Xanadu to Go Public in $3 B Photonic Quantum SPAC

4 Nov 2025 – In a landmark deal for the quantum industry, Canada’s Xanadu Quantum Technologies announced plans to go public via a merger with a special-purpose acquisition company (SPAC). The deal, unveiled November 3, values Xanadu at a pre-money equity value of US$3 billion and is expected to provide around $500 million in gross proceeds for the company’s expansionthequantuminsider.com. Once completed, Xanadu will become the world’s first publicly traded pure-play photonic quantum computing firm, with shares listed on the NASDAQ and Toronto exchanges.

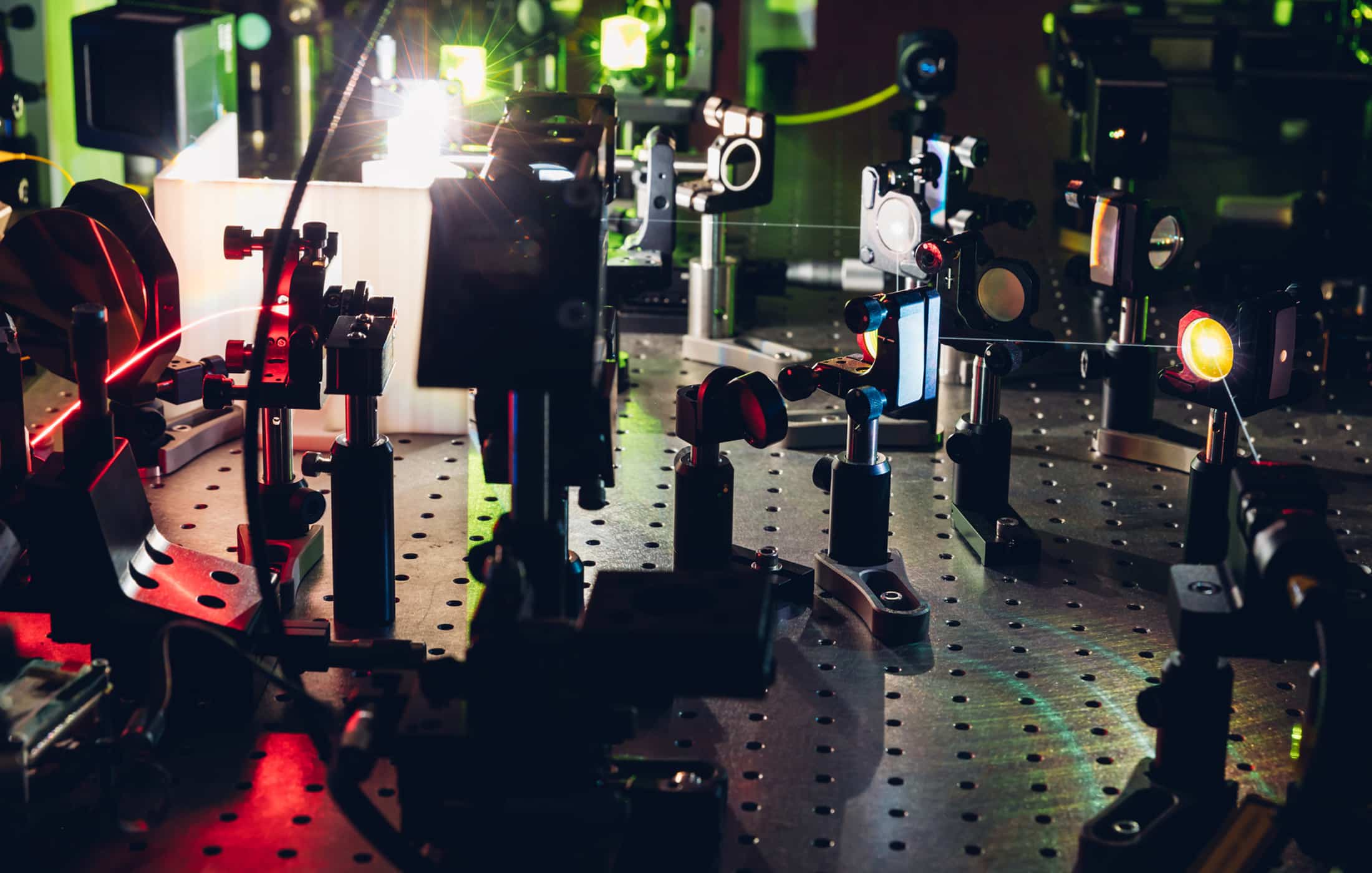

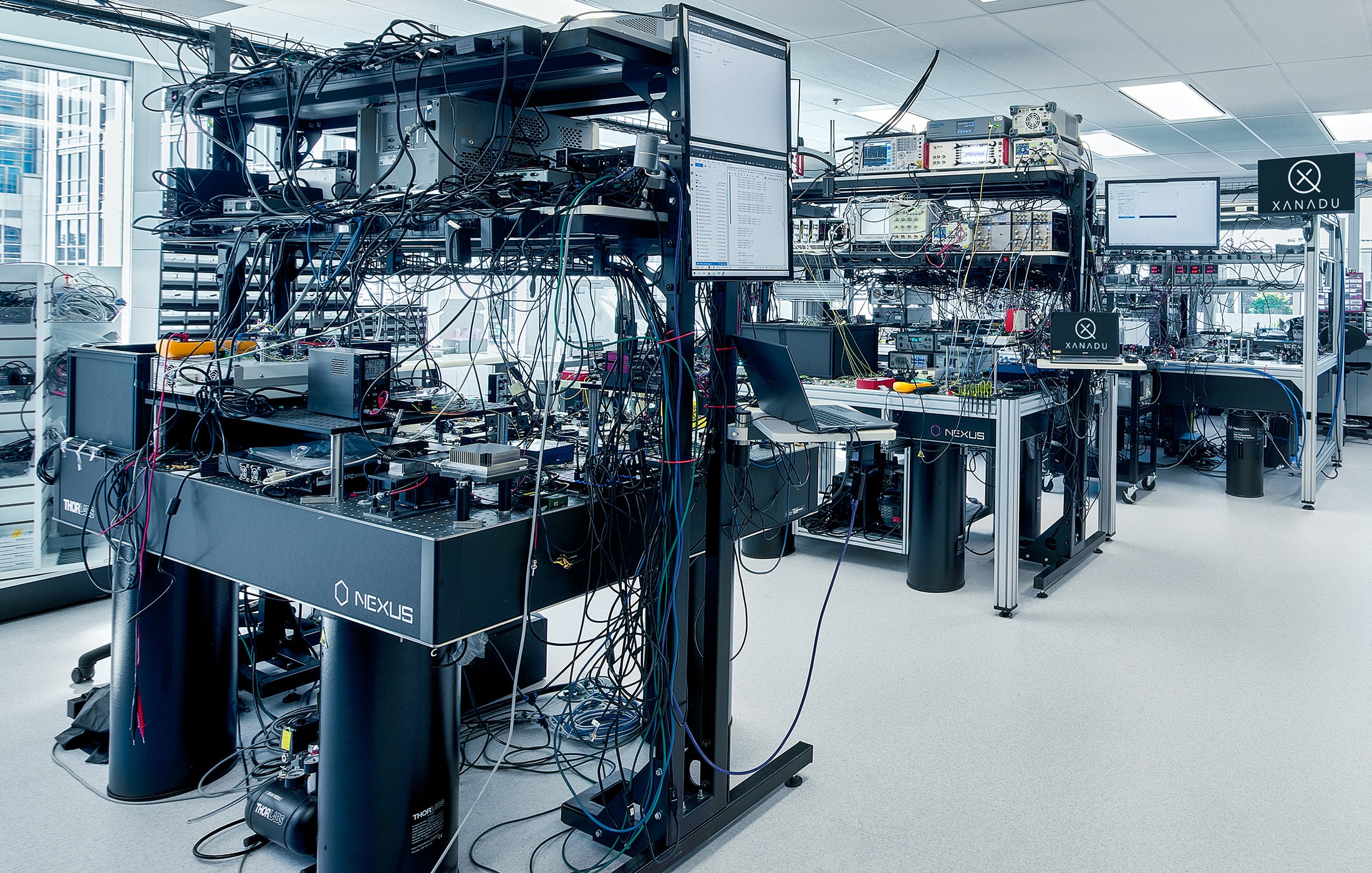

Xanadu is known for its photonic approach to quantum computers – using laser pulses and optical circuits (beam splitters, interferometers, etc.) to create qubits and perform computations at room temperature. Its 216-qubit Borealis photonic processor made headlines in 2022 by achieving a quantum computational advantage (solving a sampling problem faster than a supercomputer could). More recently, Xanadu demonstrated Aurora, a modular photonic quantum architecture that was the first to show real-time error correction decoding with light-based qubits. Unlike superconducting qubits that need deep cryogenic cooling, Xanadu’s photonic chips run in standard lab conditions, which could simplify scaling up.

CEO Christian Weedbrook hailed the SPAC move as “transformative” for both the company and the broader field. Going public will give Xanadu the capital to accelerate its roadmap toward a fault-tolerant photonic quantum computer by 2029. Their target is ambitious: about 100,000 physical photonic qubits, with error-correcting codes condensing those into ~1,000 logical qubits, all working in a modular netwok. Photonics offers potential advantages in error correction – Xanadu claims its approach could be 10× more efficient in overhead than other qubit technologies, thanks to the ease of moving and entangling photons for redundancy.

The deal also reflects investor excitement around photonic quantum solutions, which have lagged in funding behind superconducting or ion-trap systems until now. A $3 billion valuation for a pre-revenue startup underscores the belief that photonics might leapfrog other modalities in the long run (for instance, by integrating with existing fiber networks and telecom photonics manufacturing). Xanadu’s SPAC partner, Crane Harbor, and existing investors (which include the likes of Georgian and Bessemer) evidently see a clear path to commercialization – likely through cloud access to intermediate photonic processors and partnerships for specific applications like quantum machine learning.

Once public, Xanadu will join a small club of quantum companies on the stock market (IonQ, D-Wave, Quantum Computing Inc., and anticipated Rigetti via SPAC were earlier examples, though none focusing purely on photonics). This listing could pave the way for more quantum IPOs, and it will subject the field to greater scrutiny from public investors. Success will hinge on hitting technical milestones. Xanadu will need to grow its qubit count and fidelity, demonstrate useful error-corrected operations, and show that photonics can solve valuable problems. Weedbrook expressed confidence, noting that “with the technological foundation and an identified path to scaling fully fault-tolerant computers in place, this transaction will provide us the capital to accelerate our mission”.

Beyond finance, the SPAC news also came alongside technical bragging rights: Xanadu can claim it was the first quantum supremacy demonstration by a startup (Borealis 2022), and now it aims to be the first to truly realize a networked, modular quantum computer (Aurora’s recent progress). If those achievements hold, public investors may well be rewarded. Either way, Xanadu’s bold SPAC leap shows that quantum computing’s “photon side” is stepping into the limelight.

Quantum Upside & Quantum Risk - Handled

My company - Applied Quantum - helps governments, enterprises, and investors prepare for both the upside and the risk of quantum technologies. We deliver concise board and investor briefings; demystify quantum computing, sensing, and communications; craft national and corporate strategies to capture advantage; and turn plans into delivery. We help you mitigate the quantum risk by executing crypto‑inventory, crypto‑agility implementation, PQC migration, and broader defenses against the quantum threat. We run vendor due diligence, proof‑of‑value pilots, standards and policy alignment, workforce training, and procurement support, then oversee implementation across your organization. Contact me if you want help.