Financing the Quantum Leap: Funding Strategies for University Spin‑offs

Table of Contents

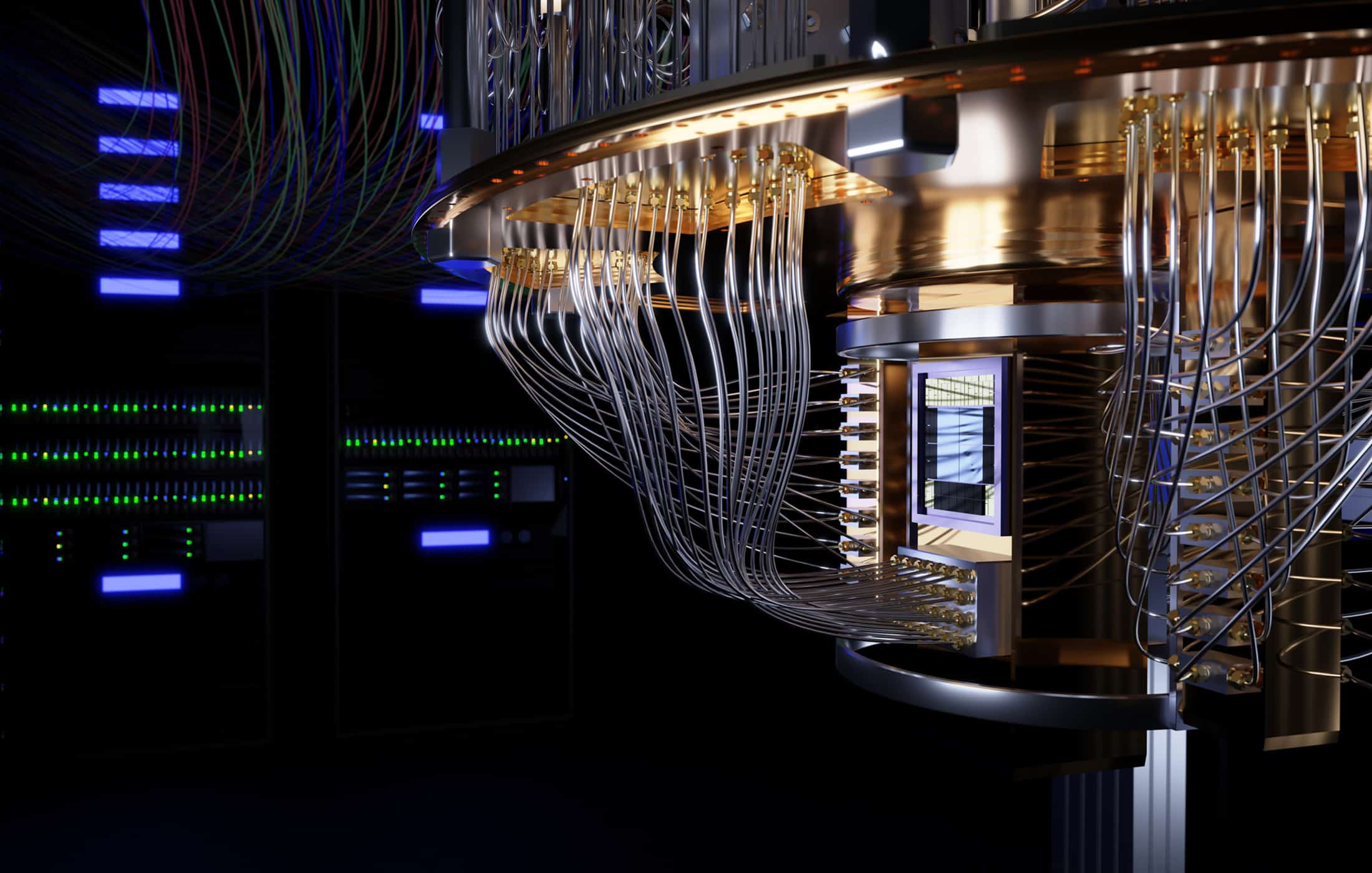

In a basement laboratory, a prototype quantum device glows faintly amid a tangle of cables. A grad student-turned-founder holds the fragile experiment in one hand and a business plan in the other, standing at the crossroads between academia and entrepreneurship. Such scenes are unfolding at top universities worldwide, as researchers attempt the leap from lab bench to market. Quantum technology, once the realm of abstract physics, is now a burgeoning startup sector racing toward real-world impact. But fueling this journey requires more than brilliant science – it demands savvy financing. From the gold rush of venture capital to the lifelines of government grants, the funding landscape for quantum spin-offs is as complex and entangled as a multi-qubit system. This article explores how academic entrepreneurs and their tech transfer offices can navigate that landscape, constructing a viable financing roadmap to carry quantum innovations from the cradle of the university to the cutting edge of industry.

The Quantum Gold Rush: A Funding Landscape in Flux

Not long ago, quantum startups were rare oddities; today they form a vibrant ecosystem attracting unprecedented investment. In the past decade alone, the number of quantum startups worldwide has surged by over 500%, fueled by a recognition that quantum tech could spark the next computing revolution. Venture capital poured into the field, peaking in 2022 when global quantum companies raised about $2.35 billion. That exuberance was tempered in 2023, which saw VC investment in quantum computing drop by about 50%, from 2022’s high down to $ 1billion – $1.2 billion (estimates vary). Industry analysts attribute the pullback partly to inflated expectations colliding with quantum’s long development timelines, as well as competition from other hot sectors – generative AI notably stole some limelight (and VC dollars) that year. Some observers even whispered about a looming “quantum winter.”

And yet, reports of a deep freeze were premature. Even as private investors cooled, governments ramped up: by late 2023, worldwide public-sector commitments to quantum R&D had ballooned to an estimated $40–42 billion cumulatively. From the United States and Europe to China, nation states declared quantum technology strategically vital and opened the spigots of funding. This surge of sovereign investment helped counterbalance the VC dip. By 2024, confidence was returning to the private market as well – Crunchbase tallied over $1.5 billion in venture funding for quantum startups in just the first part of 2024. In short, the quantum gold rush is far from over. It’s evolving. A senior deep-tech investor noted the pattern: initial hype leads to big rounds, then a sober realization that “deep tech is hard, things take more money to build” – but importantly, the money is still flowing.

Indeed, 2024 brought headline-grabbing deals that underscored a renewed momentum. The U.K.-based venture Quantinuum (itself a spin-out of Honeywell’s quantum division merged with Cambridge Quantum) secured a $300 million round at a $5 billion valuation. In Australia, a bold public-private pact saw the federal and Queensland governments pledge $620 million (AUD$940M) in funding to California-based startup PsiQuantum, luring part of its ambitious quantum computer project to Brisbane. And over the summer, quantum software specialist Riverlane raised a healthy $75 million Series C to advance error-correcting algorithms. Such infusions, alongside massive national programs (China, for example, launched a government-backed fund reportedly as large as ¥1 trillion – roughly $138 billion – for emerging tech including quantum), signal that quantum tech is entering a new phase. There is caution, yes, but also a deepening resolve by both investors and governments to stake out territory in what many view as a transformational industry. In 2024 there is obviously growing confidence in quantum’s potential.

From Campus Lab to Startup: Navigating the “Valley of Death”

For university spin-offs, securing funding is not just about riding macro trends – it’s an existential challenge of crossing the infamous “lab-to-market” chasm. Academia provides fertile ground for discovery (some call universities the “cradles of quantum innovation”, with tech transfer offices acting as midwives to deliver breakthroughs into the world), but turning a physics experiment into a product often means venturing into hostile terrain where academic grants give way to market forces. This early-stage gap – often dubbed the Valley of Death in innovation – looms especially large in quantum technologies. The science is complex, the path to revenue unclear, and traditional VCs can be skittish about funding unproven hardware over long horizons. “We don’t have enough knowledge yet to jump straight to products,” observed one national lab director, underscoring that sustained R&D and a skilled workforce are still prerequisites for viable devices. In practice, that means many quantum spin-offs must stitch together creative financing strategies to survive their toddler years.

What does a successful early financing roadmap look like for a quantum spin-off? It typically starts with non-dilutive support to validate the science. Founders leverage government grants, research endowments, or innovation awards as first fuel. In the US, this might be an NSF grant or SBIR/STTR contracts; in Europe, programs like the EU’s Quantum Flagship or national innovation agencies play a similar role. For example, the UK’s national quantum programme has seeded dozens of university-based projects with grant funding, while in the U.S. states like Illinois have launched funds to co-invest alongside startups. (Illinois recently used its new EDGE for Startups incentive to support quantum hardware venture EeroQ’s move to Chicago, providing tax credits and venture funds in exchange for local R&D investment.) Such public funds act as a bridge, helping spin-offs develop prototypes and signal credibility to private investors.

Next comes the delicate courtship of angel investors, seed funds and accelerators. Academic entrepreneurs, often first-time founders, are increasingly turning to specialized accelerators that understand deep tech. “Duality”, for instance, is a first-of-its-kind accelerator exclusively for quantum startups, launched in Chicago in 2021 with backing from the University of Chicago, national labs, and corporate partners. Its mission is literally to “help quantum startups bridge the gap between the laboratory and the marketplace” – exactly the journey spin-offs must navigate. Programs like this (as well as creative incubators such as Canada’s Creative Destruction Lab, or corporate-run startup studios) provide mentorship, industry connections, and often a modest amount of capital or guaranteed research contracts. They also teach academic founders the vocabulary of business that venture capitalists expect. Many university TTOs partner with or even host such incubators, knowing that preparing researchers for the rigors of entrepreneurship is as important as the tech itself.

University spin-offs also increasingly tap university-affiliated venture funds and consortia in early rounds. Major research universities have set up their own seed funds (Oxford Science Enterprises, for example, or MIT’s “The Engine” fund) to invest in spin-outs from their labs. These funds are more patient and technically savvy, aligning with the long gestation of quantum products. In the case of post-quantum cryptography startup PQShield, being an Oxford University spin-out meant it could secure backing from Oxford’s enterprise fund alongside traditional VCs. PQShield’s Series B round in 2024 raised $37 million – led by VC firm Addition, but also bringing in strategic investors like Chevron’s tech venture arm and Oxford Science Enterprises – to help the company hire and productize its quantum-resistant encryption solutions. Such mixed investor syndicates, blending financial and strategic capital, are becoming the norm. An oil industry investor (Chevron) might seem surprising in a cryptography startup, but it signals broad industry awareness of quantum’s disruptive potential, as well as the appeal of startups that can generate nearer-term revenue by securing communications before quantum computers arrive.

Perhaps the most critical piece in the spin-off funding puzzle, though, is patient capital – investors willing to bet on deep tech for the long haul. Unlike a social app that can scale to millions of users in a year, a quantum hardware breakthrough might take a decade to reach market. This is where specialized venture funds and corporate strategic investors step in. Quantonation in France, for instance, is a VC fund dedicated to quantum and physics startups; it has backed dozens of early-stage companies (from algorithms to hardware) and often co-invests with national initiatives. U.S.-based Darwin Ventures and Phase One Ventures have similarly targeted deep-tech, as have big-name firms like Andreessen Horowitz and Sequoia which now scour physics departments for the next quantum unicorn. Corporate venture capital plays an outsized role too: aerospace and defense giants, keenly aware of quantum’s implications, have been early backers in many spin-offs. Lockheed Martin, Airbus, Boeing, Bosch – such companies have venture arms that invested seed funding or expertise into quantum startups that align with their strategic interests (sensing, computing, materials). In short, assembling the “right” money often means mixing sources: a dash of public grant, a portion from a university seed fund, a lead VC with deep-tech appetite, and a sprinkle of corporate strategic dollars or in-kind support. The cap table of a successful quantum spin-off is frequently a mosaic of different capital types, all united by belief in the technology even if their motivations differ.

Finally, one strategy to bridge the lab-to-market gap is to generate revenue early through partnerships or contracts, rather than waiting for a finished product. Quantum startups are increasingly pursuing joint development agreements with large corporates or government agencies that provide milestone-based funding. For example, Australian spin-off Q-CTRL (born out of the University of Sydney) secured contracts with the U.S. Department of Defense and Australian Department of Defence to develop quantum navigation sensors that could one day replace GPS. Under these deals, the customer (military in this case) funds stages of R&D – effectively non-dilutive financing – and the startup gains a testbed and a guaranteed early market. Q-CTRL’s quantum control software has also been bundled with hardware from partners like IBM and Quantinuum, generating service revenue even as the core product is still evolving. By tapping such “strategic” funding – whether government grants, corporate R&D contracts, or paid pilots – a university spin-off can sustain itself without solely relying on venture capital to pay the bills during the tough technical build-out years.

Hardware vs. Software: Contrasting Capital Requirements

All quantum technologies are not created equal when it comes to funding needs. A quantum computing hardware venture might aspire to build a machine that one day outperforms today’s supercomputers – but getting there is an expensive marathon. In contrast, a quantum software start-up or a company in quantum cryptography or sensing can often run “leaner,” with lower upfront costs. University spin-offs must tailor their financing strategies to the subdomain they operate in, because the capital intensity and investor expectations differ greatly across the quantum landscape.

Quantum Computing Hardware Startups

On the heavy end of the spectrum, quantum computing hardware startups are capital-eaters. Building cutting-edge hardware – whether it’s superconducting qubit chips that must be cooled near absolute zero, laser arrays for trapping ions or atoms, or photonic circuits that manipulate single photons – demands specialized facilities, high-end equipment, and teams of PhDs and engineers. The vast majority of venture funding in the quantum sector to date has flowed into these hardware efforts. It’s not uncommon for a hardware-focused spin-off to raise tens of millions before even delivering a product or revenue. Investors essentially bankroll multi-year R&D programs, more akin to pharmaceutical development or rocket design than a typical software startup. Successful hardware spin-offs have learned to pursue “mega” rounds or unique funding avenues. For instance, Pasqal, a French spin-off building quantum processors from arrays of neutral atoms, raised $109 million in a Series B in 2023 led by Singapore’s sovereign wealth fund (Temasek) and including Saudi Aramco’s venture arm. That round not only provided capital but forged strategic links – soon after, Pasqal agreed to supply a quantum computer to Saudi Arabia, cementing a high-profile partnership. The message: if your tech is capital-intensive, you might align with capital-rich partners (whether nations or multinationals) who have a stake in the technology’s future.

The journeys of IonQ and PsiQuantum further illustrate how hardware startups marshal huge funding. IonQ, which spun out of research at the University of Maryland and Duke University, methodically grew through a series of fundraises that pulled in some of the world’s biggest tech companies and investors. It started modestly – a $2 million seed from NEA and an IP license from the university – but soon attracted the likes of Google, Amazon, and Samsung as backers, eager to help develop IonQ’s trapped-ion quantum computers. By 2021, IonQ had raised private rounds totaling over $75 million (including a $55 million round led by Samsung’s Catalyst Fund and UAE’s Mubadala). That year it took the unprecedented step of going public via a SPAC merger, securing a $650 million war chest in the process. Going public so early was almost unheard-of for a university spin-off, but IonQ used the booming SPAC market as a financing vehicle to outpace its rivals – becoming the first publicly traded pure-play quantum computing firm. The NYSE listing not only injected capital, it raised IonQ’s profile and helped it win major deals (like cloud partnerships to offer its quantum machines through AWS and Azure, and multi-year government contracts for quantum networking research). IonQ’s story shows that for hardware startups, sometimes the “wall of capital” needs to be scaled via bold moves – whether it’s tapping public markets, or securing anchor customers – to sustain the lengthy hardware development cycle.

PsiQuantum, likewise, epitomizes the go-big-or-go-home mentality. Founded by professors from Bristol and Stanford, PsiQuantum set out to build a million-qubit photonic quantum computer – a moonshot goal that would be laughable if not for the credibility of its founders and the audacity of its execution. Rather than attempt it on a shoestring, PsiQuantum relocated to Silicon Valley and amassed an astronomical war chest: by 2021 it had raised $665 million in VC (including a $450 million Series D led by BlackRock) – making it one of the first quantum “unicorns” with a valuation over $3 billion. The company then forged partnerships with manufacturing giants (GlobalFoundries, one of the world’s largest chip fabs, agreed to produce PsiQuantum’s photonic chips at scale) and tapped into government programs like DARPA for further support. In 2024, PsiQuantum struck a landmark agreement with Australia: the Commonwealth and Queensland governments will invest $620 million to host a PsiQuantum facility and build a “utility-scale” quantum computer on Australian soil. This blend of venture capital and sovereign funding underscores a key truth – if you’re attempting a quantum leap (literally) in hardware, you may need to align your vision with national agendas. Nations are willing to co-invest for strategic and economic returns, effectively sharing the burden of high upfront costs. By pursuing photonics (compatible with existing semiconductor fabs) and courting public mega-funders, PsiQuantum positioned itself to overcome the lab-to-market gulf at a scale that few others could match.

Quantum Software and Algorithm Startups

On the other side of the spectrum sit quantum software and algorithm startups, which often follow a leaner model. These ventures don’t build quantum processors; instead, they develop the “brains” that will run on someone else’s future machine, or they create tools to augment today’s imperfect quantum devices. Because their primary outputs are code, algorithms, or cloud-based platforms, their capital needs tend to be lower – akin to a typical software startup (though hiring top quantum talent is never cheap). Many originated as spin-offs from university computer science or math departments, founded by theorists who realized they could advance quantum applications without waiting for a perfect hardware. Phasecraft, for example, emerged from University College London and Bristol to focus on quantum algorithms for materials and chemistry. Its team of academics raised a $17 million Series A in 2022 – a healthy sum for an algorithm company but an order of magnitude less than hardware players. “The vast majority of venture funding has gone into making hardware that can perform more operations,” Phasecraft’s COO Gabrielle Maroso explained, contrasting that with the company’s mission to optimize algorithms so that useful results can be achieved with fewer qubit operations. In other words, software startups pitch efficiency: they make current or near-term quantum machines more useful, which both accelerates time-to-impact and appeals to investors who don’t want to wait 10 years for a payoff. Firms like Phasecraft, Germany’s Kipu Quantum, and others in quantum simulation and error-correction have been able to raise on the premise of delivering value on today’s hardware constraints. Their challenge is proving they can generate revenue (often via SaaS models or research contracts) even while true quantum advantage remains on the horizon. The upside is that if they succeed, their burn rate is far lower – they won’t need a $100 million round to keep the lights on.

Quantum Sensing and Communication Startups

Between hardware-heavy and pure software lies quantum sensing and communication, a subdomain with its own funding profile. Quantum sensing startups build devices like ultra-precise magnetometers, quantum LiDAR, or navigation systems that use quantum effects (e.g. atom interferometry or NV-diamond sensors) to achieve performance far beyond classical sensors. These often spin out of physics or engineering labs and require building physical hardware, but usually on a smaller scale and closer to market than a full quantum computer. This means they can sometimes start with modest funding and get early revenue through pilot deployments or instrument sales to industry/government. Take Q-CTRL’s evolution: while known for its software to stabilize quantum computers, it also delved into quantum sensing for defense. Rather than raise a massive round up front, Q-CTRL partnered with Lockheed Martin on a Department of Defense contract to prototype a quantum inertial navigation system for GPS-free navigation. The contract (through the Defense Innovation Unit) was an alternative to VC funding – effectively paying the company to develop its technology with the military as a future customer. In Australia, Q-CTRL similarly secured a government partnership to build navigation sensors for aircraft under the AUKUS pact. This path – leveraging customer-funded development – can sustain a sensing-focused spin-off until its product matures. Of course, many quantum sensor startups still raise venture capital (often from firms interested in dual-use tech), but the sizes are moderate. It’s common to see seed or Series A rounds in the low millions to build field prototypes, sometimes supplemented by grants from programs like the EU’s Quantum Flagship (which heavily supports quantum sensing projects alongside computing). The relatively shorter path to a commercial prototype in sensing (a quantum gravity sensor might find buyers in civil engineering or defense within a few years) means investors expect faster validation, if not large profits right away. This is an advantage compared to quantum computing ventures that might not have a sellable product for many years. In short, quantum sensing spin-offs often operate like “deep-tech instrumentation” startups, straddling academic research and industrial hardware markets, and can tap somewhat different funding pools (including corporate R&D budgets and defense procurement) earlier in their lifecycle.

Post-Quantum Cryptography (PQC) Startups

Finally, post-quantum cryptography (PQC) startups stand out as an example of a quantum-related field that can follow a more traditional tech startup playbook. These companies aren’t building quantum machines; they’re building algorithms and devices to withstand other people’s future quantum machines. Since their technology runs on classical computers (just with new mathematical underpinnings), PQC startups resemble conventional cybersecurity firms. They can often get by with smaller teams of cryptographers and go-to-market partnerships in the cybersecurity industry. As a result, their funding rounds look more like those of normal software security startups: typically in the single-digit millions at seed, scaling to $20–40 million in Series B once they have pilot customers. PQShield, the Oxford spin-off mentioned earlier, is a case in point – it raised $20 million in Series A (2022) and $37 million in Series B (2024) to expand its team and productize quantum-proof encryption toolkits. Those numbers, while substantial, pale next to the nine-figure hauls of quantum hardware companies. The reasoning is straightforward: PQShield can start generating revenue by selling encryption IP and software licenses to companies that need to upgrade their security (a need that’s growing as governments like the U.S. mandate a transition to quantum-safe encryption in coming years). Thus, PQC firms offer investors a relatively shorter route to returns, anchored in enterprise software metrics, even though their story rides on the quantum wave. It’s a niche where university cryptography labs have spun out multiple ventures (e.g. Canada’s Isara, France’s CryptoNext) that attract VC interest not just for the “quantum” buzzword but because cybersecurity is a huge existing market. For tech transfer offices, this means PQC spin-offs might be some of the lowest-hanging fruit in quantum commercialization – easier to fund initially and potentially sustainable through early sales or acquisition by larger security companies.

In summary, the quantum sub-field dictates the scale and style of funding: big-iron hardware demands bold fundraising and often public sector partnership; algorithm and software ventures must prove their cleverness in squeezing results from limited tech, while keeping burn rates low; sensor and communication device startups often hybridize funding, mixing VC with contract/grant income; and quantum-safe crypto plays in a hybrid quantum-classical space that can leverage traditional tech investment paradigms. University founders must know their segment and craft funding strategies (and pitches) accordingly. A hardware spin-off CEO might emphasize nation-leading “moonshot” potential to snag a $100M government grant, whereas a quantum software CEO will focus on near-term use cases and a flexible runway to convince a seed fund to come onboard.

Case Studies: Lessons from Quantum Spin‑offs

Real-world examples of university spin-offs illustrate how these funding strategies play out in practice. Let’s explore a few prominent cases – PsiQuantum, IonQ, QuEra, and Q‑CTRL – each of which began as an academic project and navigated a unique path to funding. Their journeys offer cautionary tales and success strategies for tech transfer offices and founders following in their footsteps.

PsiQuantum: Betting Big on Photons and Public Funds

PsiQuantum emerged from research led by Professor Jeremy O’Brien, who spent years in academia (Bristol in the U.K.) exploring photonic quantum computing. In 2016, O’Brien and colleagues took the plunge to found PsiQuantum in Palo Alto, with an audacious goal: build the world’s first utility-scale quantum computer using light. From the outset, PsiQuantum’s financing strategy was about scale – both in technology and capital. Recognizing that a photonic quantum computer would require integrating millions of components, the team pursued a path that leveraged existing semiconductor manufacturing. They partnered early with GlobalFoundries, a leading chip manufacturer, to fabricate their silicon-photonic chips, effectively piggybacking on the mature infrastructure of the silicon industry. This gave investors confidence that PsiQuantum could eventually produce machines in quantity, not just lab curiosities.

On the funding side, PsiQuantum raised eye-popping sums in rapid succession. The spin-off attracted blue-chip venture firms (Atomico, Silicon Valley’s Playground Global) and by 2020 had secured strategic investments from tech giants and financial powerhouses – including BlackRock, which led PsiQuantum’s $450 million Series D in 2021. In total, the company amassed roughly $665 million of VC funding by 2021, making it one of the best-funded quantum startups on the planet. This largesse gave PsiQuantum a valuation in the billions, despite having no commercial product yet – a testament to the investors’ belief in the team’s scientific pedigree and the potential payoff if they succeed. But PsiQuantum didn’t stop at private capital. They shrewdly pursued government partnerships to supplement their coffers and de-risk the most expensive steps ahead. The U.S. Air Force’s quantum research office (AFRL) awarded PsiQuantum contracts to develop photonic chips for networking. And in 2024, the company pulled off a funding coup on the other side of the world: it convinced the Australian government to invest $620 million (a mix of equity, grants, and loans) to build a quantum computing facility in Queensland. In essence, Australia is paying for the privilege of hosting PsiQuantum’s first large-scale machine – an arrangement that gives PsiQuantum vast resources to build, while giving Australia a leapfrog position in quantum computing. “Scale is the point,” O’Brien has said, defending his strategy of raising big money and spending it to attack quantum’s hardest scaling challenges. By aligning his startup’s goals with those of nations and deep-pocketed investors, O’Brien turned PsiQuantum’s academic origins into a globe-spanning enterprise. The takeaway: an academic spin-off with a moonshot vision can indeed raise astronomical sums, but it requires uniting many stakeholders behind the mission. PsiQuantum’s journey also highlights how a spin-off can leverage its founders’ credibility and early breakthroughs to form alliances (with a foundry, with DARPA and Microsoft on research, and with governments) that amplify its financing beyond what venture capital alone would provide.

IonQ: From Campus Lab to Wall Street

If PsiQuantum is the archetype of a privately held unicorn, IonQ represents another path increasingly relevant to university spin-offs: tapping the public markets. IonQ’s story begins at the University of Maryland and Duke University, where professors Chris Monroe and Jungsang Kim were pioneers in trapped-ion quantum computing. With support from UMD’s incubator and a license to foundational ion trap technology from Monroe’s lab, IonQ was founded in 2015 in College Park, MD – essentially on the university’s doorstep. The company’s early funding was notable for its blend of academic, venture, and corporate support. A $2 million seed from NEA (a venture firm with a history of funding university spin-offs) got IonQ off the ground, alongside contributions from the UMD system. By the time IonQ built its first prototypes, it had drawn the attention of Amazon and Google, each of which invested (through their respective venture arms) in a $20 million round and agreed to integrate IonQ’s quantum processors into their cloud platforms. This was a strategic masterstroke: by partnering with Amazon Web Services and Microsoft Azure, IonQ gained immediate credibility and a way to let paying customers experiment with its quantum computers via the cloud. In effect, the university spin-off plugged into a global distribution channel, something few early-stage startups achieve. These partnerships also reassured investors that IonQ wouldn’t have to spend wildly on its own infrastructure to reach customers.

IonQ continued to raise capital through relatively traditional Series A and B rounds (including a $55 million round led by Samsung and Mubadala in 2019, bringing in a sovereign wealth fund from Abu Dhabi and one of the world’s biggest tech companies as stakeholders). But the most daring funding move came in 2021: IonQ agreed to merge with a special-purpose acquisition company (SPAC) sponsored by dMY Technology, thereby becoming a publicly traded company on the NYSE. Through this SPAC deal, IonQ raised $650 million in gross proceeds and achieved a post-merger valuation of about $2 billion. For a university spin-off barely six years old, this was like strapping on a rocket booster. It instantly made IonQ the best-capitalized quantum startup and the first pure-play quantum computing stock available to public investors. The influx of capital allowed IonQ to expand aggressively: hiring engineers from Big Tech, scaling up its hardware from a handful of qubits to dozens, and opening new facilities. It also put IonQ under pressure to deliver, as public markets can be unforgiving – but so far the company has shown progress, reporting growing bookings for its quantum cloud services and snagging marquee contracts (in late 2024, IonQ won a $54 million deal with the U.S. Air Force to develop quantum networking hardware). IonQ’s funding journey demonstrates how a spin-off can evolve from a professor’s side project to a publicly-listed leader by deftly leveraging every rung on the financing ladder: university support, venture and corporate capital, and ultimately the stock market. It’s a reminder to TTOs and founders that liquidity events (like IPOs or SPAC mergers) aren’t the endgame but rather a financing tool – one that can supercharge growth if timed well. IonQ effectively turned its research credibility into a brand that excited Wall Street, all while maintaining tight links to its academic roots (the company still collaborates with UMD’s Quantum Lab and benefits from the local D.C.-area quantum innovation cluster). The lesson here is twofold: first, strategic partnerships (with cloud providers, in IonQ’s case) can significantly enhance a spin-off’s funding prospects by showcasing immediate use cases; and second, going public is an increasingly viable option for deep-tech startups to raise capital – not as an exit per se, but as a fundraising milestone on the long road of development.

QuEra: Academic Excellence Attracts Big Tech Backing

While IonQ and PsiQuantum shot for the moon, QuEra Computing charted a more measured course – but one that still required crossing the lab-market divide with careful strategy. QuEra was founded in 2019 out of Harvard and MIT by a team including professors Mikhail Lukin and Vladan Vuletić, world-renowned experts in quantum optics. Their approach uses neutral atoms controlled by lasers (specifically, Rydberg atom arrays) to build quantum processors. At the outset, QuEra benefited immensely from its academic pedigree: having Lukin and Vuletić on board gave the startup instant credibility and access to talent, not to mention intellectual property that had been developed over years of federally funded research. However, prestige alone doesn’t pay for expensive hardware development. QuEra’s founders recognized that to convince investors, they needed to demonstrate technical milestones quickly and forge partnerships that extend their reach.

One smart move QuEra made was to get an early prototype of its quantum computer (a 256-atom system named Aquila) onto Amazon Braket, the cloud platform for quantum computing. By making Aquila the first neutral-atom quantum machine available on AWS’s cloud, QuEra punched above its weight – a small startup suddenly had a global user base of researchers and companies who could run experiments on its hardware. This showed investors that QuEra was not just a lab curiosity; it was providing a service and gathering real-world data and feedback. The AWS partnership also probably eased the burden on QuEra’s own infrastructure (leveraging Amazon’s cloud resources), another cost-saving benefit for a young company.

When it came to raising money, QuEra did so incrementally at first (a few million in seed funding from friends, family, and local seed funds like The Engine and Safar Partners, many with Harvard/MIT ties). But the real validation came in 2023–2024. Impressed by QuEra’s technical progress and its cloud presence, major investors jumped in. In a Series B financing completed in early 2025, QuEra raised over $230 million – a massive leap that brought in SoftBank’s Vision Fund 2, Google, and other institutional investors as new backers. Google’s involvement is telling: here is a tech giant that has its own quantum computing effort, yet it invested in QuEra, a sign that big players are hedging bets across multiple approaches (and perhaps eyeing talent and IP through these investments). SoftBank’s Vision Fund, known for writing huge checks in tech, likewise signaled a belief that QuEra’s technology had breakout potential. The round’s success was undoubtedly buoyed by QuEra’s academic alliances – the press release explicitly highlighted the “considerable technical breakthroughs” achieved in collaboration with the founders’ labs at Harvard and MIT. In essence, QuEra turned its university partnerships into a selling point: rather than severing ties with academia after spinning out, QuEra remained entwined with it, continuing to co-author scientific papers and advance the fundamental science even as a private company. This helped reassure investors that QuEra was at the forefront of innovation, not an outsider trying to catch up.

QuEra’s case teaches a few key lessons. First, early customer access (even if it’s just experimental usage via the cloud) can distinguish a spin-off from the pack and attract investment – it demonstrates a path, however nascent, to market adoption. Second, deep academic integration can remain an asset post spin-off; the credibility of having top researchers on your team and the pipeline of ideas from their university labs can be leveraged to raise capital. Finally, QuEra shows that you don’t have to grab $500 million out of the gate to succeed; you can raise moderately at first and then, upon hitting technical goals, unlock much larger funding when the time is right. In QuEra’s case, patience and proving oneself (with that 256-qubit demonstration and real cloud users) eventually unlocked a SoftBank-sized investment that will carry the company forward to building bigger, more powerful neutral-atom quantum computers. For TTOs, QuEra is an example where staying closely involved with the spin-off (through joint research and perhaps equity sharing agreements) can increase the company’s value and attractiveness to outside funders.

Q-CTRL: A Lean Startup with Global Partnerships

Australian-based Q-CTRL provides a contrast to the hardware builders – it’s a quantum infrastructure software company that emerged from a university lab and pursued a nimble, partnership-driven growth strategy. Q-CTRL was founded in 2017 by Professor Michael Biercuk of the University of Sydney, initially to commercialize his lab’s expertise in quantum control – techniques to reduce errors in quantum hardware. In essence, Q-CTRL makes software (and firmware) that sits alongside quantum computers to stabilize them and enhance performance. This was a savvy niche for a university spin-off: it meant Q-CTRL could support all hardware platforms (and thus partner with many hardware players rather than competing with them), and it required far less capital than building quantum machines from scratch.

Q-CTRL’s funding journey started with relatively small rounds by deep-tech standards – a few million in seed funding led by local Australian VCs and government innovation grants. One notable early supporter was In-Q-Tel, the venture arm of the U.S. intelligence community, which often backs quantum tech; its involvement signaled Q-CTRL’s strategic importance and helped open doors in the U.S. Q-CTRL also received a boost from Australia’s commercialization programs. But the real momentum came as Q-CTRL executed on its partnership model. The company collaborated with hardware firms like IBM, Rigetti, and IonQ to integrate its error-correcting tools into their systems, proving its value to the ecosystem. It also branched into quantum sensing, as mentioned, working with defense contractors. These moves paid off in attracting investors: Q-CTRL’s Series B funding, raised in multiple tranches through 2022–2024, totaled $113 million – the largest Series B round for any quantum software company to date. The round was led by GP Bullhound, a global tech investment firm, and included both financial investors and strategic partners. By growing its business (securing paying customers for its software subscriptions and winning defense contracts), Q-CTRL was able to “reset investor expectations” during a time when some feared a downturn in quantum funding. In the words of its founder, Q-CTRL aimed to position itself for “ubiquity and permanence” by being the indispensable layer for all quantum applications – a pitch that clearly resonated with investors who might have been wary of more speculative quantum bets.

A hallmark of Q-CTRL’s journey is how it leveraged global networks. Despite being based in Sydney – far from Silicon Valley – the startup never lacked access to capital or customers, because it actively formed international linkages. It joined startup accelerator programs in the U.S., opened an office in Los Angeles, and benefitted from the Australian government’s willingness to let local startups engage deeply with allies (as evidenced by contracts under AUKUS and partnerships with U.S. primes). Q-CTRL also did something tech transfer offices should note: it diversified its product line within its domain of expertise. Starting with quantum computing software, it realized its core algorithms for signal stabilization could apply to inertial navigation and other sensing, thus tapping into defense and aerospace budgets. This meant when quantum computing was in an R&D lull, Q-CTRL could still generate revenue from a different market. That adaptability made it a more attractive investment (and indeed, some of its Series B investors came from outside the traditional quantum VC pool, seeing Q-CTRL as a play on resilient quantum infrastructure broadly).

For university spin-offs, Q-CTRL exemplifies the power of being a “picks and shovels” provider in a gold rush – selling the enabling technology that all the major players need. It managed to raise a substantial sum without the fanfare of building a quantum computer or a headline-grabbing SPAC, largely by methodically proving its tech on others’ platforms and securing strategic partnerships. The University of Sydney, on its part, helped ensure Q-CTRL’s early success by supporting initial IP licensing and proudly promoting the startup as a national champion (which likely helped it net government backing). In 2023, as many quantum firms tightened their belts, Q-CTRL was expanding – hiring internationally and even acquiring a smaller quantum startup to enhance its capabilities. This goes to show that a lean spin-off with strong technical IP can grow into a market leader if it finds the right ecosystem role. And funding will follow: Q-CTRL’s latest round valued it among the top quantum startups globally, a validation of its less-flashy but solid approach.

Building a Quantum Financing Roadmap

The experiences of these spin-offs – and many others like them – underscore a central point: there is no single path from lab to market, but there are common strategies that improve the odds of success. University tech transfer offices and early-stage quantum founders can draw several lessons to construct a viable financing roadmap:

- Leverage Non-Dilutive Funding Early: Almost every quantum spin-off relies on grants, contracts, or prizes in its infancy. TTOs should help researchers identify and apply for these opportunities (national science grants, defense research programs, innovation challenges, etc.). This provides runway without equity dilution and serves as validation. For example, if a spin-off can say it has a Phase II SBIR contract or a government research grant, VCs will view it as de-risked science with an implicit “stamp of approval.” The key is to align the research milestones in grants with the company’s technical roadmap so that each grant-funded achievement propels the venture forward.

- Build a Consortium of Backers: The era of a single VC funding a company to unicorn status is fading in deep tech. Instead, successful quantum startups often assemble consortia of investors – combining the strengths of each. A sovereign wealth fund or government-backed fund can provide patient, large-scale capital (as Temasek did for Pasqal, or as Europe’s EIC fund does by co-investing alongside VCs in quantum projects). Corporate strategic investors bring industry know-how and sometimes a first customer (e.g. Boeing’s venture arm invested in quantum simulation software startups to eventually use their tools in aerospace design). Traditional VCs bring company-building expertise and connections for follow-on funding. University funds or local incubators add a layer of commitment and often help bridge cultural gaps between academia and business. By welcoming a mix of these, a spin-off can secure not just money, but partnerships and stability. The downside is managing many stakeholders, but good communication and clearly defined roles can turn a diverse cap table into a strength.

- Tailor the Pitch to the Tech’s Timeline: Quantum startups must set investor expectations realistically – and differently for different audiences. When pitching fast-moving angel investors or accelerators, focus on short-term milestones (a prototype demo, a research publication, a small contract) that add value within 12–18 months. When pitching government or sovereign funds, emphasize the long-term national or strategic value (being the first to a new capability, training talent, spin-off benefits to the local economy). With venture capital, be candid about timelines but also highlight intermediate products or services that can generate revenue while the end-goal is in development. For instance, a quantum computing hardware team might offer consulting or access to their prototype via cloud in the interim; a quantum materials startup might productize a novel sensor as a stepping stone to a larger platform. Having concrete milestones at 1, 3, 5, 10 year marks can convince funders that you have a plan to create value at each stage, not just a pot of gold at the rainbow’s end.

- Use Partnerships to De-Risk and Co-Fund: As seen repeatedly, partnerships are a quantum startup’s best friend. University spin-offs should actively seek collaborations with larger entities – be it a Fortune 500 company interested in joint research, a national lab that can offer facilities, or a cloud provider that can host the startup’s technology. These partnerships often come with funding or resources that substitute for capital. They also validate the startup’s approach: it’s easier to ask investors for money once you can say “Company X is testing our device” or “Lab Y is integrating our software for its experiments.” The partnerships don’t have to wait until the company is mature; many can start at the very early stage (sometimes facilitated by the TTO or university relationships). In the quantum space, an ecosystem mindset prevails – hardware needs software needs users needs integrators. If a spin-off positions itself as a valuable node in that ecosystem (rather than an isolated venture), it will find ample support. Just as Duality Accelerator’s model shows, bringing together multiple parties (university, national labs, corporations) around a startup creates a network effect that propels that startup further than it could go alone.

- Consider Alternative Funding Mechanisms: While venture capital grabs the headlines, quantum spin-offs should also explore alternative financing. This might include venture debt (for more mature startups with revenue or hard assets), corporate R&D contracts (essentially getting paid to develop your own product under contract), or even crowdfunding for certain projects (some quantum hardware startups have pre-sold usage of future machines to raise cash). In one interesting trend, a few quantum startups have used specialized investment vehicles – for example, forming joint ventures with a government where the government provides facilities and the startup provides IP. Another route, as IonQ demonstrated, is the SPAC or IPO when market conditions are favorable. The overarching advice is to stay opportunistic: in a field evolving as fast as quantum, new funding initiatives pop up frequently (just in the last two years, the EU launched the €100 million QCI fund, the U.S. passed the CHIPS and Science Act with quantum funding provisions, and countries from Israel to India announced quantum innovation funds). Founders and TTOs that keep tabs on these and are ready to apply or engage will have more shots on goal than those who stick narrowly to the classic VC pitch circuit.

- Prepare for Diligence – IP, Team, and Market: Given the high stakes and long timelines, investors in quantum deals do rigorous diligence. University spin-offs need to have their house in order: strong IP protection (clear licenses from the university, patents filed or in process), a team that isn’t just brilliant scientifically but supplemented by business or engineering talent (investors often want to see a professional CEO or at least advisors with startup experience), and a credible market story (even if the market is nascent, you must articulate who will be the customers and how large the opportunity could become). TTOs can assist by ensuring the spin-off has exclusive rights to the core technology (nothing scares investors more than ambiguous IP ownership) and by training founders in how to present market analysis. Many quantum founders make the mistake of saying “the TAM (total addressable market) is infinite because this will change everything.” A more concrete approach – e.g. “our initial target market is optimizing logistics for large automakers, a multi-billion dollar problem, and here’s why our quantum approach will beat classical methods for that niche in 3 years” – goes much further in persuading funders that the startup has a business case, not just cool science.

As the quantum technology sector matures, university spin-offs will remain at its heart – after all, much of the foundational innovation still originates in academia. But to thrive, these spin-offs must pair scientific ingenuity with financial and strategic acumen. The funding landscape has globalized and diversified: a spin-off might get money from a Silicon Valley VC, a European government grant, and a Japanese corporate partner all in the same year. This is exciting and empowering, but requires navigation skills. Tech transfer offices can play a pivotal role as guides, leveraging their networks and experience from past spin-offs (in biotech, semiconductors, etc.) to help new quantum entrepreneurs avoid pitfalls and seize opportunities.

In the end, financing a quantum leap is about building bridges – between lab and market, between public and private interests, and between today’s prototypes and tomorrow’s transformative industries. Each dollar raised and each partnership forged is like adding a plank to the bridge over the Valley of Death. With a well-crafted funding strategy, today’s PhD student with a brilliant idea can become tomorrow’s CEO of a quantum powerhouse. The journey is not easy: it demands patience, storytelling, and the courage to ask for support on an unprecedented mission. But as we’ve seen, when it all comes together – when the science, the capital, and the vision align – the results are remarkable.

Quantum Upside & Quantum Risk - Handled

My company - Applied Quantum - helps governments, enterprises, and investors prepare for both the upside and the risk of quantum technologies. We deliver concise board and investor briefings; demystify quantum computing, sensing, and communications; craft national and corporate strategies to capture advantage; and turn plans into delivery. We help you mitigate the quantum risk by executing crypto‑inventory, crypto‑agility implementation, PQC migration, and broader defenses against the quantum threat. We run vendor due diligence, proof‑of‑value pilots, standards and policy alignment, workforce training, and procurement support, then oversee implementation across your organization. Contact me if you want help.