Quantinuum Raises $800 M at $10 B Valuation

6 Nov 2025 – In a sign of surging investor confidence in quantum computing, Quantinuum – the company formed by Honeywell’s quantum unit and Cambridge Quantum – has secured an $800 million funding round that values it at roughly $10 billion. The raise, announced November 5, is one of the largest ever in the quantum industry and was oversubscribed, expanding from an initial target of $600 million due to high demand.

The round brought in heavyweight backers. Fidelity International made its first investment in Quantinuum, and other participants included NVIDIA (via its venture arm), JPMorgan Chase, Mitsui & Co., chemical giant Amgen, and several venture funds. Despite the influx of new capital, Honeywell remains the majority owner with about 54% of shares.

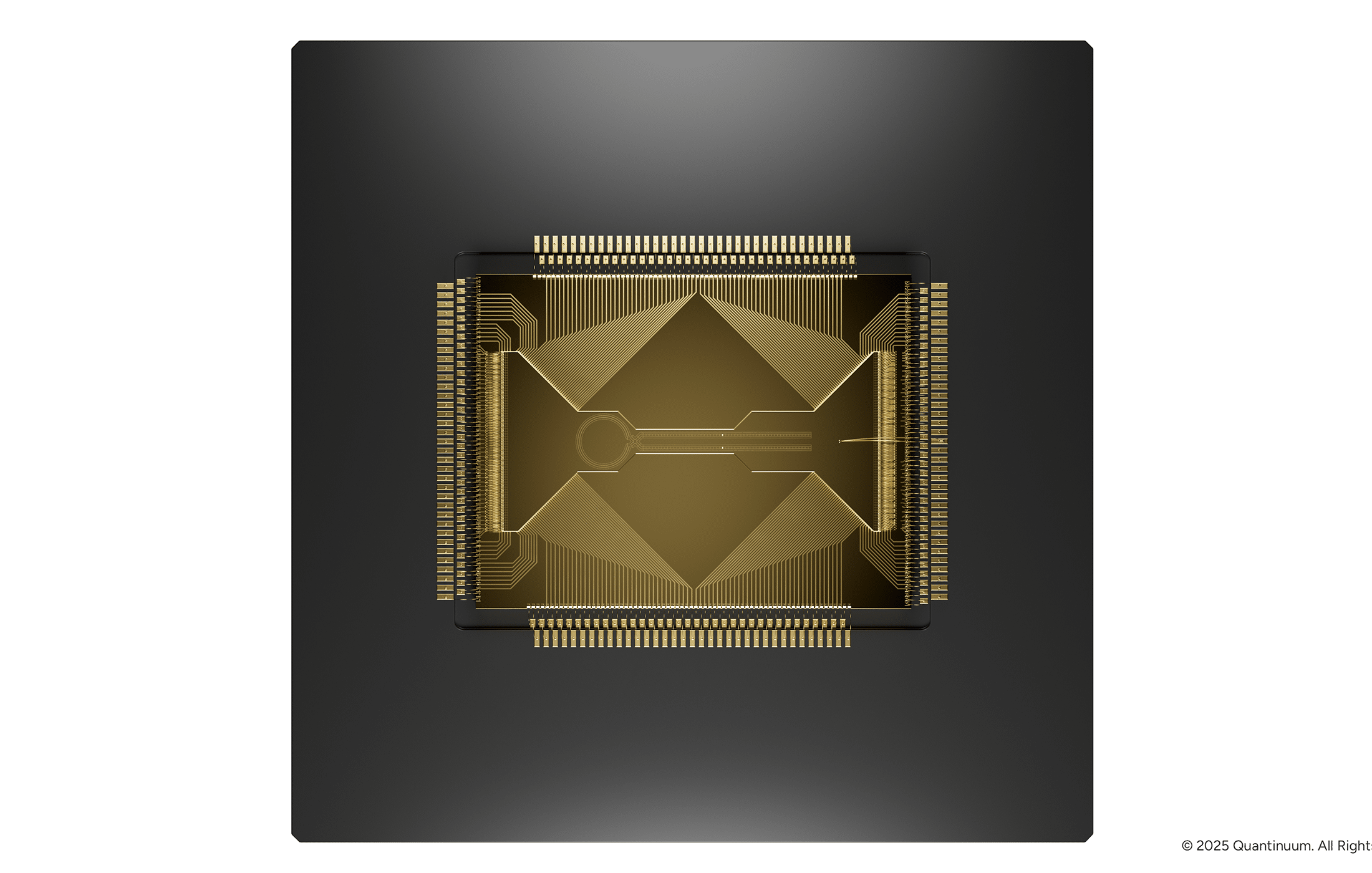

Investors are betting that Quantinuum’s hybrid approach – combining Honeywell’s trapped-ion quantum hardware with Cambridge Quantum’s software expertise – will keep it at the forefront of the field. The company has been advancing both its hardware (it recently announced the “H-Series” ion trap processors) and software platforms for applications like quantum chemistry, machine learning, and encryption. Quantinuum’s stated goal is to achieve fault-tolerant quantum computing, and this cash infusion will help fund the road toward that milestone (Honeywell has publicly aimed for a fully error-corrected quantum computer by the end of the decade).

The $10 billion valuation cements Quantinuum as one of the world’s most valuable private quantum companies – likely the most valuable, now ahead of rivals like IonQ (whose market cap as a public company has been in the single-digit billions). It underscores that quantum tech is maturing from a scientific curiosity into a commercial sector that major institutional investors see as strategically important. As Fidelity’s involvement shows, even traditional finance firms are now placing long-term bets on quantum.

This deal also caps a flurry of late-2025 quantum investment news. Notably, the same week, Canada’s photonic quantum computing startup Xanadu announced plans to go public via a SPAC at a ~$3.6 billion valuation. Together, these moves signal a “quantum boom” in capital markets – after years of smaller-scale funding, the industry is now attracting multi-hundred-million-dollar checks and public market attention. Analysts say it’s a sign that quantum tech, while still early, is de-risking: progress in hardware and algorithms has been steady, and companies like Quantinuum are generating revenue (e.g. through cloud access to their machines and enterprise software deals).

Quantinuum plans to use the $800 million to accelerate R&D and scaling. That means building next-generation ion-trap chips with more qubits and higher fidelity, and continuing to develop the software stack (the company’s Quantum Origin platform for cryptography and its IronBridge chemistry software, among others). Honeywell’s ongoing support (the conglomerate has a ~54% stake post-money) gives Quantinuum an unusual advantage of patient backing plus industrial use-cases in domains like materials and logistics.

In an interview, Quantinuum’s leadership framed the raise as not just capital but strategic validation. With partners like NVIDIA and JPMorgan on board, they expect deep collaborations – for example, NVIDIA’s investment aligns with integrating Quantinuum’s systems with GPU-accelerated simulators. And JPMorgan has been experimenting with quantum algorithms for finance, which could eventually run on Quantinuum hardware. All told, the scale of this funding round suggests that the quantum computing race is entering a new phase, one where big institutional money is picking winners and pouring in resources to help them sprint ahead.

Quantum Upside & Quantum Risk - Handled

My company - Applied Quantum - helps governments, enterprises, and investors prepare for both the upside and the risk of quantum technologies. We deliver concise board and investor briefings; demystify quantum computing, sensing, and communications; craft national and corporate strategies to capture advantage; and turn plans into delivery. We help you mitigate the quantum risk by executing crypto‑inventory, crypto‑agility implementation, PQC migration, and broader defenses against the quantum threat. We run vendor due diligence, proof‑of‑value pilots, standards and policy alignment, workforce training, and procurement support, then oversee implementation across your organization. Contact me if you want help.