Quantum Technologies & Quantum Computing in the UK

Table of Contents

Introduction

Quantum technologies – encompassing quantum computing, communications, cryptography, and sensing – have become a strategic focus for nations worldwide. The United Kingdom has emerged as a front-runner in this “second quantum revolution,” leveraging a strong academic heritage in quantum physics and substantial government investment to build a vibrant quantum ecosystem.

Historical Context of UK Quantum Research

The UK’s engagement with quantum science dates back to foundational theoretical work and early breakthroughs that set the stage for today’s technologies. In 1985, Oxford physicist David Deutsch published a seminal paper outlining the concept of a universal quantum computer, effectively introducing the idea of quantum computing to the world. A few years later, in 1991, Artur Ekert (then at the University of Oxford) pioneered entanglement-based quantum cryptography, demonstrating that quantum entanglement could be used to distribute encryption keys with security guaranteed by the laws of physics. These early contributions by UK researchers – from quantum computing theory to quantum cryptography – helped trigger a global surge of interest in quantum information science and established the UK as a hub of quantum expertise.

Building on this academic foundation, the UK government recognized the transformative potential of quantum technologies and moved early to support their development. In 2013/2014, the government launched the UK National Quantum Technologies Programme (NQTP), one of the world’s first coordinated national quantum initiatives. The NQTP was established to translate cutting-edge quantum research into new products and services, uniting academia, industry, and government around a common mission. The initial phase of NQTP (2014–2019) invested roughly £270 million to create four Quantum Technology “Hubs” at leading universities, focusing on quantum computing, communications, sensing/metrology, and imaging. This effort positioned the UK to secure a world-leading role in emerging quantum markets. The Hubs were renewed with additional funding through 2024, and by the program’s tenth year the cumulative public investment in UK quantum R&D exceeded £1 billion. Key milestones during this period included early prototypes of quantum devices and the formation of numerous quantum tech startups. In short, the UK’s early and sustained commitment – from pioneering research in the 1980s/90s to the launch of NQTP in 2014 – laid the groundwork for its current leadership in quantum technology.

Quantum Computing in the UK: Current State and Initiatives

Government Strategy and National Programs

The UK’s quantum computing advancement is underpinned by robust government strategy and funding. The National Quantum Technologies Programme (NQTP) continues to be the flagship initiative, fostering collaboration between universities, industry, and government to drive quantum innovation. Under the NQTP, the government has launched specialized centers and funding schemes to accelerate quantum computing development. A centerpiece is the National Quantum Computing Centre (NQCC) – a new national laboratory dedicated to developing quantum computing capabilities for the UK. Established with £93 million in funding, the NQCC opened its doors in late 2024 and serves as a hub for assembling quantum hardware, software development, and user access to quantum processors. According to UKRI (UK Research and Innovation), the NQCC will “ensure that the UK remains internationally competitive in [quantum computing], a critical and transformative technology set to underpin future economic prosperity and national resilience.”

In addition to research infrastructure, the UK government has crafted a long-term vision through its National Quantum Strategy, released in March 2023. This ten-year strategy commits £2.5 billion of public investment in quantum technologies over the next decade – roughly double the previous funding level – to maintain the UK’s competitive edge. The strategy outlines ambitious goals: to make the UK a “quantum-enabled economy” by 2033, support world-leading research and skills, foster adoption of quantum tech in industry and government, and secure the UK’s national security interests in the quantum era. Priority initiatives include mission-driven programs (e.g. a £70 million “Quantum Computing and Position, Navigation and Timing” mission), continued support for quantum research hubs and training (with £100 million to extend the hubs in computing, communications, sensing, imaging and timing), and increased funding for the NQCC. The government is also launching new doctoral training centers, fellowships, and a “Quantum Skills Taskforce” to grow the workforce needed to sustain this sector. Overall, the UK’s policy framework – from the NQTP to the 2023 National Quantum Strategy – demonstrates a strong government commitment to quantum computing, marrying long-term funding with clear strategic objectives.

Academic Centers of Excellence in Quantum Computing

The UK’s quantum computing prowess builds on research excellence at its universities and national labs. Oxford University has been a powerhouse in quantum computing research, particularly in trapped-ion quantum computers. Oxford led the NQIT (Networked Quantum Information Technologies) Hub during 2014–2019, which developed techniques for networking ion-trap processors into a scalable quantum computing system. Oxford researchers have demonstrated world-leading results such as high-fidelity quantum logic operations using trapped ions, and Oxford spin-outs are pushing these advances toward commercialization (discussed further below).

University of Cambridge also plays a key role, notably in quantum algorithms and software. Cambridge was home to Cambridge Quantum Computing Ltd, a pioneer in quantum algorithms and compilers, which merged with Honeywell’s quantum division to form Quantinuum – now one of the world’s largest integrated quantum computing companies. Cambridge’s academic groups, alongside industrial labs (like Toshiba’s Cambridge research lab), have also made contributions in photonic quantum processors and quantum networking.

Imperial College London is another leading institution, with research spanning superconducting qubits, photonic quantum optics, and quantum theory. Imperial scientists have, for example, explored qubit implementations in silicon and diamond, and contributed to error-correction techniques.

Other universities across the country have strong programs: University of Bristol is renowned for its work in photonic integrated quantum circuits, University of Sussex for its innovative ion-trap architectures, University College London (UCL) for solid-state qubits and quantum communications theory, and University of Edinburgh for quantum software and verification research, among many others.

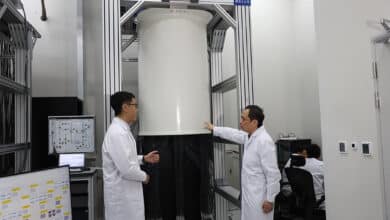

This broad academic base is supported by national laboratories such as the National Physical Laboratory (NPL), which provides expertise in quantum metrology, and the Science and Technology Facilities Council (STFC) labs, which offer advanced infrastructure (for example, STFC’s Daresbury Laboratory hosts a new PsiQuantum R&D facility with one of Europe’s largest cryogenic installations). The synergy between these institutions – often collaborating through the national hubs and consortia – ensures the UK remains at the forefront of quantum computing research.

Private-Sector Developments and Startups

The UK’s quantum computing ecosystem features a vibrant mix of startups and industry players translating research into commercial technology. Several UK-based companies have emerged as significant innovators in quantum hardware and software:

PsiQuantum – A photonic quantum computing company co-founded by British researchers (including academics from Bristol and Imperial), now headquartered in Silicon Valley but maintaining an R&D presence in the UK. PsiQuantum is pursuing an optical quantum computer with silicon photonics and has partnered with STFC’s Daresbury Lab to build advanced cryogenic testing facilities. The company’s approach uses single-photon qubits and leverages semiconductor manufacturing to aim for a fault-tolerant, million-qubit scale machine. PsiQuantum’s investment in a UK lab underscores the country’s attractive talent pool and infrastructure for quantum engineering.

ORCA Computing – A London-based startup specializing in photonic quantum computers that operate at room temperature. ORCA’s devices use single photons as qubits and incorporate proprietary quantum memory fiber loops to synchronize operations, enabling compact and flexible quantum processors. In 2022, ORCA made headlines by delivering a small quantum computing prototype (the PT-1 model) to the UK Ministry of Defence, marking the MoD’s first quantum computer acquisition. This photonic system is notable for being operational at ambient temperatures (no cryogenics) and is being used to explore applications like processing sensor data securely. ORCA has also been selected to provide a quantum computing testbed for the National Quantum Computing Centre. In a project starting 2024, ORCA will install a photonic quantum machine-learning testbed at the NQCC in Harwell, Oxfordshire, integrated with classical HPC hardware. The testbed will allow researchers and industry users to experiment with hybrid quantum-classical algorithms on a photonic platform, complementing other quantum computing hardware at NQCC.

Universal Quantum – A startup spun out of the University of Sussex, focused on building a fully scalable trapped-ion quantum computer. Universal Quantum’s design uses trapped ions as qubits but departs from traditional laser-controlled ions by using microwave technology and silicon microchips to control the ions. This innovation aims to simplify scaling: their modular ion-trap chips can be linked via fast electric-field connections, operating at around 70 K (much warmer than the millikelvin temperatures needed for superconducting qubits). The company’s bold vision and technical approach have gained international recognition – in 2022, Universal Quantum won a €67 million contract from the German Aerospace Center (DLR) to build a trapped-ion quantum computer for Germany. This is one of the largest-ever government quantum computing contracts awarded to a single firm, and notably it went to a UK startup, reflecting the UK’s strength in quantum hardware development. Universal Quantum is also backed by UK and EU grants and is collaborating with partners to solve the challenges of scaling ion-trap systems to millions of qubits.

Oxford Ionics – Another University of Oxford spin-out, Oxford Ionics is a leader in high-performance trapped-ion technology. It has demonstrated some of the world’s highest fidelities for quantum operations using a unique approach that combines trapped ions with conventional semiconductor chips (using microwave-driven gates instead of many laser beams). In 2023, Oxford Ionics announced a £6 million contract to deliver a state-of-the-art ion-trap quantum computer (nicknamed “Quartet”) to the NQCC in Harwell. This system will be used by NQCC scientists to advance quantum computing research and develop new applications on UK-built hardware. Oxford Ionics’ technology, which allows ion qubits to be controlled with integrated electronics, holds promise for scaling up quantum processors using existing chip fabrication methods. The company’s rapid growth (founded in 2019, now dozens of employees) and its partnerships – it’s part of government-funded pilots like the DSIT “Quantum Missions” program – highlight the dynamic interplay between UK startups and national initiatives.

Quantum Software and Services Startups – The UK is also home to companies focusing on the software layer and applications of quantum computing. Phasecraft (a spin-out from UCL and Bristol) is developing optimized quantum algorithms for near-term hardware and has collaborated with hardware providers (e.g., Phasecraft worked with Rigetti’s UK quantum processor to test simulation algorithms ). Riverlane (Cambridge-based) is building a quantum operating system and error-correction software, known for its “Deltaflow.OS” and work with both photonic and ion-trap hardware. On the applications side, Cambridge Quantum (now part of Quantinuum) has roots in the UK and continues significant R&D in quantum chemistry, machine learning, and cryptography software from its London and Cambridge offices. This growing private sector is bolstered by the UK’s Industrial Strategy Challenge Fund and UK Research & Innovation (UKRI) grants, which have funded consortia like the Quantum Computing Applications Cluster (bringing together companies and end-users to explore use cases in finance, pharmaceuticals, etc.). Notably, a three-year Innovate UK project led by Rigetti UK and Oxford Instruments successfully delivered one of the first UK-based quantum computers: a 32-qubit superconducting processor installed in Oxford Instruments’ facilities. This project not only built local hardware capability but also involved partners (Standard Chartered Bank, Amazon Web Services, universities) to develop quantum applications in finance and materials science. Such collaborations between startups, established tech firms, and end-users are accelerating the maturation of the UK’s quantum computing sector.

In summary, the UK’s quantum computing landscape is characterized by strong public support and a tight integration of academia and industry. Government initiatives like the NQTP and NQCC provide infrastructure and funding, universities supply world-class research and talent, and a wave of startups is translating breakthroughs into working machines and software. The result is that the UK hosts a diverse array of quantum computing approaches – superconducting qubits (via partnerships with firms like Rigetti), photonic systems (ORCA, PsiQuantum), trapped-ion platforms (Universal Quantum, Oxford Ionics), and quantum software ecosystems (Quantinuum, Phasecraft, etc.) – positioning the nation as a significant player in the global quantum computing race.

Quantum Communications and Cryptography

Quantum communications is another pillar of the UK’s quantum technology program, where the goal is to enable ultra-secure information transfer using quantum physics. The UK has devoted substantial resources to quantum communication R&D, primarily through the Quantum Communications Hub, one of the original NQTP hubs. Established in 2015 and led by the University of York, the Quantum Communications Hub brought together universities, industry partners, and government agencies to develop quantum key distribution (QKD) and related technologies. Over the past decade, this hub has achieved multiple milestones toward practical secure networks.

One major accomplishment has been the creation of a national QKD testbed network. Researchers built an “unhackable” quantum-secured fiber network linking multiple cities – with QKD testbed nodes in Bristol and Cambridge that were successfully connected via metropolitan fibers through London. This network allows the exchange of encryption keys with security guaranteed by quantum physics (any eavesdropping attempt disturbs the quantum signals and is detectable). By 2024, the hub’s work had demonstrated robust metropolitan QKD and even inter-city quantum links. In a recent breakthrough, the team extended quantum communications undersea: they sent quantum keys across a subsea fiber-optic cable beneath the Irish Sea, creating the first ever quantum-secured link between the UK and another country (connecting England and the Republic of Ireland). The link spanned the longest distance of underwater fiber used for QKD to date and showed the feasibility of extending quantum-secure networks internationally via existing telecom infrastructure.

In parallel, UK groups are exploring satellite-based quantum communications to enable global secure links. Such satellites would distribute quantum encryption keys from space to ground stations, extending QKD beyond fiber range. Additionally, efforts at Heriot-Watt University and other partners are directed at free-space quantum communication, leveraging telescopes and ground stations for secure optical links to satellites. These endeavors align with international trends towards a future quantum internet – an interconnected web of quantum links enabling secure communication and distributed quantum processing.

The UK’s focus on quantum communications also encompasses the translation of QKD technology into deployable products. For example, UK-based companies like Toshiba Europe’s Cambridge Lab and BT have collaborated to integrate QKD with conventional network equipment. The hub has demonstrated chip-scale QKD devices and even prototype handheld QKD units for consumer use. By miniaturizing and reducing the cost of QKD hardware (single-photon sources and detectors), these advances aim to pave the way for mass-market adoption of quantum-secured communication – protecting everything from bank transactions to critical infrastructure communications against future quantum code-breaking. As Professor Tim Spiller (Hub Director) noted, the technology development objectives over the 10-year program were met, and the next step is scaling these quantum-secured networks for widespread use in both commercial applications and steps toward a full quantum internet.

While QKD provides security against eavesdropping by using quantum physics, the UK is also preparing for the era of quantum computers that could break traditional encryption. In the field of post-quantum cryptography (PQC) – classical cryptographic algorithms designed to be secure against quantum attacks – the UK has active research and startup activity. The UK National Cyber Security Centre (NCSC) has been a leading voice globally in urging early adoption of PQC standards. The NCSC has published guidance for organizations to begin migrating to quantum-resistant cryptographic algorithms, emphasizing that “migration to PQC requires more than just new algorithms” and will involve re-engineering protocols and infrastructure. On the innovation side, Oxford University spin-out PQShield exemplifies the UK’s strength in this area. PQShield’s team of cryptographers have been “heavily involved in the NIST [U.S. National Institute of Standards and Technology] process” to develop new PQC standards, contributing to several of the algorithms that have been selected as global standards. In 2024, PQShield raised £37 million in venture funding to commercialize its quantum-safe security solutions. The company develops cryptographic IP for chips and software toolkits that can be integrated into smartcards, hardware security modules, and messaging applications to ensure they remain secure in the post-quantum era. Such startups, together with academic cryptography groups (for instance, at Royal Holloway University of London and University of Bristol) and government support, position the UK as a contributor to the global transition to quantum-safe cryptography.

In summary, the UK’s efforts in quantum communications and cryptography span both quantum-enabled secure communications (like QKD networks) and quantum-resistant classical cryptography (PQC). Through the Quantum Communications Hub, the UK has demonstrated end-to-end quantum key distribution in real-world conditions – from city fiber rings to subsea and potential satellite links – effectively creating a testbed for the secure quantum internet of the future. At the same time, by investing in post-quantum cryptography research and guiding industry migration to new standards, the UK is ensuring that its information security will remain robust even when large-scale quantum computers emerge. Together, these parallel tracks address the immediate opportunities of quantum communications and the long-term challenges that quantum computing poses to cybersecurity.

Quantum Sensing and Metrology Initiatives

Quantum sensing is a third crucial strand of the UK’s quantum technology drive, with applications ranging from defense to environmental science and navigation. Quantum sensors exploit quantum phenomena – such as superposition and entanglement – to achieve measurement precision or sensitivity far beyond conventional sensors. The UK’s Quantum Technology Hub in Sensors and Timing (spearheaded by the University of Birmingham) has led national efforts to develop such cutting-edge instruments. Thanks to sustained R&D, the UK has achieved several world-firsts in quantum sensing, and is working to transition these devices from lab prototypes to field-deployed tools.

One headline achievement was the demonstration of a quantum gravity sensor in real-world conditions. In 2022, a team from the Birmingham quantum hub unveiled the first quantum gravity gradiometer used outside of a laboratory, successfully detecting a subterranean tunnel a meter below ground. This device employs ultracold atoms as probes of gravitational acceleration: clouds of rubidium atoms are put into a quantum superposition and allowed to free-fall in a vacuum tube, where they act as atomic interferometers measuring tiny variations in Earth’s gravity. By comparing two atom interferometers vertically separated (one 1 m above the other), the sensor can cancel out ambient noise (like vibrations) and isolate the minute gravitational differences caused by underground structures. The result is a gravity gradient map that reveals hidden features such as tunnels, cavities, or mineral deposits. The Birmingham-led demonstration – done in an unshielded outdoor environment, with the quantum device mounted beside a road – marked the first time a quantum gravity instrument detected a target (the tunnel) in the field. It beat international competitors in the race to move quantum gravity sensing from lab to practical use, a success hailed by UKRI and the Ministry of Defence (which co-funded the project) as proof of the transformational potential of quantum technology. Such gravity sensors have immediate implications for civil engineering (e.g., surveying infrastructure or detecting sinkholes without excavation) and defense (locating underground facilities or tunnels). By mapping what is invisible to normal cameras or radars, quantum gravimeters could save cost and risk in construction and offer new capabilities in security and geophysics.

Another area of focus is quantum navigation and timing, which aims to provide GPS-independent positioning and precise time references. The UK is investing in portable atomic clocks and inertial sensors that could allow vehicles or military platforms to navigate accurately without satellite signals. For instance, a highly stable quantum atomic clock can maintain timing for navigation systems such that, if GPS were lost (due to jamming or being underground), the clock’s signal would keep an inertial navigation system on track. The UK’s NQTP has funded work on optical atomic clocks at NPL that reach extraordinary precision (errors of less than a second over billions of years) and on compact cold-atom interferometers that measure acceleration and rotation with quantum-enhanced accuracy. The 2023 National Quantum Strategy explicitly highlights Position, Navigation and Timing (PNT) as a mission area alongside computing, underlining the strategic importance of quantum navigation. While specific project details are often sensitive (especially for defense-oriented developments), it is known that the UK Ministry of Defence and companies like BAE Systems are exploring quantum inertial navigation units for submarines and aircraft, which could allow these platforms to determine their movement precisely over long periods without external signals. Such quantum inertial sensors use trapped atoms or quantum spins to sense accelerations, offering drift-free performance superior to conventional gyroscopes. If successfully engineered, a quantum inertial navigator could enable a submarine to travel submerged for months while knowing its position to within a few meters, purely by internal sensors – a game-changing capability for secure navigation.

Additionally, the UK is advancing quantum magnetometry and imaging. Quantum magnetometers, often based on vapor cells or NV centers in diamond, can detect extremely subtle magnetic fields. UK researchers have applied them to biomedical imaging – for example, measuring the magnetic fields from the human brain’s neural activity (magnetoencephalography) with devices that no longer require bulky shielding. A startup called Cerca Magnetics, linked to University of Nottingham, is commercializing wearable quantum magnetometers for brain scanning, offering a new window into neuroscience by leveraging quantum sensitivity. In parallel, quantum magnetic sensors can aid in detecting vehicles or underwater objects for defense, or even identifying mineral deposits. Meanwhile, quantum imaging techniques (like ghost imaging or quantum lidar) are being pursued by the UK Quantum Imaging Hub (led by University of Glasgow) to achieve ultra-low-light level imaging and see through obscurants (fog, smoke) using entangled photons. These could benefit medical imaging or remote sensing. Another novel application is quantum RF sensing: using Rydberg atoms as antennas to detect radio-frequency signals with high sensitivity and bandwidth, which is being explored for spectrum monitoring and communications intelligence.

Crucially, the UK’s work in quantum sensing is not just academic – it involves industry from the start to ensure devices are practical. The gravity gradiometer project, for instance, was done in partnership with RSK (an engineering firm) and funded by the Industrial Strategy Challenge Fund’s “Gravity Pioneer” project to focus on real-world needs. This market-driven approach (sometimes dubbed “quantum engineering”) is evident across other sensor projects, where companies are co-developing prototypes. The ultimate aim is to integrate quantum sensors into field operations for civil engineering surveys, defense reconnaissance, climate monitoring, and more, within the next few years. As Dr. Kedar Pandya of EPSRC noted, these successes show the “transformational potential” of quantum tech and the value of sustained support that harnesses expertise across the UK, keeping the nation “at the forefront of the coming quantum age.”

In summary, the UK has expanded quantum technology beyond computing and communications into the realm of sensing – turning quantum physics into a tool for seeing the unseen. From locating hidden tunnels via atom interferometry, to striving for GPS-free navigation with quantum clocks and inertial sensors, to imaging and measuring with unprecedented sensitivity, UK initiatives are leveraging quantum effects for practical advantage. Many of these developments, particularly in gravity and magnetic sensing, are world-leading demonstrations. As these sensors mature, the UK expects to gain both economic benefits (new industries in quantum instrumentation) and strategic benefits (improved capabilities in defense, security, and infrastructure management).

The UK’s Global Position in Quantum Technology: Strengths and Challenges

Over the last decade, the United Kingdom has established itself as one of the global leaders in quantum technology. It was among the first countries to launch a coordinated national program (in 2014), giving it an early start over many competitors. Today, the UK is generally considered in the top tier of quantum nations – often ranked alongside the US, China, and leading EU nations – though it operates with far less funding than the superpowers in this domain.

In terms of public investment, the UK’s spending on quantum R&D, while significant, is modest compared to the enormous programs in China and the United States. By 2021 estimates, China had committed $15.3 billion in public funds for quantum computing alone, more than double the EU’s ~$7 billion and about eight times the US government’s ~$1.9 billion investment at that time. The UK’s investment up to that point was roughly $1.3 billion (about £1 billion), placing it fifth worldwide after Japan (fourth with $1.8 billion). While these figures have evolved (the UK’s new strategy increases its budget, and the US and EU have also scaled up since 2021), they illustrate the funding gap. China’s “sheer financial muscle” in quantum dwarfs the UK, and the US has unleashed big spending through its National Quantum Initiative and related defense programs. The EU, through its Quantum Flagship (€1 billion over 10 years) and individual nation programs (Germany, France, Netherlands each investing billions), also collectively outspends the UK. This disparity in resources is a key challenge for the UK: it must strategically focus its efforts to remain competitive and seek international partnerships to augment its investments.

Despite smaller budgets, the UK leverages its strengths in coordination and academia. Observers often cite the UK’s National Quantum Technologies Programme as a model for how to effectively organize a quantum effort. The program has tightly integrated academia and industry from the start, seeding over 49 startup companies out of university research in its first several years. This vibrant startup ecosystem (Orca, Universal, Ionics, etc.) is a competitive advantage; in contrast, many EU countries have excellent research but fewer quantum startups, and China’s industry is dominated by large state-supported firms. The UK’s talent pool is another asset – British universities consistently produce top-tier quantum scientists and engineers, and the country has managed to attract and retain key talent (though competition is fierce). The presence of pioneering figures (Deutsch, Ekert, etc.) and strong theoretical foundations help the UK punch above its weight. Additionally, the UK has strengths in specific sub-fields: for example, quantum communication where China leads in implementations, but the UK is trusted as a provider of secure network technology (the UK’s democratic institutions and alliances can make others more willing to adopt UK quantum security products than Chinese ones). The UK also excels in photonic quantum technologies and quantum software, areas that complement the hardware strengths of the US (superconductors) or EU (neutral atoms).

Another strength is the UK’s global partnerships. Post-Brexit, the UK is no longer formally part of the EU Quantum Flagship, but it has doubled down on bilateral and multilateral collaborations. The UK has a unique position bridging the US and Europe, and also connecting to Commonwealth allies like Canada and Australia, which are emerging quantum players. In 2023, the UK and US signed joint statements to cooperate on quantum information science, aligning research priorities and even exchange of researchers. The UK is also actively engaging in setting international standards and ethical guidelines for quantum tech – for instance, through the OECD and ISO working groups – aiming to be a thought leader. The National Quantum Strategy calls for expanding partnerships with “global allies” and playing a role in shaping regulation and standards in international fora. By being open and collaborative, the UK multiplies the impact of its own R&D and stays connected to breakthroughs wherever they occur.

However, the UK faces challenges as it strives to maintain its position. Funding uncertainty had been a risk – the NQTP’s initial phase was successful, but until the 2023 Strategy was announced, there were questions about whether the UK would scale up its investment to keep pace with others. The £2.5 billion commitment over 10 years is a strong signal, but still behind the multi-billion per year levels in the US and China. Ensuring this money is spent effectively will be crucial; hence the UK is focusing it via targeted missions and industry partnerships rather than pure research alone. Brain drain is another concern: the global tech industry hunger for quantum talent means UK-trained experts might be lured abroad by higher salaries or larger teams (e.g., several UK quantum scientists have joined big U.S. companies or Silicon Valley startups in recent years). The UK will need to continue offering attractive opportunities domestically – the creation of the NQCC and funding of startup growth are steps in this direction, providing facilities and capital for talent to stay.

There are also strategic considerations around supply chains and security. Quantum technologies often require specialized components (high-end lasers, cryogenics, vacuum systems, semiconductors). The UK has strength in some areas (for example, Oxford Instruments and Cryox manufacture cryostats for quantum hardware; companies like TMD and Teledyne e2v make components for atomic clocks and sensors ), but it relies on international supply chains for others. The government is aware of this and has indicated export controls and domestic capability protection for critical quantum tech in the National Security Investment Act. Maintaining access to cutting-edge fabrication (often in collaboration with EU or US foundries) will be important for the hardware programs. Additionally, as quantum technologies inch toward practical use, the UK will need to develop a regulatory framework (for example, around quantum cryptography usage, or safety standards for quantum sensors) and ensure public trust and understanding of these technologies.

Relative to the U.S., the UK’s advantage is in its cohesive national network and perhaps a greater emphasis on certain niches (like quantum encryption where US efforts are more fragmented). But the US has massive private investment (tech giants like Google, IBM, Amazon are pouring resources into quantum) which the UK cannot match directly – however, the UK is smartly leveraging those investments by partnering (e.g., Amazon’s AWS is collaborating with British universities on quantum software, and IBM’s Quantum Network has UK university members). Relative to China, the UK cannot compete in scale, but it competes in quality and openness. China’s achievements (such as the satellite QKD with Micius satellite, and claimed 76-qubit photonic computer) are impressive, but the UK has the benefit of international collaboration and a market-driven approach that might lead to quicker commercial products in some areas. Against the EU, the UK has had to ensure it stays relevant despite being outside the EU programs; the quick launch of its own strategy and continued funding of joint projects (the UK still works with European partners on many quantum research efforts, and as of late 2023 the UK has associated with Horizon Europe which may reopen some funding avenues) help mitigate that. Interestingly, UK companies winning contracts from EU countries (like Universal Quantum’s win in Germany ) indicate that UK innovation is sought-after beyond its borders.

In conclusion, the UK’s global position in quantum technology is one of a highly capable middle power: it is not the top spender but is recognized for its leadership and innovation. The UK’s early start, strong science base, and integrated approach have made it a “go-to place” for quantum – indeed, a stated goal of the national program is to make the UK the go-to location for quantum businesses and talent. Its strengths lie in agility, world-class research, thriving startups, and trusted partnerships. The challenges remain securing sufficient investment and talent in the face of competition and ensuring that breakthroughs translate into economic and security benefits at home. How the UK navigates these will determine whether it can maintain its status as one of the foremost quantum nations in the coming decade.

Conclusion and Future Outlook

As the UK enters the next phase of its quantum technology journey, it does so with momentum and clarity of purpose. The launch of the National Quantum Strategy in 2023 marks the beginning of a new chapter: a ten-year commitment to take quantum research out of laboratories and into the fabric of the economy and national infrastructure. We can expect several developments from UK quantum initiatives in the coming years:

Progress Toward Useful Quantum Computers: With the National Quantum Computing Centre now operational and hosting multiple quantum hardware platforms (superconducting, photonic, ion-trap), the UK is poised to accelerate the development of a home-grown quantum computer. In the next few years, prototypes from Oxford Ionics (“Quartet”), ORCA, and others will be tested and scaled at NQCC. The government’s mission-oriented approach – for example, dedicating a portion of NQCC computing time to “critical applications of societal benefit” – means we will see high-impact use cases explored early (such as quantum-optimized machine learning for healthcare or logistics). While a fault-tolerant universal quantum computer is still likely a decade or more away, the UK aims to achieve “quantum advantage” in specific tasks sooner, perhaps via medium-sized processors or quantum simulators solving industry problems faster than classical supercomputers. Partnerships with end-users (finance, pharma, energy) foreshadow pilot projects where quantum algorithms run on UK hardware to tackle real-world problems – a necessary step to building a quantum-ready economy.

Expansion of Quantum Networks: Building on the Quantum Communications Hub’s successes, we can expect the first operational quantum-secured networks to emerge in the UK. These may start as closed networks for government and critical infrastructure communications, using QKD to protect sensitive data links (for example, securing communications between central banks or between government data centers). The technology maturation suggests that within a few years, the UK could have a continuous QKD network running from London to other hubs (e.g., Cambridge, Bristol, Manchester), possibly managed by telecom providers like BT. Additionally, the UK is likely to participate in building a European quantum communication network (the EuroQCI), now that it can collaborate with EU programs again – linking its national nodes with cross-border QKD links. On the space front, if the planned quantum cubesat launch goes well in 2025, the UK could take a lead in satellite QKD, enabling secure links to remote regions and ships or planes. These initiatives would solidify the UK’s position in the coming quantum internet, and provide lessons on integrating quantum security with classical networks (including post-quantum encryption as a complementary layer).

Quantum Sensors in Practical Use: The next few years should see quantum sensing breakthroughs transition into deployed tools. By around 2025–2030, we may see quantum gravity sensors being used in civil engineering surveys or rail/road tunnel checks in the UK – likely via commercial services offered by spin-outs or engineering firms in partnership with the Birmingham hub. Quantum timing devices (portable atomic clocks) might be installed at financial centers and telecom hubs as backups to GPS timing, ensuring resilience against time-sync attacks or outages. In defense, one can anticipate field trials of quantum inertial navigation on Royal Navy submarines or Royal Air Force aircraft, assessing their performance for future integration. The UK’s Ministry of Defence and Defence Science and Technology Laboratory (Dstl) will continue to work closely with academics to adapt these sensors for harsh conditions. If successful, the UK armed forces could gain an edge through navigation systems that cannot be jammed and sensors that detect threats invisible to conventional radar/sonar. On the scientific front, quantum sensor networks could enhance climate and environmental monitoring – e.g., arrays of quantum gravimeters tracking groundwater changes or quantum magnetometers monitoring space weather – areas where UK research institutions collaborate globally.

Growing Quantum Industry and Jobs: With the government fostering a “quantum-enabled economy”, we can expect the UK quantum industry to grow significantly. The strategy’s investments in skills and training (new PhD centres, apprenticeships, etc.) will start producing a larger pool of technicians and engineers proficient in quantum hardware and software. This will support the scaling of companies. Many of the current startups will likely expand, and we may see a few mergers or acquisitions (similar to Cambridge Quantum’s evolution into Quantinuum) as the industry matures. New startups may also emerge, particularly in niche applications of quantum computing (like quantum-inspired optimization software) or enabling technologies (e.g., error-correcting codes, component manufacturing). The UK’s aim to attract international quantum companies could result in overseas firms setting up research branches or even manufacturing facilities in Britain. For instance, if a company like IBM or Google were to deploy a quantum data center in Europe, the UK would position itself as an attractive host given its talent and supportive policies. All of this suggests that by the end of the decade, quantum tech could be a notable sector in the UK economy, contributing to high-skill jobs and intellectual property generation.

Continued Global Collaboration and Competition: Internationally, the UK will remain actively engaged in the quantum science community. We will see UK researchers co-authoring papers with European colleagues (the UK will try to rejoin EU research projects where possible) and partnering in transatlantic initiatives (e.g., joint UK-US projects on quantum standards, or UK-Canada exchanges on quantum algorithms). On the competitive side, how the UK fares will depend on its ability to sustain innovation. The U.S. and China are not standing still – their advancements in quantum computing (like IBM’s roadmaps or Chinese photonic and superconducting experiments) will set high bars. The UK’s strategy of focusing on strengths (like photonics, ions, quantum software) rather than duplicating others’ work will be key. For example, if superconducting qubits become dominated by US giants, the UK’s bet on photonic and ion-trap avenues might differentiate it. Similarly, the trust element in communications tech could make the UK a preferred supplier for allied nations wanting QKD without relying on Chinese hardware. We may also see the UK advocating for ethical use of quantum technologies, ensuring that as things like quantum computing break encryption, there is a framework to protect privacy and security globally – an area where the UK’s democratic institutions and policy experience (through bodies like the Royal Society and standards agencies) can influence the conversation.

In conclusion, the United Kingdom’s quantum technology initiatives have moved from foundational research into a phase of delivery and implementation. The country’s comprehensive approach – supporting research excellence, investing in infrastructure and industry collaboration, and aligning with national goals in security and economy – provides a strong platform for future success. Over the next decade, the UK is expected to deliver tangible quantum innovations: from prototype quantum computers accessible to researchers and industry, to secure quantum communication links safeguarding data, to quantum sensors revealing and navigating the world in fundamentally new ways. The UK’s vision is to make quantum technology an integral part of its digital backbone and advanced manufacturing base, ensuring prosperity and security in the quantum era. If current trends continue, by the early 2030s the UK could indeed realize a “quantum-enabled economy” – one where quantum computers, networks, and sensors work alongside classical technology to solve problems previously unsolvable, heralding a new era of technological and economic growth driven by quantum innovation.