finance/defense). The momentum is clearly on an upward trajectory: five years ago, quantum technology was barely on the radar of most ASEAN policymakers, but today it features in national tech strategies and high-level discussions. The region has also proven capable of innovation – achieving “firsts” like SpooQy-1 in space, or building a robust quantum collaboration network within Thailand – which give it credibility on the world stage.

Conclusion and Forward Outlook

As ASEAN forges ahead in the quantum realm, the coming years are poised to bring significant developments, driven by both optimism and a clear-eyed understanding of the challenges. The initiatives underway in quantum computing, communications, cryptography, and sensing across Southeast Asia are steadily transforming the region from a follower into an active contributor in the global quantum community.

In the near future (next 2–3 years), we can expect to see concrete milestones emerge from the current programs. Singapore will likely unveil early prototypes of its own quantum processor demonstrators under the National Quantum Processor Initiative – perhaps a small trapped-ion quantum computer or a neutral-atom array developed in local labs. These wouldn’t immediately rival IBM or Google machines, but they would mark ASEAN’s entry into building quantum computing hardware, not just using others’ devices. Singapore’s National Quantum Safe Network could move from trial to initial deployment, securing links between critical government data centers and financial institutions with a mix of QKD and post-quantum encryption. We might also see the first quantum-secured cross-border communication in ASEAN: for example, a QKD-secured fiber link between Singapore and Malaysia (Johor) could be tested, leveraging the close geographical proximity, or a satellite QKD link between Singapore and an overseas site. On the corporate side, more multinational tech companies may set up quantum research collaborations in Singapore, drawn by the talent pool and government support – this could include hardware companies establishing quantum photonics fabrication in partnership with institutes like A*STAR, or consulting firms launching quantum computing incubators for ASEAN businesses.

For Malaysia, the next few years will be critical to translate plans into policy. We anticipate Malaysia formally launching a National Quantum Technology Roadmap or Strategy, possibly by 2025–2026, to coordinate efforts (the calls for such a strategy are growing louder ). This would allocate dedicated funding for quantum research (beyond the current ad-hoc project grants) and set targets for talent development and industry adoption. The MIMOS Quantum Computing Centre will start engaging local universities and companies – we can imagine hackathons or pilot projects where Malaysian students solve problems on a quantum cloud platform, or local startups working with MIMOS to incorporate quantum algorithms into fintech or logistics optimization. Malaysia’s involvement in quantum cryptography may increase too; NACSA could run trials of PQC algorithms in government VPNs or partner with telecom providers to test QKD for secure communications in the public sector.

Thailand is likely to progress from research to implementation in some areas. By the later 2020s, Thailand’s optical atomic clock should be operational and contributing to an “Asian timekeeping network,” improving regional GPS accuracy and time traceability for science and finance. The quantum communication research at PSU might culminate in a prototype QKD network in Bangkok, perhaps connecting a few government offices as a demonstration. Thailand’s education system may also adapt: seeing the quantum roadmap, Thai universities could introduce specialized quantum engineering tracks, thus enlarging the skilled workforce. And with Thailand hosting international conferences like SQST (Siam Quantum Science and Technology), the country will cement its position as a regional knowledge hub, attracting collaborations with researchers from Japan, Europe, and the US who wish to work with the Thai teams on tropical quantum labs or unique use-cases (like quantum sensors for archaeological sites in Thailand’s rich historical locales, an intriguing possibility).

Indonesia’s trajectory might involve integrating quantum readiness into its digital economy masterplan (akin to how it approached AI and Industry 4.0). In 3–5 years, Indonesia could launch a Quantum Awareness initiative for its tech industry – essentially educating its large IT workforce about quantum computing and encouraging universities to produce graduates with combined classical-quantum computing skills. We may see BRIN’s quantum center collaborating with Indonesian cybersecurity agencies to simulate quantum attack scenarios on encrypted data, leading to national guidelines on quantum-safe cryptography by the time Indonesia updates its cyber laws. Given Indonesia’s focus on 2045, much of the heavy deployment (like acquiring quantum hardware or building secure quantum communication for defense) might come later, but the preparatory steps (standards, human capital, international MOUs) will accelerate in the coming years.

Regionally, greater ASEAN coordination on quantum technology is a likely and positive outcome. ASEAN as an organization could establish a formal ASEAN Quantum Technology Working Group under its science and technology committees. This group might facilitate joint research calls – for example, an ASEAN-wide grant for a project linking labs from three or four member states on a common quantum research goal (the quantum equivalent of the CERN model but distributed). ASEAN might also engage in capacity-building programs: stronger members like Singapore and Thailand hosting trainees from Laos, Cambodia, and others, ensuring no member is completely left out of the quantum age. With external powers eager to build influence, ASEAN may be able to attract funding for regional projects (like an EU-ASEAN collaborative program on quantum internet protocols, or US-ASEAN workshops on quantum policy and ethics). Such collective approaches would boost ASEAN’s capabilities and bargaining power.

Another important aspect of the future will be commercialization pathways. Right now, the quantum “industry” in ASEAN is tiny, but as research matures, bridging the valley of death (from lab to market) becomes key. Governments might consider establishing Quantum Innovation Zones or Hubs – perhaps extensions of existing tech parks – where startups, industry, and academia co-locate to prototype quantum devices or software for real customers. Singapore will likely continue incentivizing startups and might even see a significant exit or acquisition – for instance, if one of its startups like Horizon Quantum Computing develops a valuable platform, it could get acquired by a tech giant or grow to be a major player in its own right, which would validate the local ecosystem. Success stories like that would encourage venture capital in the region to invest more boldly in quantum tech ventures. By 2030, we could foresee several ASEAN-originated quantum products or services in the market: perhaps a Southeast Asian quantum encryption appliance being sold to banks globally, or a quantum sensor device commercialized to mining companies for mineral exploration, or cloud-accessible quantum simulators hosted in Singapore for APAC clients.

In terms of scientific breakthroughs, ASEAN researchers are positioned to contribute especially in areas like quantum materials, quantum algorithms for niche problems (like traffic optimization in mega-cities), and multi-lingual quantum-safe communication protocols (relevant for a region with diverse languages and legacy systems). They will also benefit from global breakthroughs. If, as Dr. Yap speculated, we see error-corrected qubits in small numbers within this decade and a possible demonstration of true quantum advantage in about 10 years, ASEAN must be ready to harness those breakthroughs. This means staying closely involved in global research collaborations so that when a big leap (say a stable 1000-qubit error-corrected processor) becomes available, ASEAN scientists know how to use it for local problems (like climate modeling for ASEAN’s tropical climate, or large-scale optimization of ASEAN’s smart cities).

The long-term outlook (10+ years) suggests that by the mid-2030s, quantum technology could be sufficiently mature that countries either reap benefits or fall behind in tech competitiveness. ASEAN’s current efforts indicate it intends to be in the former category. If momentum is sustained, by that time Singapore may house a mid-sized quantum data center (integrated quantum computers working alongside classical supercomputers ), and ASEAN could be operating a regional quantum-secured communication backbone (perhaps piggybacking on satellites launched with partners like Japan or India). The cumulative economic impact for ASEAN might be significant: studies by BCG estimate quantum computing could create $450–$850 billion in value globally over the next 15–30 years, and ASEAN would certainly want a slice of that – whether through new industries or efficiencies in existing ones.

In conclusion, ASEAN’s venture into quantum technology is a story of proactive adaptation to a coming wave. The region has moved from virtually no presence in this field to a coordinated set of initiatives spanning multiple countries and domains. Key takeaways include Singapore’s exemplary leadership and infrastructure, the rising engagement of Malaysia, Thailand, and Indonesia, and a collaborative ethos that binds the region’s efforts. While challenges of funding, talent, and scale remain, ASEAN has shown that it can maximize its strengths – agility, cooperation, and strategic focus – to punch above its weight. In the coming years, we can expect ASEAN not only to adopt global quantum innovations but also to contribute its own, whether in niche technologies or novel applications tailored to its needs.